Wealthaven.com review

There’s something oddly familiar about Wealthaven. Sleek website, promising slogans, “regulated” status, and claims of top-tier trading conditions. It’s the kind of setup that’s designed to impress at first glance. But the more we looked into it, the more it felt like déjà vu — as if we were staring at yet another clone in a long line of shady brokers.

We’ve seen this formula before: flashy presentation on the outside, but once you start peeling back the layers, it all begins to fall apart. And fast. Wealthaven checks way too many boxes in the scammer’s playbook — a freshly registered domain, a fake offshore license, and suspiciously polished reviews.

So we decided to dig deeper. Not just skim the surface, but really investigate: who’s behind this broker? What’s hiding in the fine print? And most importantly — is this platform really safe for your money?

What we found… well, let’s just say it didn’t inspire confidence.

Wealthaven – Broker Summary

| Parameter | Details |

| Website | wealthaven.com |

| Domain Registration | December 18, 2023 |

| Declared License | Mwali International Services Authority (MISA) |

| License Type | Fake |

| Trustpilot Score | 2.9 / 5 |

| Account Types | Standard, Silver, Gold, VIP |

| Maximum Leverage | 1:500 |

| Contact Info | Email, phone (not clearly listed) |

Wealthaven.com review

At first glance, everything looks pretty polished. The name sounds trustworthy, the website seems neat, even the logo looks like someone put effort into it. But we’ve learned the hard way — never judge a broker by its front page.

