Fin Trends Review — Is This Broker Hiding Something?

At first glance, Fin Trends looks like your typical modern broker — sleek website, bold claims, and a whole lot of buzzwords. They promise expert trading solutions, “top-tier” security, and a professional team ready to help you grow your wealth. But here’s the thing… we’ve seen this setup before. More than once.

That’s why we decided to dig deeper and do a full Fin Trends review — not based on shiny banners or sales talk, but on cold, hard facts. Because when it comes to online brokers, especially those that popped up recently, trusting the surface can cost you more than just time.

What we found behind the curtain? Let’s just say the glossy image starts to fall apart very quickly.

Fin Trends Review — Broker Overview

| Parameter | Details |

| Website | fintrends.io |

| Date of Domain Purchase | September 20, 2023 |

| Leverage | Up to 1:500 |

| Types of Accounts | Basic, Silver, Gold, Platinum |

| Contact Email | [email protected] |

| Phone Number | +44 203 807 4652 |

| Location (claimed) | London, UK |

| License | Mwali International Services Authority (Fake/Offshore) |

A few things immediately stand out.

Offering 1:500 leverage is extremely aggressive — legit EU or UK-regulated brokers are capped at 1:30 for retail clients. That’s not just a number — that’s a red flag. High leverage like this is often used by shady platforms to attract risk-takers, then flip the script on them.

Their contact information is also pretty standard — a UK phone number, an email, and a London address. But again, a claimed UK address means nothing without FCA regulation. And spoiler: they don’t have it.

So once again, the surface-level info looks okay. But when you start putting it together with everything else… the puzzle starts to look more like a trap.

