IC Markets – Brand Review: Something Doesn’t Add Up

The name IC Markets might ring a bell — it’s been floating around the trading scene for years, often pitched as a veteran broker with experience dating back to 2007. But when we started digging into this brand review, things quickly got sketchy. The deeper we looked, the more inconsistencies popped up: suspicious licensing, strange domain activity, and reviews that feel just a bit too polished.

It’s easy to get blinded by a sleek website or familiar name — that’s exactly what scam brokers count on. But if you look just a little closer, it becomes obvious: something here isn’t quite right. Let’s break it all down step by step.

IC Markets – Broker Information Table

| Parameter | Details |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:500 |

| Trading Platforms | MetaTrader 4 / MetaTrader 5 |

| Account Types | Not specified |

| Support Email | [email protected] |

| Website | icmarketsapp.com |

| Regulation Claimed | FSA Seychelles (offshore license) |

| Domain Creation Date | 06.10.2023 |

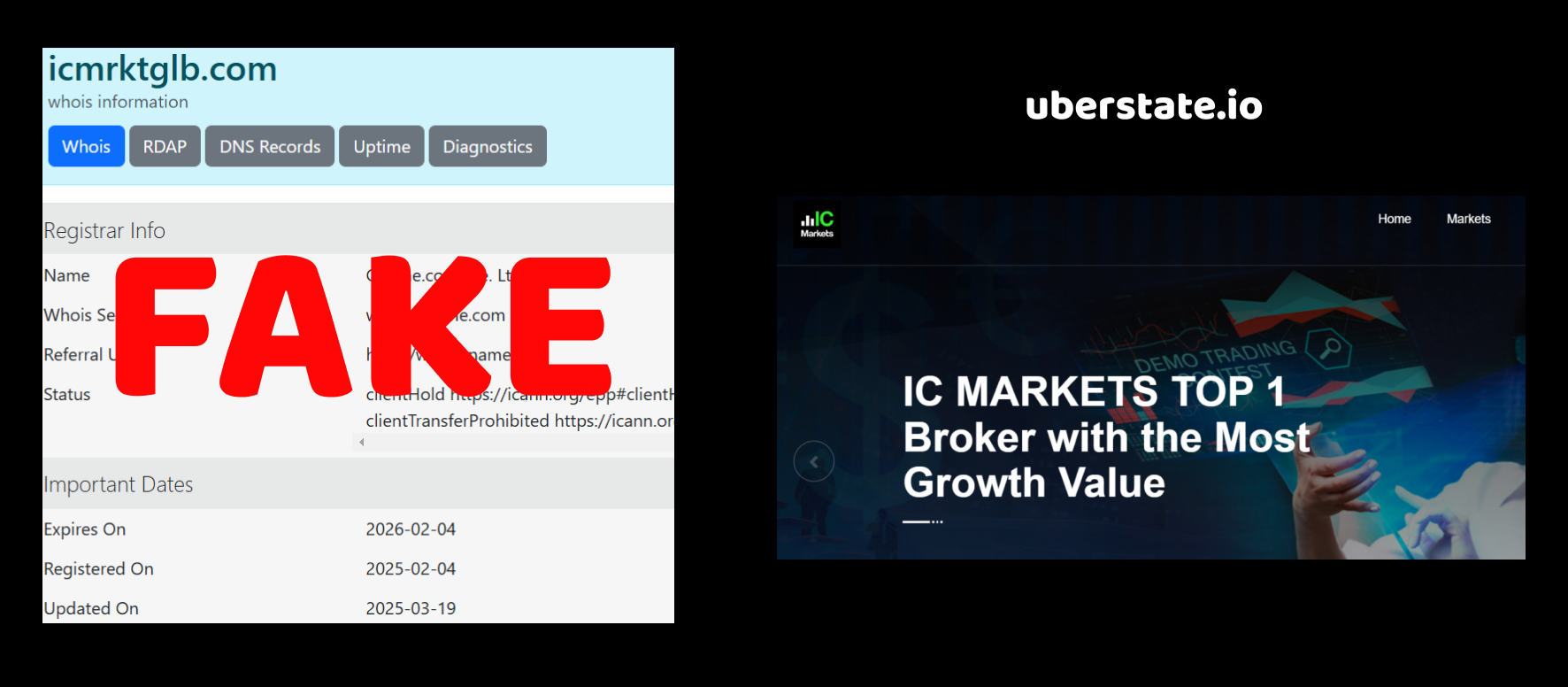

IC Markets – Brand Review: Argument 1 – Domain Creation Date

At first glance, IC Markets might look like a reliable broker. The branding seems polished, the name is well-known, and everything appears legit. But let’s not jump to conclusions — we dug a little deeper.