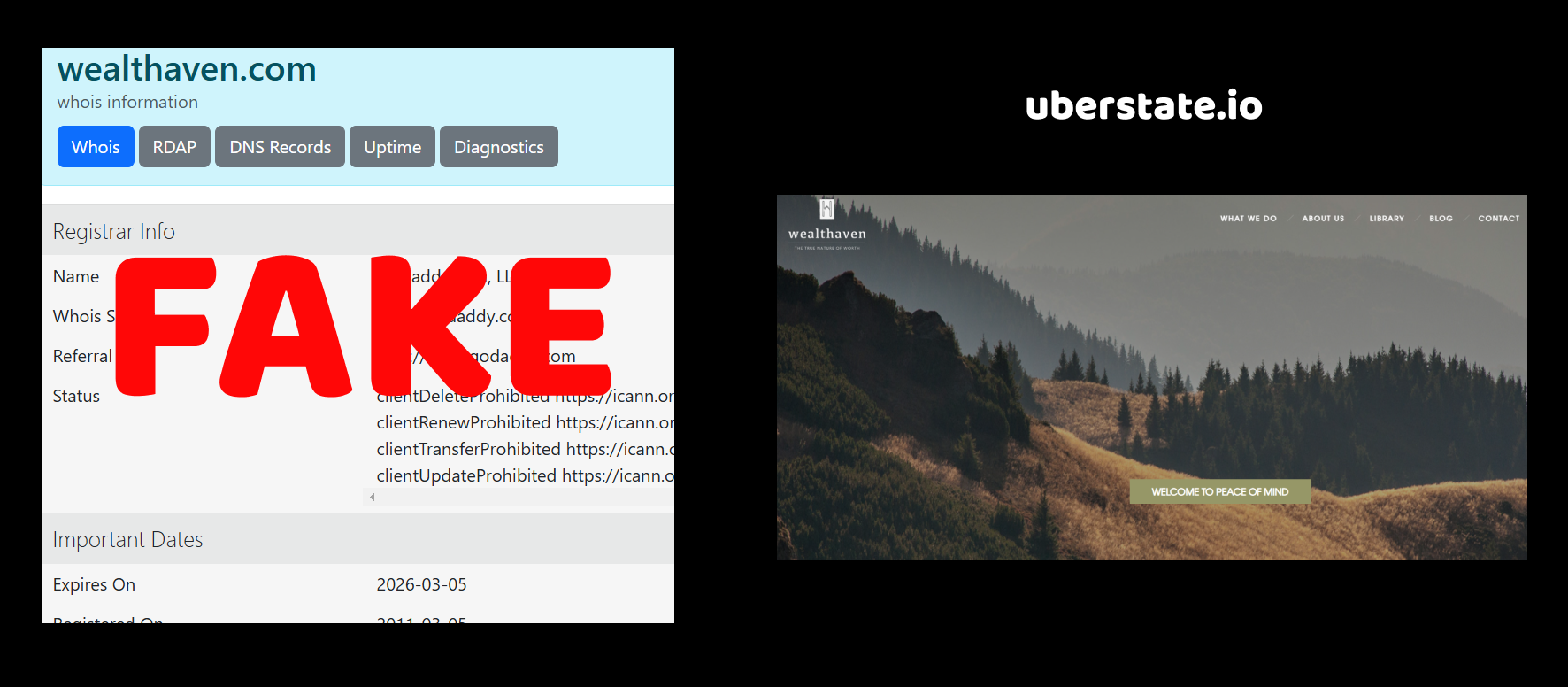

When we took a deeper dive into the technical side of Wealthaven, one detail immediately raised a red flag. The domain was registered on December 18, 2023. So, we’re dealing with a website that’s been around for just a few months — barely enough time to even test the waters, let alone prove itself as a trustworthy financial platform.

And here’s the weird part — they already claim to have tons of clients, glowing reviews, and this whole aura of being a “professional” broker. Really? In just a couple of months?

Why would anyone put their money into a platform that appeared out of nowhere?

This is classic behavior for shady schemes — launch a brand-new site, create the illusion of success, and lure in those who don’t check the fine print. Because let’s face it: scammers don’t need long-term clients. In fact, they avoid them. Why? Because long-term clients start asking questions. They dig. They notice inconsistencies. And that’s the last thing these creators want.

So yeah… the creation date says more than it seems.

Wealthaven license reviews

Once we got past the shiny surface and checked their so-called “regulation,” things really started to unravel. Wealthaven claims to be licensed, which is a bold statement — but hey, we’ve seen this trick a hundred times. So we took a closer look.

Turns out, their “license” is issued by an entity called Mwali International Services Authority (MISA). Sounds exotic, doesn’t it? Mwali — that’s a small island in the Comoros. You’d think a serious broker would aim for at least a CySEC or FCA license, right?

But here’s the thing: MISA is a fake regulator when it comes to the world of financial oversight. These types of offshore “authorities” hand out licenses like candy — no strict rules, no client protection, and most importantly, zero accountability. If something goes wrong with your money, you’ll be lucky if anyone even responds to your complaint.

And let’s be honest — why would a legitimate broker go all the way to some remote island to get “regulated”? What are they trying to avoid? Maybe real supervision?

We’ve seen this pattern before. Scammers love fake licenses because they look official at first glance, but in reality, they’re just paper shields. They know most people won’t double-check. And even if someone does — by the time you figure it out, it’s already too late.

So yeah, Wealthaven didn’t just skip real regulation. They went out of their way to create the illusion of it. That alone speaks volumes.

