Fintxpert Review — A Broker Wrapped in Red Flags

You’ve probably seen flashy ads or slick social media posts promising easy profits with Fintxpert. They offer “premium” trading accounts, “experienced” analysts, and a “cutting-edge” platform. Sounds tempting, right?

But here’s the thing — we’ve seen this movie before.

When our team started digging into Fintxpert, it didn’t take long to realize something’s off. From their barely-existent licensing to the suspicious patterns in reviews, this broker feels more like a setup than a service. It’s almost as if the entire brand was built around the appearance of trust, not the substance of it.

And that’s exactly what scam operations specialize in — building a mask convincing enough to lure people in, just long enough to make a quick exit.

So let’s break it all down, one red flag at a time.

Fintxpert – Broker Overview

| Parameter | Details |

| Domain | fintxpert.com |

| Domain Registration | 26 November 2024 |

| Claimed Founded | 2022 (but the domain was bought two years later — strange?) |

| Regulation | ❌ No license at all |

| License Type | Without license |

| ⭐ Trustpilot Score | 2.2 / 5 |

| Total Reviews | 33 reviews (7 are negative — and the rest smell fake) |

| Languages | English |

| Account Types | – Standard — €250

– Silver — €10,000 – Gold — €25,000 – Premium — €100,000 |

| Leverage | No information provided |

| Trading Platform | No information (not even a mention of WebTrader, MT4, or anything else) |

