Centris FX Brand Review: Can You Really Trust This Broker?

When we first stumbled upon Centris FX, we were hit with a wave of promises — tight spreads, professional support, advanced platforms, and, of course, claims of being a reliable partner in the trading world. But as always, we’ve learned not to take glossy websites at face value.

Because here’s the thing: scammers have become incredibly good at playing the role. Sleek design? Check. Fake license? Usually. Polished reviews? Most likely paid. So naturally, we rolled up our sleeves and took a closer look.

And the deeper we dug, the more the story unraveled.

From a freshly registered domain pretending to represent an “experienced” brand, to a license from a regulator that holds no actual authority, and user reviews that sound like they were written by bots — the cracks in Centris FX’s reputation started showing fast.

So let’s break it down — one red flag at a time.

Centris FX Brand Review: Basic Info Every Trader Should See

Before diving into any platform, it’s smart to check the basics — the kind of info a real broker should be upfront and transparent about. So here’s what we found when we examined Centris FX’s offerings, features, and contacts.

| Category | Details |

| Website | centrisfx.com |

| Leverage | Up to 1:500 |

| Account Types | Standard, Gold, Platinum |

| Regulator | Mwali International Services Authority (fake license) |

| [email protected] | |

| Phone | Not listed |

| Live Chat | Available |

| Minimum Deposit | Not clearly specified |

| Languages | English |

| Trading Platform | Web-based terminal (custom) |

At first glance, they try to present a full-featured setup — multiple account tiers, 1:500 leverage (which, by the way, is a red flag on its own when offered without proper regulation), and a flashy platform interface.

But look closely and you’ll notice something odd. There’s no physical address, no clear info on who runs the company, and the minimum deposit is left vague — something many shady brokers do to lure users into overcommitting funds once they’re hooked.

And again — why offer sky-high leverage with no proper licensing, if not to attract risk-hungry beginners who don’t yet know the dangers?