And here’s what we found: the domain was only registered on October 6, 2023.

Now hold on… they claim the brand has been operating since 2007.

So, here’s the big question: Why would a broker that’s supposedly been around since 2007 only just register their domain in 2023?

Let’s think this through. Even if they changed their domain for some reason — maybe a rebrand or a switch in strategy — you’d expect the old domain to redirect users or at least remain publicly accessible. That’s not the case here. It’s like someone bought a fresh domain in 2023 and started presenting themselves as an established brand.

That’s shady.

It’s basically like registering “coca-cola-global.com” today and claiming you’ve been selling soda since 1886. Sounds convincing? Not really.

And why would a legit broker throw away years of SEO, trust, and online reputation just to start fresh with a new domain? Makes zero sense for a real business. But for scammers trying to piggyback off an existing brand’s credibility? It’s a classic move.

So when the domain is brand new, but the brand is supposedly ancient — that’s a red flag. A big one.

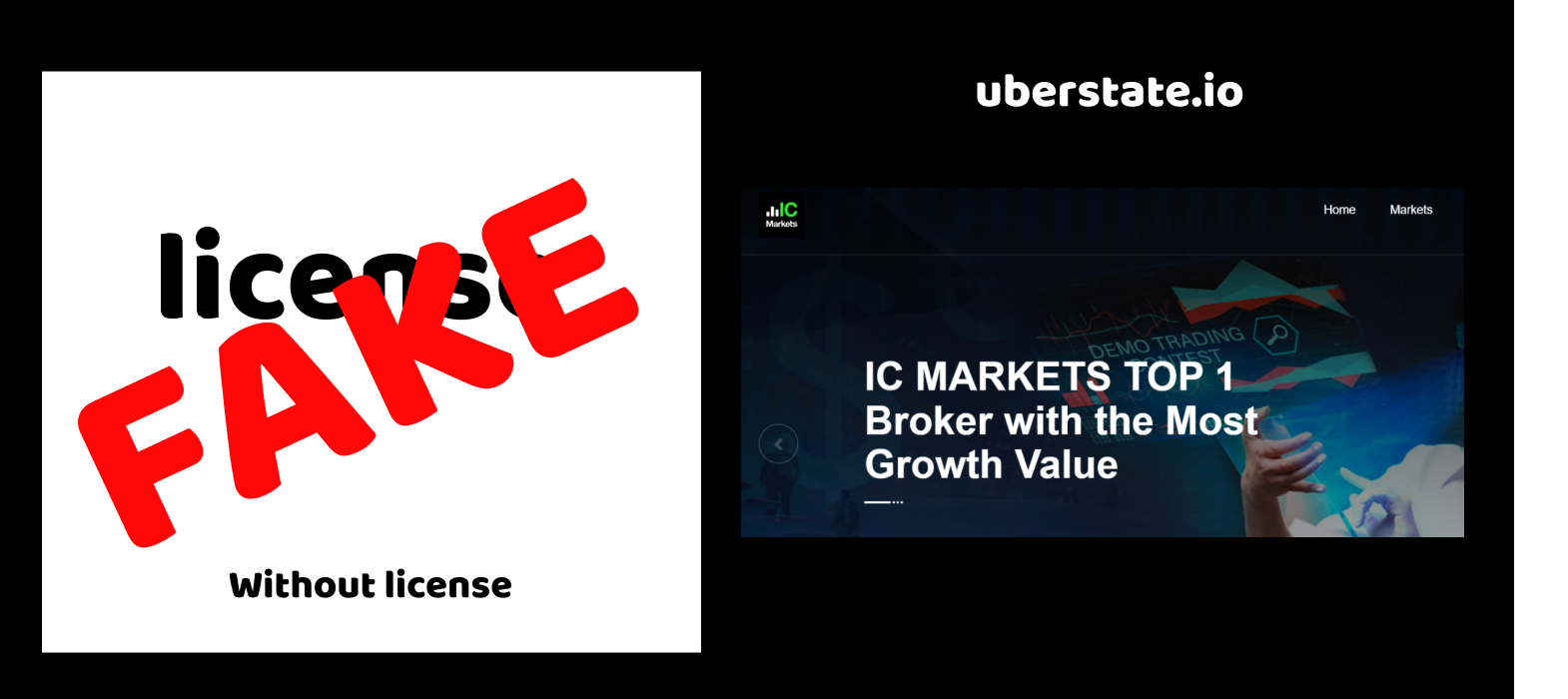

IC Markets – Brand Review: Argument 2 – License Check

When we checked the license information for this so-called “broker”, something immediately felt off. According to the data, IC Markets supposedly operates under a license from FSA of Seychelles.