| Restricted Countries | Not specified |

| Contact | [email protected] |

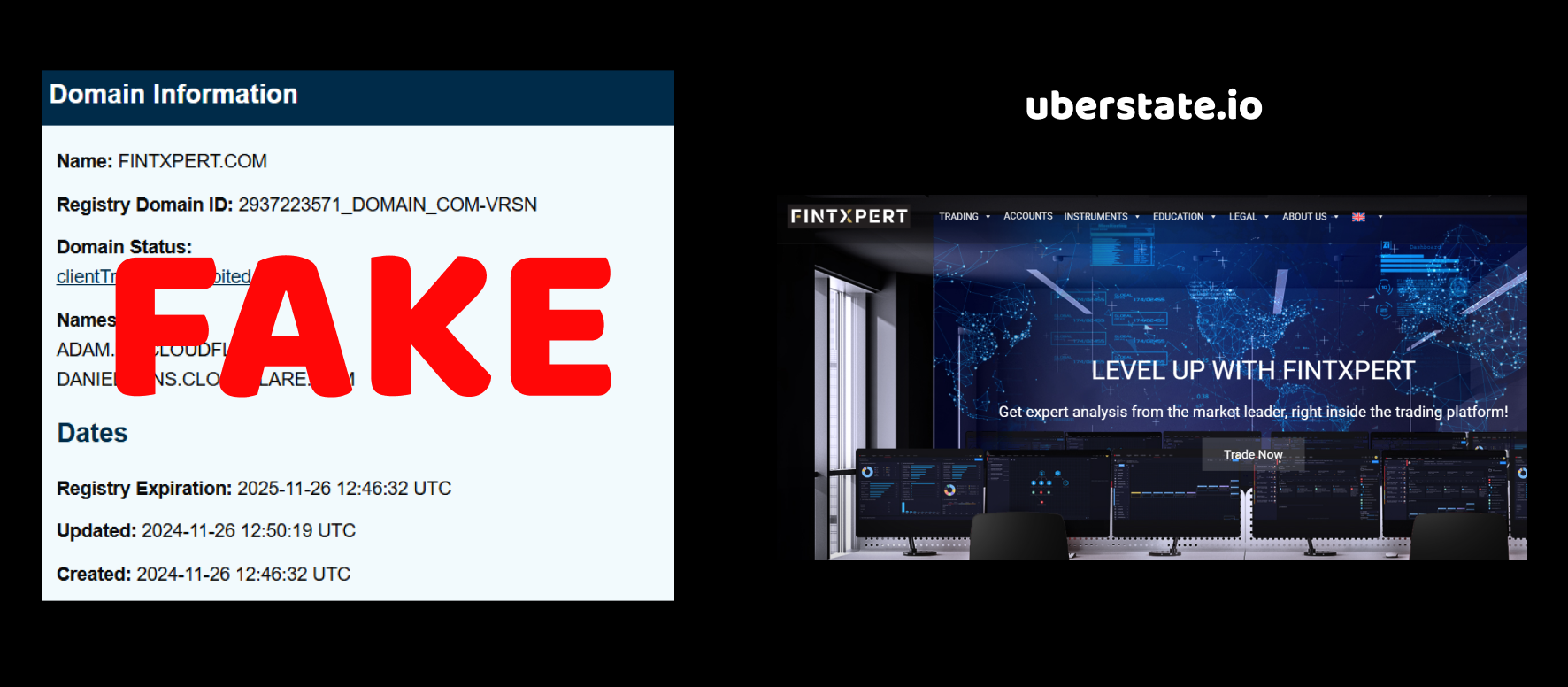

Argument 1: Domain Creation Date

When we looked into Fintxpert, the first red flag popped up before we even reached their homepage. We checked the domain registration date — and guess what? The domain was purchased on November 26, 2023.

Why does this matter?

Because the so-called “company” claims to have years of trading experience, a team of seasoned financial experts, and a long track record of helping clients. Really? All that in just a few months?

Let’s be real here — a broker with such a fresh domain can’t possibly have the history they claim. It simply doesn’t add up. Even if they try to hide behind some holding company or rebranding story, that doesn’t erase the digital footprint. The internet remembers everything.

But here’s where it gets even more suspicious… Scam brokers love to create the illusion of being well-established, hoping that no one will actually check when their domain was bought. After all, why would scammers want clients who are smart enough to investigate?

So if their digital presence only started at the end of 2023, and everything before that is just smoke and mirrors — isn’t that a bit too convenient?

We’re just getting started.

Argument 2: The License — or the Total Lack of One

After checking Fintxpert’s regulatory status, we didn’t just find something suspicious — we found nothing at all. That’s right: this broker operates without any license whatsoever. Not even a fake one to at least pretend to be legit.

No Mwali. No SVG. No Vanuatu. Nothing.

And that’s actually worse. Because usually, scam brokers at least try to dress themselves up in some offshore “regulation” to trick new traders. But here, they didn’t even bother. Why would they? Their target audience probably isn’t expected to ask any questions.

But think about this: would you ever hand your money over to a financial “service” that isn’t being watched by any regulator? No audits, no rules, no oversight. If they disappear tomorrow — there’s no one you can complain to.

And you know what else feels weird?

Their website is up, they accept client deposits, they promote multiple trading accounts — and yet they’re doing all of this without any legal authorization. In most countries, that’s not just shady — it’s illegal.

So let’s ask the obvious: why would a “serious” broker skip regulation entirely? Is it because they don’t want to be held accountable? Or maybe… they know they wouldn’t pass even the most basic checks?

It’s almost like they’re setting up the perfect exit strategy from day one.