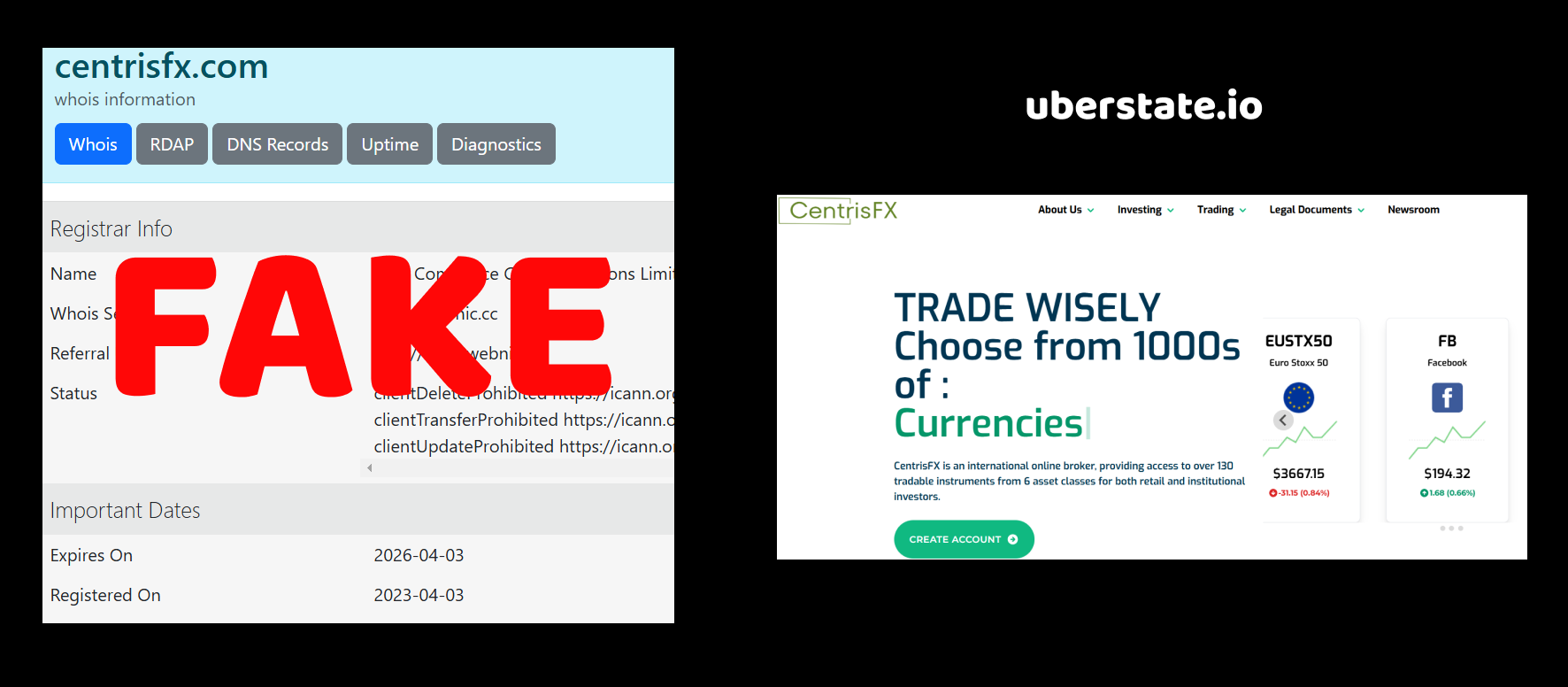

Suspicious Domain Timeline

When we finished digging into Centris FX, the very first thing that caught our eye was the domain registration date. According to WHOIS data, the domain centrisfx.com was registered on September 30, 2023. That’s alarmingly recent.

Now here’s the catch — the website doesn’t just present itself as a fresh startup. On the contrary, it tries hard to pose as an established, professional broker with years of experience under its belt. They talk about “trusted services,” “loyal clients,” and even hint at a long-standing reputation in the market.

But how can that be if the domain was only purchased a few months ago?

Unless they were operating under a completely different name before (which they don’t mention anywhere), it makes no sense. And if they were, wouldn’t transparency demand they tell users about their past branding? The fact that they don’t say a word about it makes the situation even sketchier.

Why hide something like this… unless the truth is inconvenient?