Now, let’s break that down.

The FSA (Financial Services Authority) of Seychelles is a classic offshore regulator. And when we say offshore — we mean a jurisdiction with loose oversight, almost zero real enforcement, and a reputation for handing out licenses like candy. They’re not exactly known for protecting traders or chasing after scammers. Why would they? They don’t really suffer any consequences.

So the real question is:

Why would a serious broker — especially one claiming to exist since 2007 — rely on such a low-tier license?

They had more than enough time to get regulated by major authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). But they didn’t.

And here’s where it gets even more suspicious. Brokers regulated by respected jurisdictions are under strict control: regular audits, client fund protections, transparency requirements. Scammers don’t want that. It slows them down and makes fraud harder. That’s why shady brokers run offshore — fewer questions, less accountability.

So no, an offshore license from Seychelles doesn’t prove anything — except that they deliberately chose the easiest path to look “legal” without actually being under serious supervision.

And let’s be honest:

Why would scammers want extra clients who could expose them, just because they got a real license?

They don’t. They want something that looks like regulation, without the responsibility.

So while they proudly show off the FSA badge — that badge is basically worthless.

IC Markets – Brand Review: Argument 3 – Trustpilot Reviews

We took a closer look at what people are saying about IC Markets on Trustpilot — and the picture isn’t pretty once you scratch the surface.

At first glance, the score is 3.6, which already isn’t impressive for a company that claims to be operating since 2007. But here’s where things get really interesting: the positive reviews look… suspiciously unnatural.

You know those reviews that all sound like they were written by the same person, just with slight variations?

Yeah — that’s exactly what’s happening here.

Short, generic praises like “Good broker!”, “Very fast withdrawals”, “Support is okay” — but without any detail. No mention of actual trading experience, no talk of instruments, spreads, or platform performance. It’s like they’re trying to boost their rating without putting in much effort.

And another thing: they often come in clusters. Several five-star reviews posted on the same day or within hours of each other. Real users don’t do that. It’s a classic sign of review manipulation.

Meanwhile, the negative reviews are a whole different story — long, emotional, full of concrete details about withdrawal issues, account blocking, and sudden platform glitches. And most of these bad reviews are coming from real, frustrated users who have clearly tried to get help and hit a wall.

So let’s ask the obvious question:

Why would a legit broker need to flood Trustpilot with fake-sounding five-star reviews if they really provided good service?

They wouldn’t.

That 3.6 rating, combined with forced positivity and real user frustration — that’s not just a red flag. That’s a full-blown siren.

Final Verdict – Is IC Markets What It Claims to Be?

After going through everything — the domain, the license, the reviews, and even the basic broker details — a clear pattern starts to emerge. And let’s be honest, it doesn’t look good.

The domain was only registered in October 2023, yet the broker tries to pass off a legacy dating back to 2007. That alone should make anyone pause. If you’re a real company with a long track record, why on earth would you operate under a brand-new domain that wasn’t even around a year ago? Unless, of course… you’re not the real company at all.

Then comes the so-called license. FSA Seychelles? Come on. That’s one of the most toothless offshore regulators out there. It’s the kind of license scammers love — it looks official, but it’s practically meaningless. No serious oversight, no investor protection, no accountability.

And the reviews? A sloppy attempt to build fake trust. Short, repetitive five-star posts that reek of being written by the same hand. Meanwhile, the angry, detailed one-star reviews tell a much different story — and those are the ones that feel real.

Add to that vague account info, shady support emails, and the use of MetaTrader platforms (which are easy to clone and manipulate) — and you’ve got yourself the perfect setup for a scam operation masquerading as a trusted broker.

So, ask yourself:

Would a real, regulated, transparent broker need to hide behind a fake domain, an offshore license, and manipulated reviews?

Didn’t think so.

Whatever this version of “IC Markets” is — it’s not the real deal. It’s a copycat operation, likely designed to confuse traders, steal deposits, and disappear without a trace. Stay away.