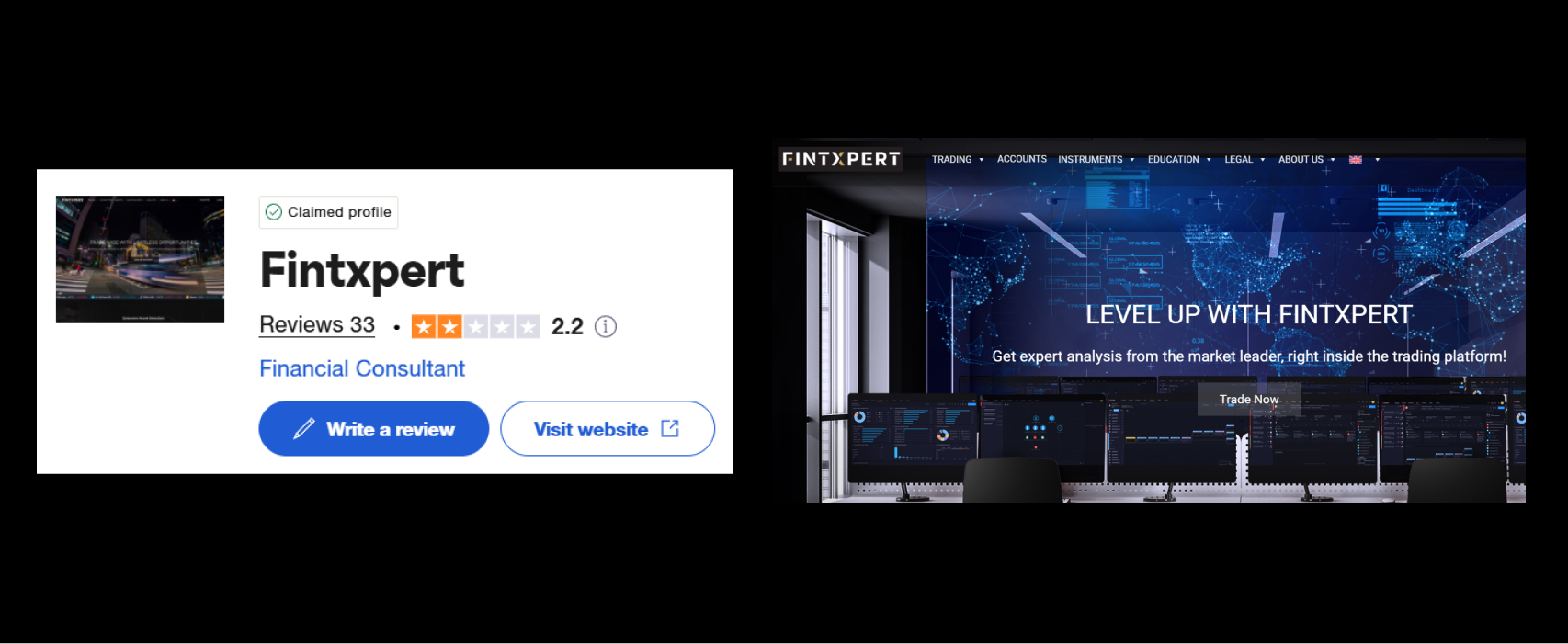

Argument 3: Trustpilot Reviews — And the Smell of Manipulation

Fintxpert has a profile on Trustpilot with a score of 2.2 out of 5. That’s already a massive red flag. But we didn’t stop at the number — we took a deep dive into how people are reviewing this broker. And let me tell you, the pattern is all too familiar.

Out of 33 total reviews, 7 are clearly marked as bad — that’s over 20% of people openly warning others. And the rest? That’s where it gets weird.

Most of the positive reviews are written in the same tone, same structure, and often repeat the same ideas: fast withdrawals, helpful support, easy to use. But no specifics. No real names. No mention of any actual trading experience. It’s like they were written from a script.

You know what that usually means? Manufactured reviews. Probably bought in bulk from some shady service to push up the rating just enough to not scare off new victims.

Now here’s what legit reviews usually look like — they’re detailed, personal, sometimes messy. People talk about their specific issues or wins. But here, it’s the opposite. A bunch of vague praise drowning out the warning signs from real users.

And ask yourself this: if Fintxpert really were reliable, would they need to pad their profile with fake positivity?

Because let’s not forget — 2.2 out of 5 is still terrible. Even after all that effort to manipulate the perception. Imagine what the score would be if they hadn’t tried to cover their tracks.

So what’s the real story hiding behind those glowing one-liners? Probably a lot of angry clients who never got their money back.

Final Verdict: Fintxpert Is a Risk You Don’t Want to Take

After going through every layer of Fintxpert’s operation — or rather, performance — it’s hard not to see it for what it really is.

First, the domain was bought in late 2024, while the company pretends to have years of experience. That’s not just misleading — it’s pure fiction. Then there’s the lack of any license whatsoever, not even one of those fake offshore ones most scammers use. They didn’t even try to look legit.

Next, we looked at the reviews, and the pattern was almost textbook — a low Trustpilot score (2.2), a wave of oddly similar “positive” comments, and a decent chunk of honest, frustrated users calling out the scam.

And when you add in the rest — vague account types, no transparency, basic contact info, and zero legal presence — the whole thing starts looking less like a broker… and more like a trap.

Because here’s the deal: real brokers don’t hide behind fake reviews, unregulated setups, and invented histories. But scam brokers? That’s their entire playbook.

So ask yourself — why would you trust your money to a company that gives you every reason not to?

Fintxpert doesn’t just raise red flags. It waves them like a parade.