Wealthaven Trustpilot reviews

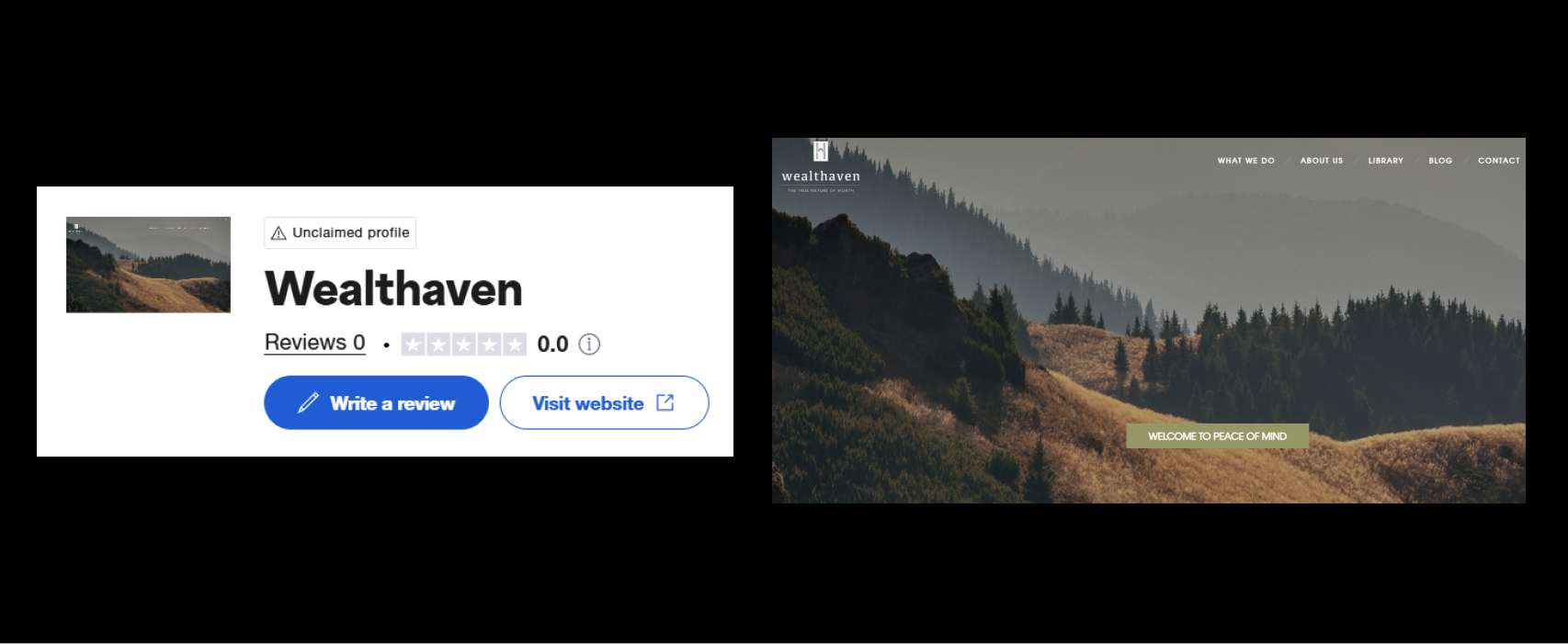

We’ve seen all kinds of tricks, but fake reviews? That’s one of the oldest in the scammer playbook. Naturally, we checked Wealthaven on Trustpilot — and guess what? Their score is just 2.9 out of 5. That’s already below average, but the story doesn’t end there.

The negative reviews are full of red flags: users complain about not being able to withdraw funds, getting ghosted by customer service, or being asked to deposit more money before “processing” withdrawals. Classic scam behavior.

But what’s even more telling is the style of the positive reviews.

Almost all of them look… manufactured. Same writing tone. Generic phrases like “great experience,” “very professional broker,” “helped me earn money fast.” Really? From a broker that’s only been around for a few months? That alone should make anyone suspicious.

And the timing? Many of those positive reviews were posted in a very short period, almost like someone hired a crew to quickly polish up their image. Real customers don’t post that way — they leave reviews over time, with different tones, different languages, different details. This looks like a copy-paste operation.

So here’s the question: if the service was so “great,” why do the real users keep saying their money disappeared?

We’ve learned to read between the lines. And in this case, the lines are screaming: manipulated reputation.

Final thoughts on Wealthaven

After digging through every layer of Wealthaven, it became painfully clear: this is not a platform built for long-term, honest trading. It’s a trap — carefully decorated, but ultimately designed to funnel money out of your pocket and into someone else’s.

Let’s recap what we uncovered.

The domain was created just a few months ago — a clear sign we’re dealing with a freshly baked project. There’s no trading history, no track record, no reputation that’s been earned over time. Instead, there’s only a rushed setup and a heavy reliance on first impressions.

Their so-called license? Issued by MISA, a fake regulator from a remote island with no authority or protection for clients. This is a classic move among scammers — use a flashy badge from a jurisdiction no one’s heard of, just to look “legit.” But real regulation comes with oversight. And that’s exactly what they’re trying to avoid.

Then we have the Trustpilot reviews. A mix of red-flag complaints from real users, and fake, robotic 5-star reviews that all read like they were written by the same person on the same day. We’ve seen this manipulation tactic far too many times. It’s not just about building fake trust — it’s about drowning out real warnings.

And when we combine all this with their vague contact info, unrealistic promises, and overall lack of transparency — it all fits the same pattern. Wealthaven isn’t just risky. It’s engineered to mislead.

Because let’s be honest — why would a trustworthy broker need fake reviews, offshore “licenses,” and a mysterious history?

The answer is simple: they don’t. But scammers do.