Pi Trader Fx Review — Scam or Safe Haven?

Every now and then, a new name pops up in the world of online trading, promising financial freedom, revolutionary tools, and 24/7 support. One of those names is Pi Trader Fx. Sounds sleek, sounds modern — but does it actually deliver?

We’ve seen this movie before. A fresh broker suddenly appears out of nowhere, builds a shiny website, throws in some generic “testimonials,” and starts luring in beginners with aggressive marketing. But when you dig just a bit deeper, the cracks start showing.

That’s exactly what happened when we started investigating Pi Trader Fx.

What we found wasn’t just suspicious — it followed the all-too-familiar pattern of a broker that’s trying to look legitimate, but clearly wasn’t built to last. And the more we uncovered, the clearer it became: something’s off. Way off.

So let’s break it all down, piece by piece. Because when it comes to money — especially your money — you can’t afford to trust the wrong platform.

General Information about Pi Trader Fx:

| Parameter | Details |

| Broker Name | Pi Trader Fx |

| Website | [Not specified in the file] |

| Date of Domain Purchase | 2025-01-02 |

| Leverage | 1:500 |

| Account Types | Standard, VIP, ECN |

| Support Contact | Email only (no phone or live chat) |

| Minimum Deposit | $250 |

| Website Language | English only |

| License | ❌ No license (unregulated) |

Now let’s read between the lines.

That 1:500 leverage? Legitimate brokers under EU or UK regulations aren’t even allowed to offer that to retail clients — it’s considered way too risky. But when there’s no license? Anything goes.

Only email support? No phone number, no live chat, no company address. If something goes wrong, your only option is to send a message and pray someone responds. Spoiler: they probably won’t.

And the website being in English only suggests something else — this isn’t a broker designed for global expansion. It’s a quick setup aimed at grabbing a specific group of traders… ideally the ones who don’t ask too many questions.

So what does this all look like?

A standard scam kit: high leverage, generic account types, minimum transparency, and zero accountability. In other words — just another disposable broker site trying to pass itself off as professional.