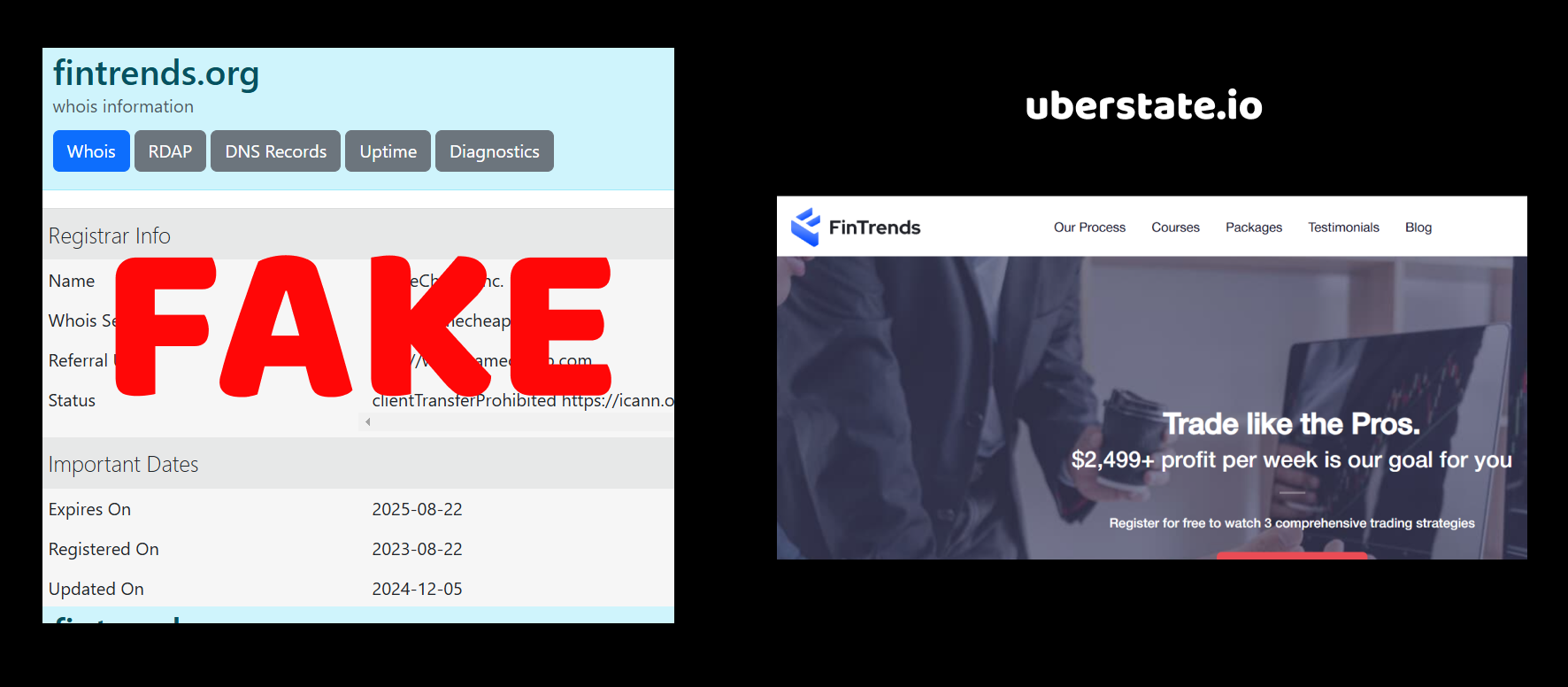

Fin Trends Review — Argument 1: Domain Registration Date

When we looked into fintrends.io, the first thing that jumped out was the domain registration date — September 20, 2023.

Now here’s the catch: the project presents itself as if it has years of experience in financial markets. They talk about their “expert analysts,” “long-standing reputation,” and even claim to have helped thousands of clients worldwide. But how could all this be true if the website didn’t even exist before fall 2023?

Let’s be honest — building that kind of reputation takes time. And we’re not talking about a few weeks or months. You don’t become a trusted player in the financial world right after buying a domain. So why are they in such a hurry to convince us of their long history?

We’ve seen this trick before — fake legacy. Scammers know that people trust brands with “experience.” So they try to manufacture it. But the truth always leaves a trace, and in this case, the domain age tells the real story.