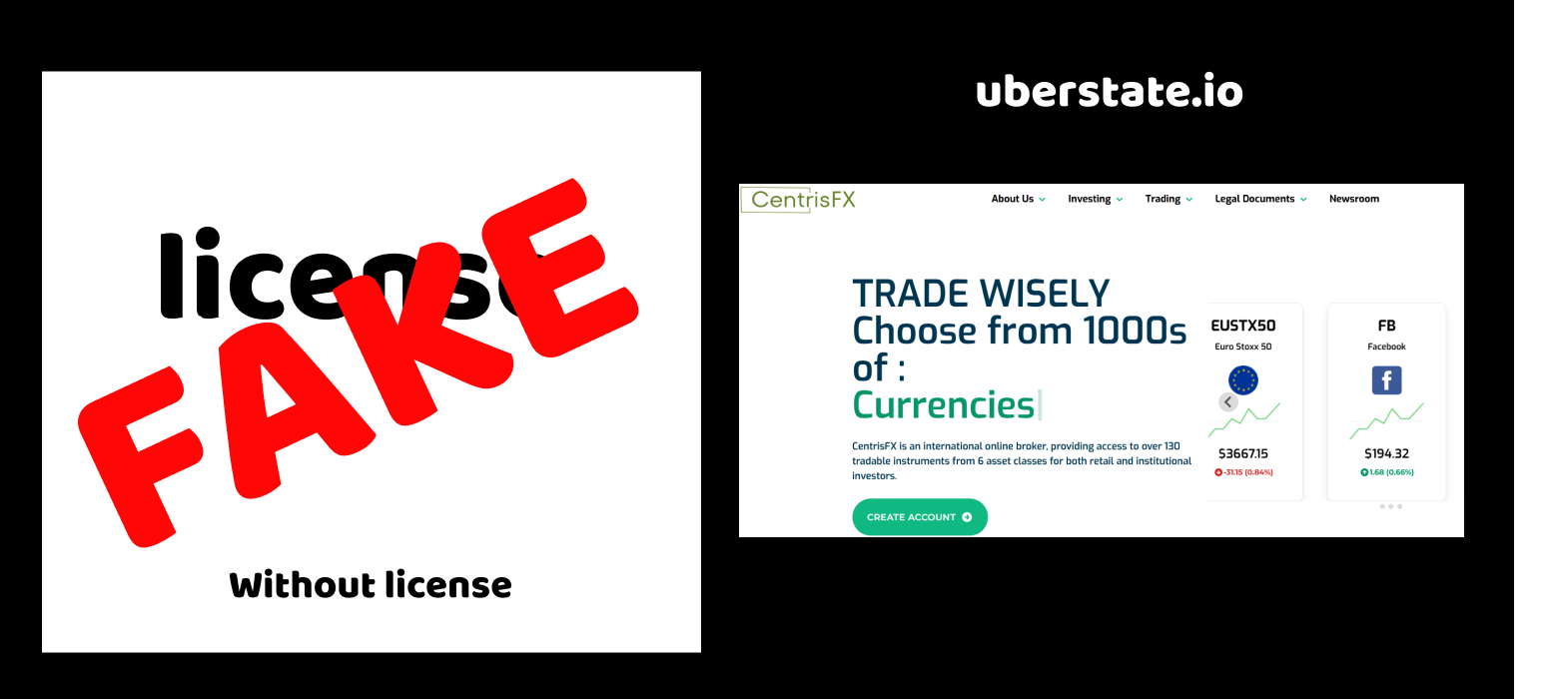

Fake Licensing from a Dubious Source

Let’s talk about one of the most important things any trader looks for in a broker — a license. After all, who wants to risk their money with a company that isn’t properly regulated?

But guess what? Centris FX claims to be licensed… yet the supposed regulator listed is Mwali International Services Authority. Sound familiar? Probably not — and there’s a reason for that.

This so-called regulator is based in Comoros, and it’s infamous for being used by dozens of shady brokers who want to look “legit” without actually following any real rules. In our internal checklist, licenses from Mwali and similar entities are marked as FAKE — because these bodies don’t provide real oversight. No audits. No compensation schemes. No accountability. Just a nice-looking PDF anyone can pay for.

And here’s the question — why would a “serious financial platform” choose such a questionable regulator instead of applying through the FCA, CySEC, or even ASIC? Real regulators are tough, sure. But isn’t that the whole point? To protect traders?

Or maybe Centris FX doesn’t want strict oversight. Maybe it’s more convenient for them to operate where no one’s really watching.