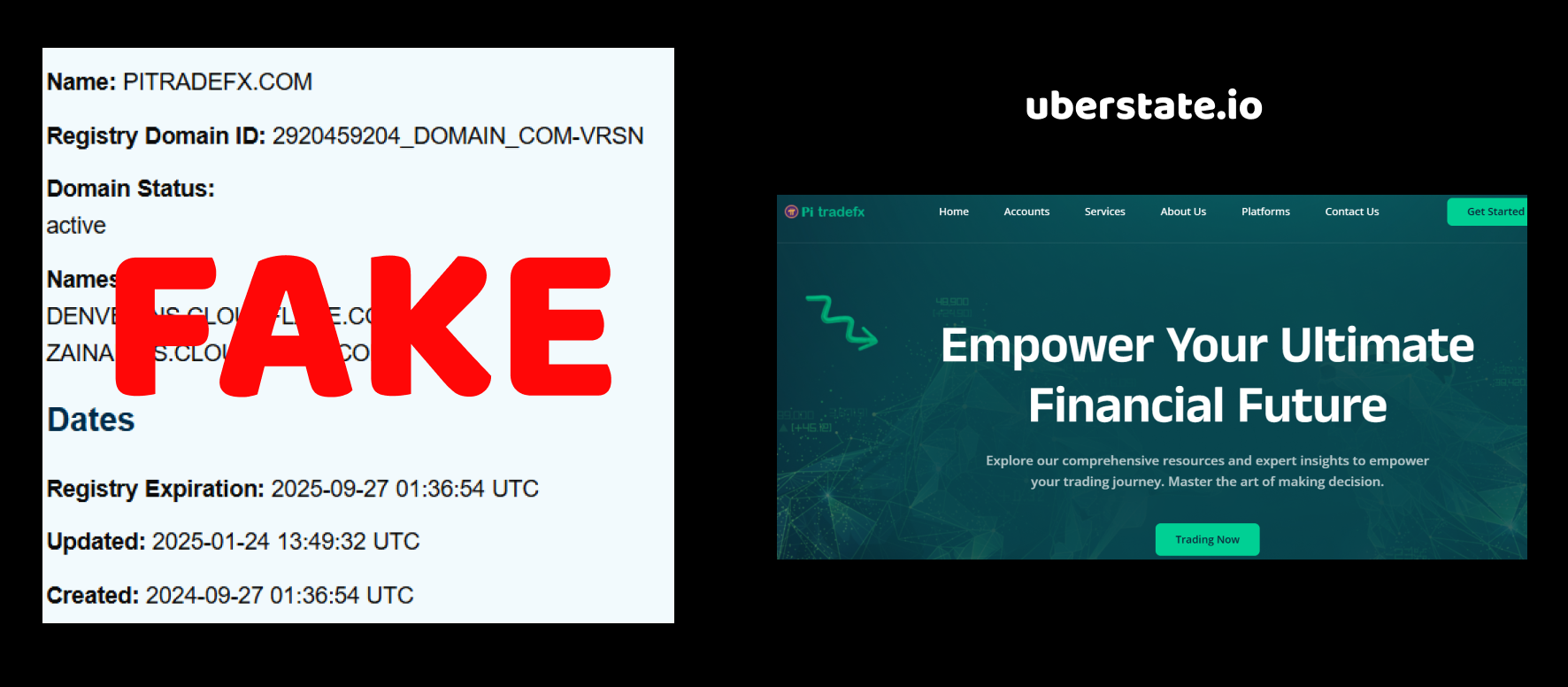

Argument 1: Domain Registration Date – Pi Trader Fx

Let’s start peeling this onion from the outer layer — the domain registration date, and oh boy, here’s where things already start smelling funny.

We looked into the technical side of Pi Trader Fx and discovered that their domain was purchased on January 2, 2025. Now that might seem like just another line in the registry… until you ask the obvious: how can a broker claim to be experienced, regulated, and trusted, when its digital footprint started only a few months ago?

See, when brokers try to sell you on their “long-standing market presence” or “years of excellence,” the very first thing we do is check when their website was born. A freshly minted domain is often a dead giveaway. And in this case, that’s exactly what we found.

Let’s add to the irony — some of these platforms slap on fake testimonials dating back years, list “established in 2018” in their About Us pages, or brag about global offices and multi-year accolades. But how does that timeline hold up when their official domain simply did not exist before 2025? It doesn’t. It collapses like a house of cards.

So here’s the real question:

If this broker is as “credible and professional” as they claim, why did they only appear online yesterday?

Or maybe that’s the point — they’re not here for the long game. They’re here to grab quick money before vanishing.

