Capitalix Review – Is This Broker a Scam?

When choosing a broker, traders look for reliability, transparency, and strong regulation. But what happens when a company looks too polished on the surface but hides serious red flags underneath? That’s exactly what we found with Capitalix.

At first glance, Capitalix presents itself as a professional broker with years of experience, a solid platform, and positive reviews. But as we dug deeper, inconsistencies started to appear. From a suspicious domain registration date to a questionable offshore license and potentially fake reviews, there’s a lot that doesn’t add up.

So, is Capitalix a legitimate trading platform or just another scam broker waiting to trap unsuspecting traders? Let’s break it down.

General Information About Capitalix

To give you a clearer picture of this broker, here’s a detailed breakdown of their key features:

| Category | Details |

| Website | capitalix.com |

| Regulation | FSA (Seychelles) – Not a reliable regulator |

| License Type | The license cannot be trusted |

| Established | 2008 (claimed), but domain registered in 2010 |

| Restricted Countries | USA, Canada, EU, Japan, Iran, North Korea, Sudan |

| Leverage | 1:200 |

| Trading Platforms | No information provided (another red flag) |

| Account Types | Silver, Gold, Platinum, VIP |

| Trustpilot Score | 4.0 (suspicious, with fake-looking reviews) |

| Total Reviews | 469 (with 113 bad reviews, nearly 25%) |

| Common Complaints | Withdrawal issues, aggressive sales tactics, price manipulation |

Key Takeaways

- No strong regulation – FSA Seychelles offers weak oversight

- No real trading platform details – Could mean lack of transparency

- Leverage of 1:200 – High leverage can be risky, especially with unregulated brokers

- Suspicious review patterns – Many positive reviews look fake

Would you trust your money with a broker that hides information, has weak regulation, and a history of complaints? The risks are too high!