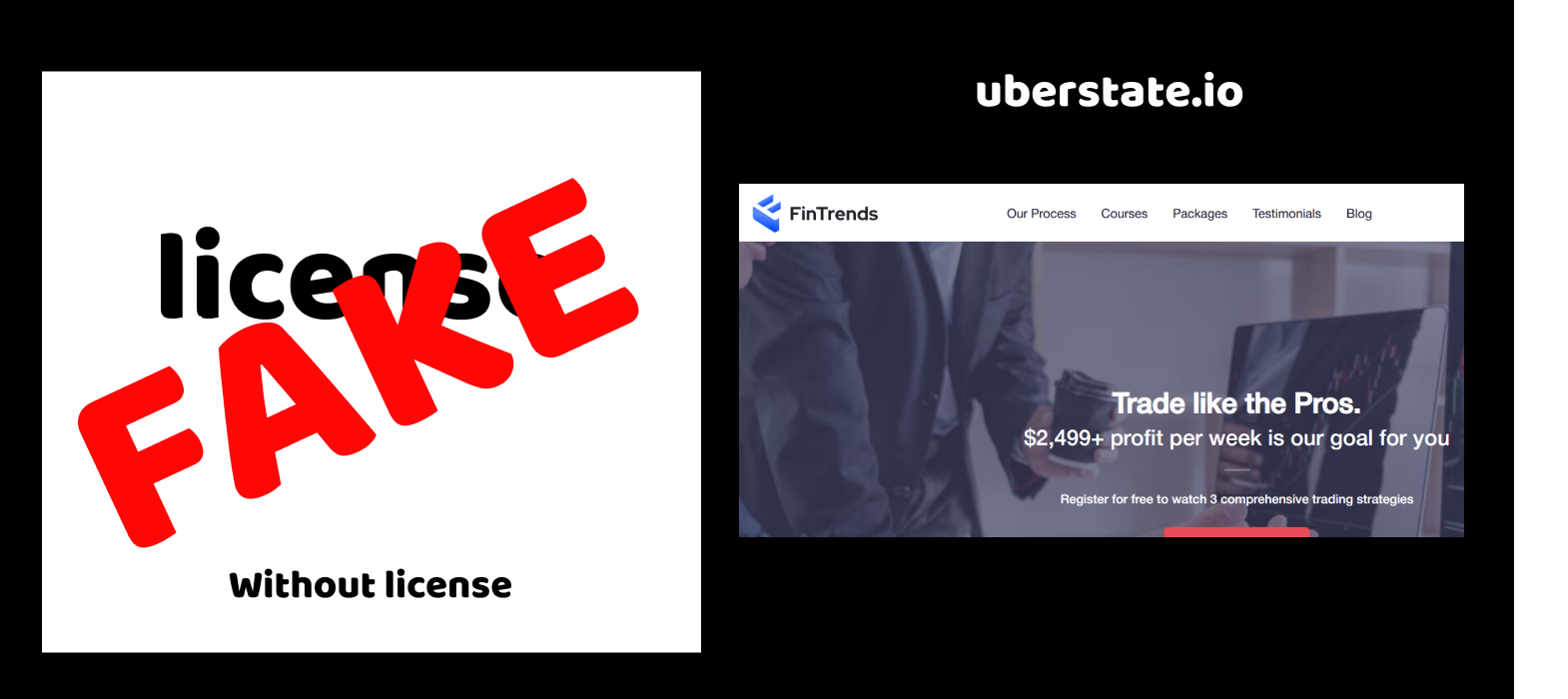

Fin Trends Review — Argument 2: Fake License Alert

After digging through the legal section of Fin Trends, we noticed something that instantly raised red flags. They claim to be regulated by an entity called “Mwali International Services Authority” — sounds official, right? But here’s the twist: this so-called regulator is from the Comoros Islands, and in the world of finance, that name doesn’t exactly scream “trustworthy oversight.”

We’ve checked this body many times before — and every time, it leads to one conclusion. This is not a serious regulator. It doesn’t provide any investor protection, doesn’t audit broker behavior, and most importantly — it doesn’t go after scammers. So what’s the point of such a license, really?

Let’s think about it: why would a “professional” broker choose some obscure offshore license, instead of going for a legit one like FCA (UK), ASIC (Australia), or CySEC (Cyprus)? Probably because those regulators actually hold firms accountable. They fine, suspend, and publish reports. Mwali? They just hand out papers for a fee. That’s it.

And this leads to the bigger question:

Why would a real broker avoid real regulation?

Unless, of course, their business model depends on not being watched too closely…