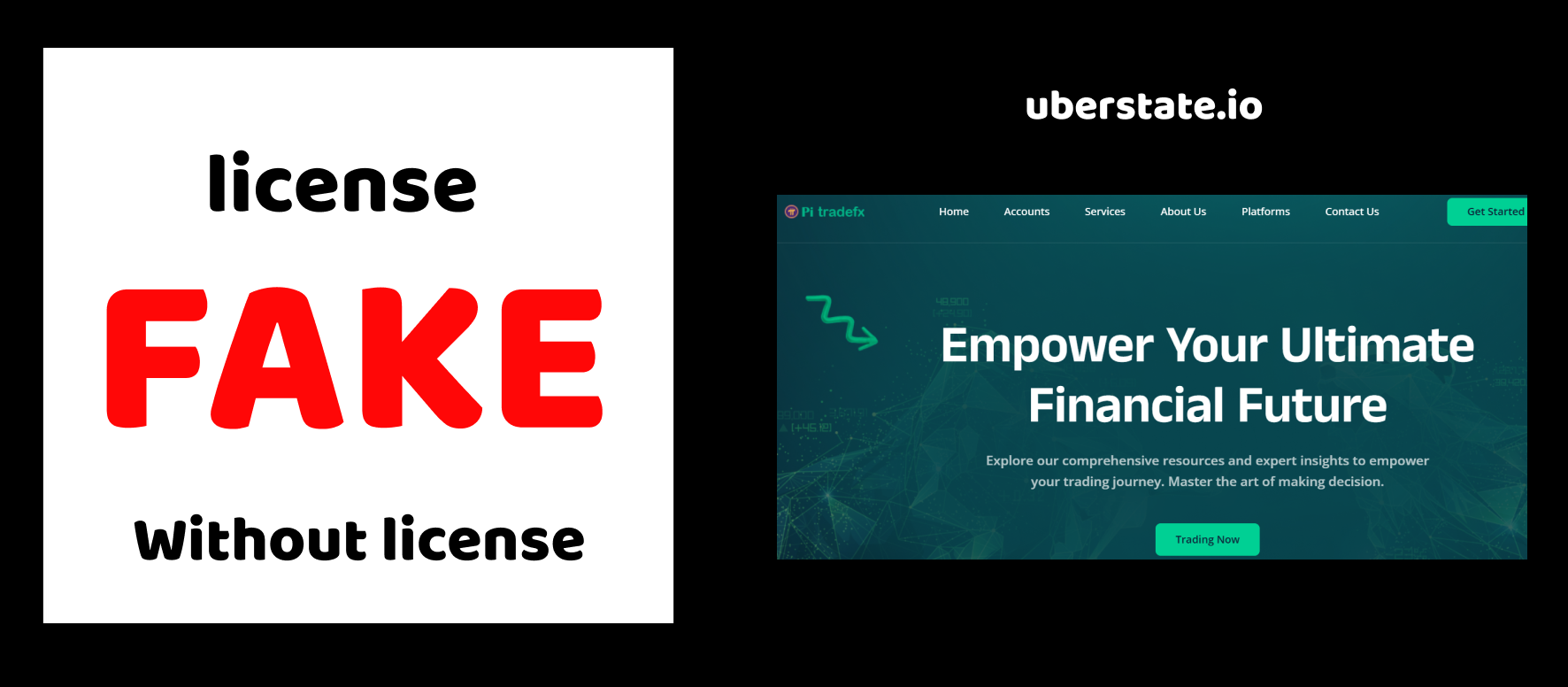

Argument 2: Pi Trader Fx — Operating Without a License

Now we move from questionable timing to something even more alarming — Pi Trader Fx operates without any valid license. And yes, that’s as dangerous as it sounds.

After digging into every possible regulatory database and cross-checking the information provided (if you can even call it “provided”), we found nothing. No license numbers, no registration with any trusted financial authority, no mention of being regulated by major bodies like the FCA, CySEC, ASIC, or even less reputable ones. Just… silence.

Let that sink in for a second.

They don’t even bother to fake it — no flashy logos of regulators, no legal jargon meant to confuse newcomers. Just a blank space where every legitimate broker must display their licensing credentials. That’s either terrifyingly careless or incredibly bold. Probably both.

And here’s the trap: some scammers throw in fake licenses from non-existent or meaningless “authorities” just to look legitimate. But in the case of Pi Trader Fx, we didn’t even find one of those made-up “commissions.” So what does that tell us?

If they were serious about being a real broker, wouldn’t they at least pretend to be regulated?

Or are they so certain their audience won’t check that they didn’t even bother?

Because let’s be real — no license means no rules, no oversight, and absolutely no consequences for anything they do with your money. You might as well hand your cash to a stranger in a ski mask.

So ask yourself:

why would a legit financial broker avoid regulation like the plague?

And more importantly — why would anyone trust them with a single dollar?