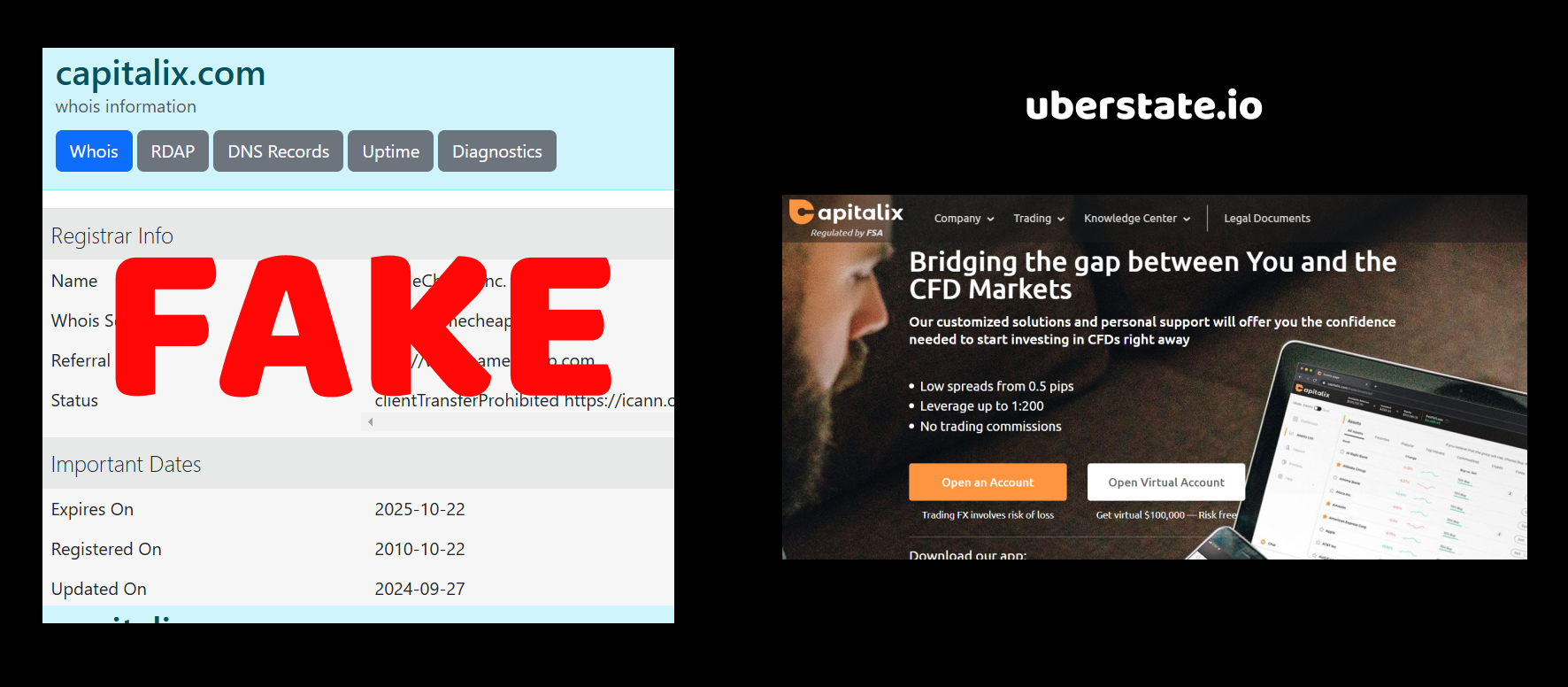

Capitalix – Suspicious Domain History

One of the first red flags when investigating a broker is checking the domain history. If a company claims to have been in business for years but their website is relatively new, that’s already a major inconsistency. And guess what? That’s exactly the case with Capitalix.

The company states that it was established in 2008, giving the impression that they have over a decade of experience. Sounds solid, right? But when we checked the actual domain registration date, we found that capitalix.com was only registered on October 22, 2010.

Now, some might argue: “Well, two years of difference isn’t too bad.” But let’s think about it critically. If Capitalix really started in 2008, where was their website for the first two years? Any legitimate broker would have had an online presence from day one. This suggests either a major inconsistency in their history or an intentional deception to appear more established than they really are.

And that’s not even the worst part. Many scam brokers buy expired domains to fabricate history. Could this be the case here? The gap between their claimed founding date and the domain purchase raises doubts.

This is just the first piece of the puzzle, but it’s already looking suspicious. What’s next? Let’s dig deeper.

Capitalix – Fake or Unreliable License?

One of the most crucial factors in determining whether a broker is trustworthy is its regulation. A legitimate broker must be licensed by a well-known, reputable financial authority—think FCA (UK), ASIC (Australia), or CySEC (Cyprus). These regulators enforce strict rules to protect traders.

So, what about Capitalix? According to their own claims, they are regulated by the FSA (Financial Services Authority). But here’s the catch—which FSA?

Why is this suspicious?

The abbreviation FSA can refer to multiple organizations, including reputable ones like the UK’s former Financial Services Authority (now FCA). However, the FSA that “regulates” Capitalix is based in Seychelles, a jurisdiction notorious for weak regulatory oversight.

And here’s where things get even worse—our research shows that Capitalix’s license type is marked as “The license cannot be trusted”. What does this mean? Essentially, it’s a worthless piece of paper. The Seychelles FSA does not impose strict requirements on brokers, allowing them to operate freely without real oversight.

Why would a “serious” broker choose a weak regulator?

The answer is simple: a real regulator would never approve them. Scammers often register under offshore regulators because they:

- Don’t require strong financial backing

- Don’t enforce strict customer protection measures

- Allow brokers to disappear with clients’ money without consequences

So ask yourself: if Capitalix was truly a safe and professional broker, why wouldn’t they obtain a respected license? The answer is clear—they either couldn’t, or they didn’t want to. Either way, that’s bad news for traders.

With a license that’s essentially meaningless, who’s going to protect you if they decide to freeze your account or refuse withdrawals? Exactly—no one.

Capitalix – Suspicious and Possibly Fake Reviews

When checking a broker’s credibility, one of the biggest indicators is user feedback. Real traders leave real experiences—both good and bad. But when reviews look too polished or overly negative, it’s a sign that something is off.

What did we find about Capitalix on Trustpilot?

At first glance, Capitalix has a Trustpilot rating of 4.0, which might seem decent. But don’t be fooled—when we dug deeper, we found some very concerning patterns:

- 469 total reviews, which is an unusually high number for an offshore broker.

- 113 negative reviews—that’s almost 25% of all feedback being bad.

- Many positive reviews look fake—they are generic, overly positive, and often written in the same style.

Signs of Review Manipulation

If you check the positive reviews, a pattern emerges. Most of them:

✔ Use generic phrases like “Great platform!” or “Very good broker!”

✔ Lack specific details about trading experience

✔ Appear in clusters, meaning multiple 5-star reviews appear in a short time (a known sign of paid reviews)

✔ Often come from accounts with only one review, meaning the user was likely created just to boost the rating

Meanwhile, the negative reviews tell a different story—and they are very specific. Many users complain about:

❌ Withdrawal problems – Requests ignored, money never received

❌ Aggressive account managers – Calling constantly, pushing for deposits

❌ Price manipulation – Spikes and slippage causing unexpected losses

❌ Sudden account restrictions – Blocking accounts after users try to withdraw

So let’s think: If a broker was truly great, would so many traders report the exact same issues? Not likely. The only reason they still have a somewhat high rating is because they likely buy fake reviews to drown out the real ones.

The Real Picture

The genuine reviews paint a clear picture—Capitalix is not trustworthy, and many traders have lost money due to their shady practices. The faked positive reviews only confirm one thing: this broker is trying to hide the truth.