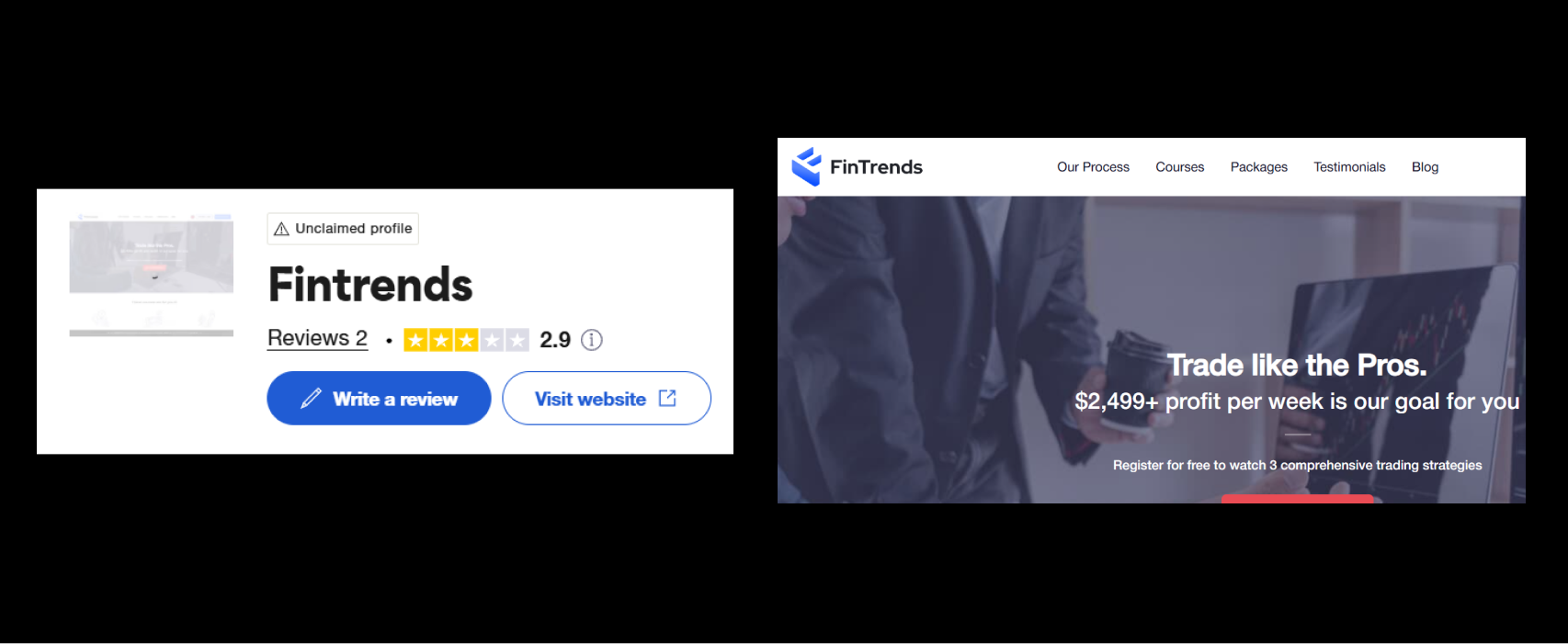

Fin Trends Review — Argument 3: Suspicious Reviews on Trustpilot

We checked Trustpilot, and here’s what we found: Fin Trends has a suspiciously low score of 2.8. That alone is a red flag — reputable brokers usually aim for at least a 4.0+. But the story doesn’t end there.

What caught our eye wasn’t just the low score — it was how fake the positive reviews looked.

We went through them manually. The five-star ones? They all read like they were written by the same person on repeat:

“Great support.” “Fast withdrawals.” “Best platform ever.”

No details, no nuance, no actual trading experience. Just vague praise. And strangely, most of those reviews were posted within a short time span — another typical sign of review farming.

Meanwhile, the negative reviews? Way more detailed. People complained about withdrawal issues, blocked accounts, and unresponsive support. Some even mentioned being pressured to deposit more money or being ghosted after asking for their funds back.

So here’s the contradiction:

Why are real users reporting scammy behavior, while a bunch of robotic five-star reviews pretend everything is perfect?

Looks like someone’s trying really hard to clean up their image… but doing a poor job of it.

Fin Trends Review — Final Verdict

After putting all the pieces together, the image becomes painfully clear: Fin Trends is not what it pretends to be.

They try to pass themselves off as an established, trustworthy broker — but the domain was only registered in late 2023. That alone should make any experienced trader pause. Why fake your history if you’ve got nothing to hide?

Then comes the license — or rather, the illusion of one. A paper from a remote offshore “regulator” like Mwali might sound official to a newcomer, but in reality, it means no legal protection, no oversight, no consequences for misconduct. It’s the kind of license chosen by those who don’t want anyone looking over their shoulder.

And the reviews? A sad attempt at damage control. While real users complain about being scammed, a wave of generic five-star posts tries to drown them out. But it’s too obvious — too scripted. Why would a real broker need fake praise unless they’re trying to hide real problems?

So let’s ask the question one more time:

Why would legit brokers go through all this effort to mislead people?

They wouldn’t. But scammers would. Because they’re not looking for smart, cautious clients — they’re looking for quick victims. And the more we dug into Fin Trends, the more it felt like that’s exactly what this project is built for.

Stay sharp. Stay skeptical. And never trust a broker just because they look professional.