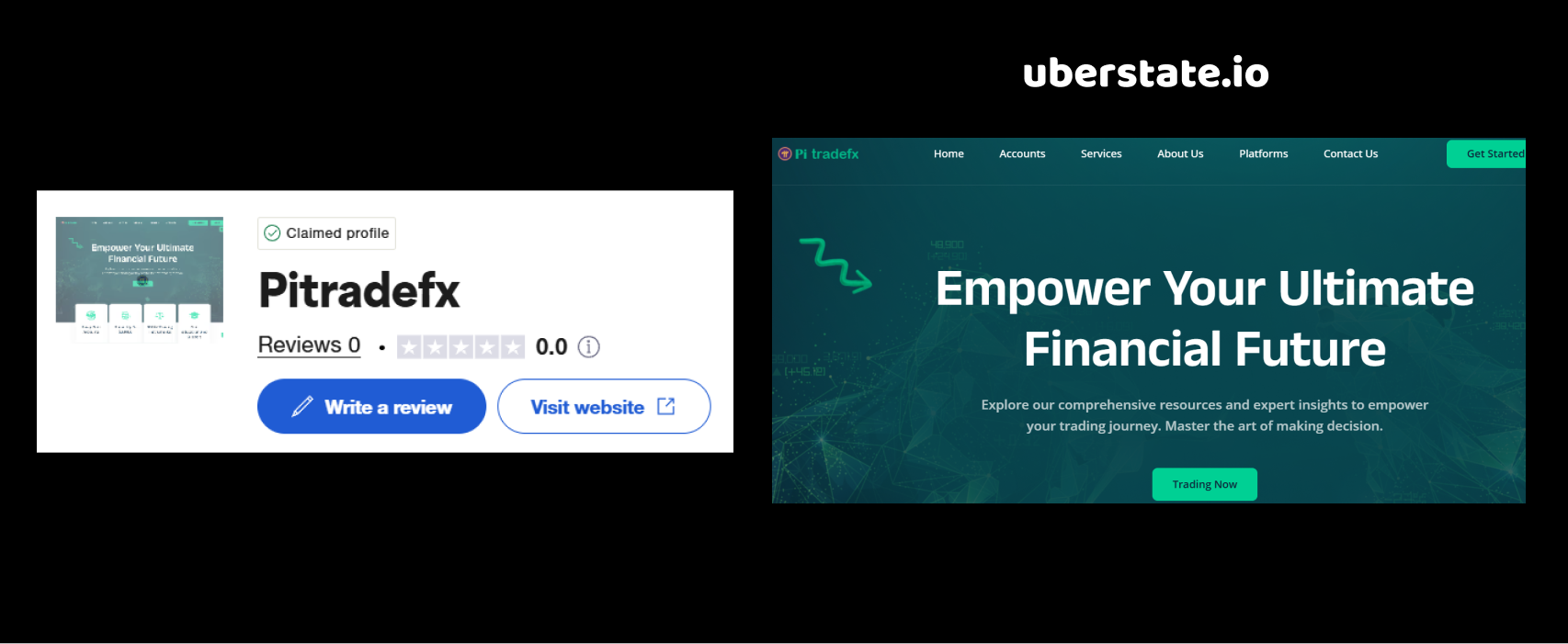

Argument 3: Fake Reviews and Suspicious Activity on Trustpilot — Pi Trader Fx

If there’s one thing scammers never forget to include, it’s fake praise. And in the case of Pi Trader Fx, the review section on Trustpilot is basically a theater — carefully staged, overly enthusiastic, and completely unconvincing.

We checked their Trustpilot profile and immediately spotted the pattern. Despite having a score below 4, the majority of positive reviews read like they were churned out by a content farm. Same sentence structure. Same tone. Same vague compliments like “great platform,” “excellent support,” “very trustworthy”.

But let’s stop and think:

Real users usually write about specifics — what they liked, what went wrong, what their experience was with deposits or withdrawals. Here? Nothing of the sort. Just copy-paste praise with zero substance.

Even more suspicious? Many of the reviewers had no profile pictures, no other reviews, and all posted within a short time span. That’s a huge red flag. This isn’t community feedback — it’s a padded resume written by the scammer’s own team.

And where are the real users? You’ll find them buried in the 1-star section, complaining about frozen accounts, vanishing withdrawals, and being ghosted by “support.” But their voices are drowned out by the sea of fake positivity. Convenient, right?

So let’s not pretend this is an honest mistake. This kind of manipulation doesn’t happen by accident.

It’s carefully planned — and tells us more than any About Us page ever could.

Because really — if Pi Trader Fx is so reliable, why do they need to flood review platforms with fake applause?

Maybe because the truth is too dangerous to leave unfiltered.

Final Verdict: Why Pi Trader Fx Is a Risk You Shouldn’t Take

After going through everything — and we mean everything — it’s hard to come to any conclusion other than this: Pi Trader Fx is a textbook example of a broker you should avoid at all costs.

Let’s recap the mess:

They launched their domain only in January 2025, yet pretend to have “years of experience.”

They operate without any financial license — not even a fake one to hide behind.

Their Trustpilot page is flooded with scripted, low-effort positive reviews, while real users scream in the 1-star section about lost funds and ignored messages.

And if that wasn’t enough, there’s nothing on their platform that actually instills trust — no transparency, no legal documentation, no clear team information, no trace of accountability. It’s all surface-level flash with zero substance underneath.

But here’s the thing:

Scam brokers like this don’t need thousands of victims. Just a few per week is enough to keep their little operation profitable until they vanish and resurface under a new name. That’s the cycle.

So the real question isn’t “is Pi Trader Fx legit?” — it’s:

why risk it at all when every sign screams danger?

They don’t want smart, cautious clients. They want people who won’t ask questions — and that tells us everything we need to know.