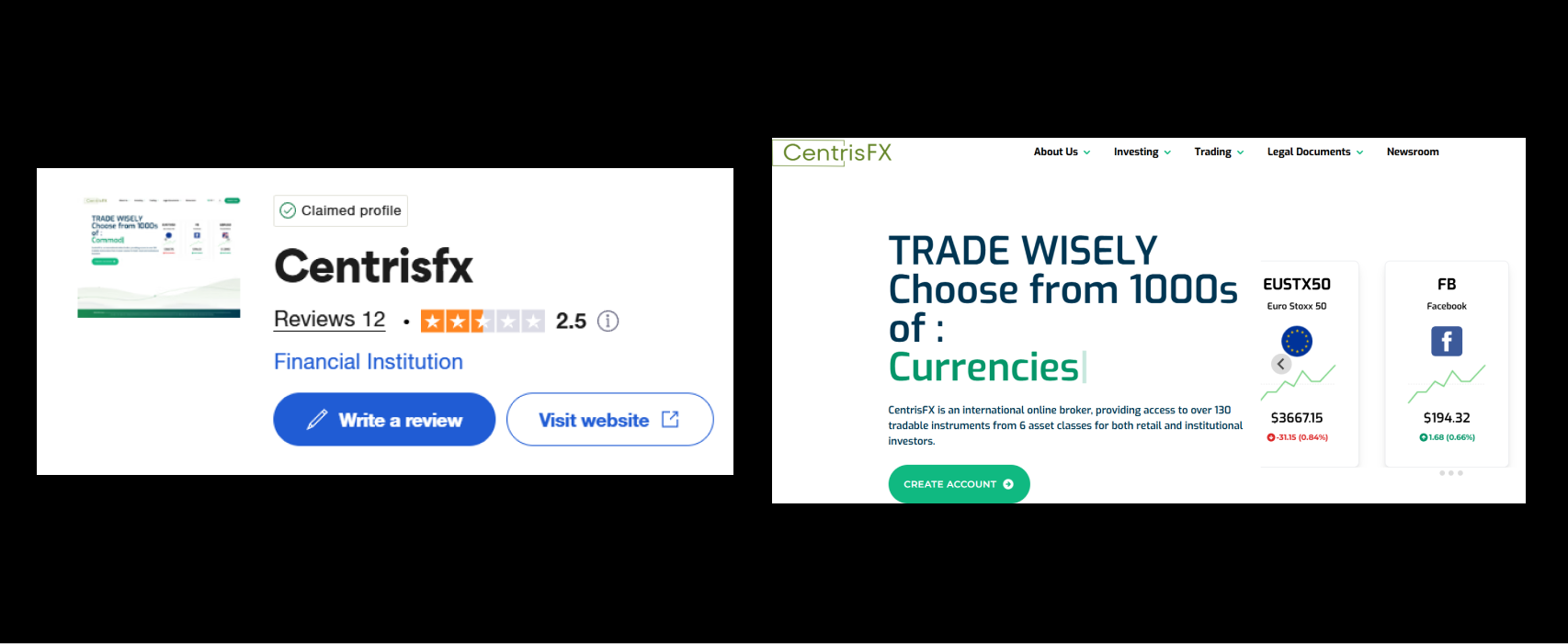

Overpolished Reviews, Suspicious Patterns

After we took a close look at Centris FX’s Trustpilot profile, one thing became painfully clear: the reviews don’t pass the smell test.

Their overall score is 3.7, which is already a red flag for any broker claiming to be “top-tier.” But what’s even more telling is how that score is built. Nearly all of the positive reviews look like they were written by the same person—or at least by people following the exact same script.

Phrases like “excellent customer support,” “fast withdrawals,” and “trusted broker” repeat across reviews, almost like someone copy-pasted them with minor edits. No personal trading stories. No real specifics. Just generic praise.

Now ask yourself: when real people leave reviews—especially about their money—they usually mention details. Things like specific instruments, account managers, problems they faced, or how long they’ve been trading. But here? Silence.

Another weird twist? The few negative reviews that exist are way more detailed and sound way more real. Users mention blocked withdrawals, unanswered emails, and the sudden disappearance of support.

So let’s break this down.

Why would a legitimate company need to inflate their rating with templated reviews? Why not just let real customers speak? Maybe… because real customers wouldn’t be so kind?

Centris FX Brand Review: Final Verdict — Too Many Red Flags, Not Enough Trust

After wrapping up the full analysis of Centris FX, there’s really no way to sugarcoat it — everything about this broker points in one direction, and it’s not the one honest traders want to see.

The domain? Registered in late 2023, yet they market themselves like industry veterans. That’s not just misleading — it’s deliberately deceptive. The license? Issued by an offshore “regulator” that’s been linked to dozens of scam operations, and offers zero protection for traders. The reviews? Flooded with generic 5-star fluff, likely generated to drown out the few real complaints that actually describe what it’s like to use this platform.

And when you add it all up — the fake licensing, the shaky reputation, the scripted reviews, the attempt to appear more established than they are — the picture becomes painfully clear.

Centris FX doesn’t behave like a broker that wants long-term clients. It behaves like one that needs just enough people to fall for the act before the game collapses.

Because let’s be honest — why would real professionals go through so much trouble to fake their image if they were offering a legitimate service?

Trust is everything in trading. And here, it’s the one thing that’s clearly missing.