As an established platform in the world of online trading and investments, OANDA.com has earned a strong reputation for its comprehensive offerings, user-friendly interface, and commitment to providing reliable services to traders of all experience levels. In this detailed review, we at Uberstate.io will explore the various features, advantages, and potential drawbacks of using OANDA.com as a trading platform, comparing it with other platforms in the industry and assessing its overall value to both novice and experienced traders.

Overview of OANDA.com

OANDA is a globally recognized forex broker, offering a wide range of trading instruments, including forex, indices, commodities, and shares. Founded in 1996, OANDA has built a solid reputation over the decades, known for its transparency, robust trading platforms, and regulatory compliance. The platform caters to both retail and institutional clients, providing services that include currency conversion, online trading, and market analysis.

Trading Instruments and Market Access

One of the standout features of OANDA.com is the extensive range of trading instruments it offers. Traders can access over 70 forex pairs, making it one of the most comprehensive offerings in the market. Additionally, OANDA provides access to CFDs (Contracts for Difference) on indices, commodities, shares, and ETFs, allowing traders to diversify their portfolios effectively.

The platform also supports trading in cryptocurrencies, which is increasingly becoming a critical asset class for modern traders. OANDA offers CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, among others. This wi

de array of instruments positions OANDA as a versatile platform capable of meeting the needs of a diverse trader base.

Trading Platforms

OANDA offers multiple trading platforms to suit different trading styles and preferences. The primary platform, OANDA Trade, is a web-based platform known for its intuitive design and comprehensive features. It includes advanced charting tools, a wide range of technical indicators, and customizable layouts, making it a powerful tool for both novice and professional traders.

For those who prefer desktop applications, OANDA offers the OANDA Desktop platform, which provides even more advanced features, including enhanced charting capabilities and algorithmic trading options through APIs. Additionally, OANDA supports the popular MetaTrader 4 (MT4) platform, allowing traders to leverage its extensive ecosystem of plugins, EAs (Expert Advisors), and custom indicators.

OANDA also caters to

traders on the go with its mobile trading app, available for both iOS and Android devices. The app mirrors the functionality of the web-based platform, ensuring that traders can manage their positions and analyze the markets from anywhere.

Account Types and Spreads

OANDA simplifies the account setup process by offering a single standard account type with competitive spreads. This approach contrasts with many brokers that offer multiple account tiers with varying benefits and minimum deposit requirements. OANDA’s straightforward model ensures that all tr

aders, regardless of their initial investment, have access to the same trading conditions and spreads.

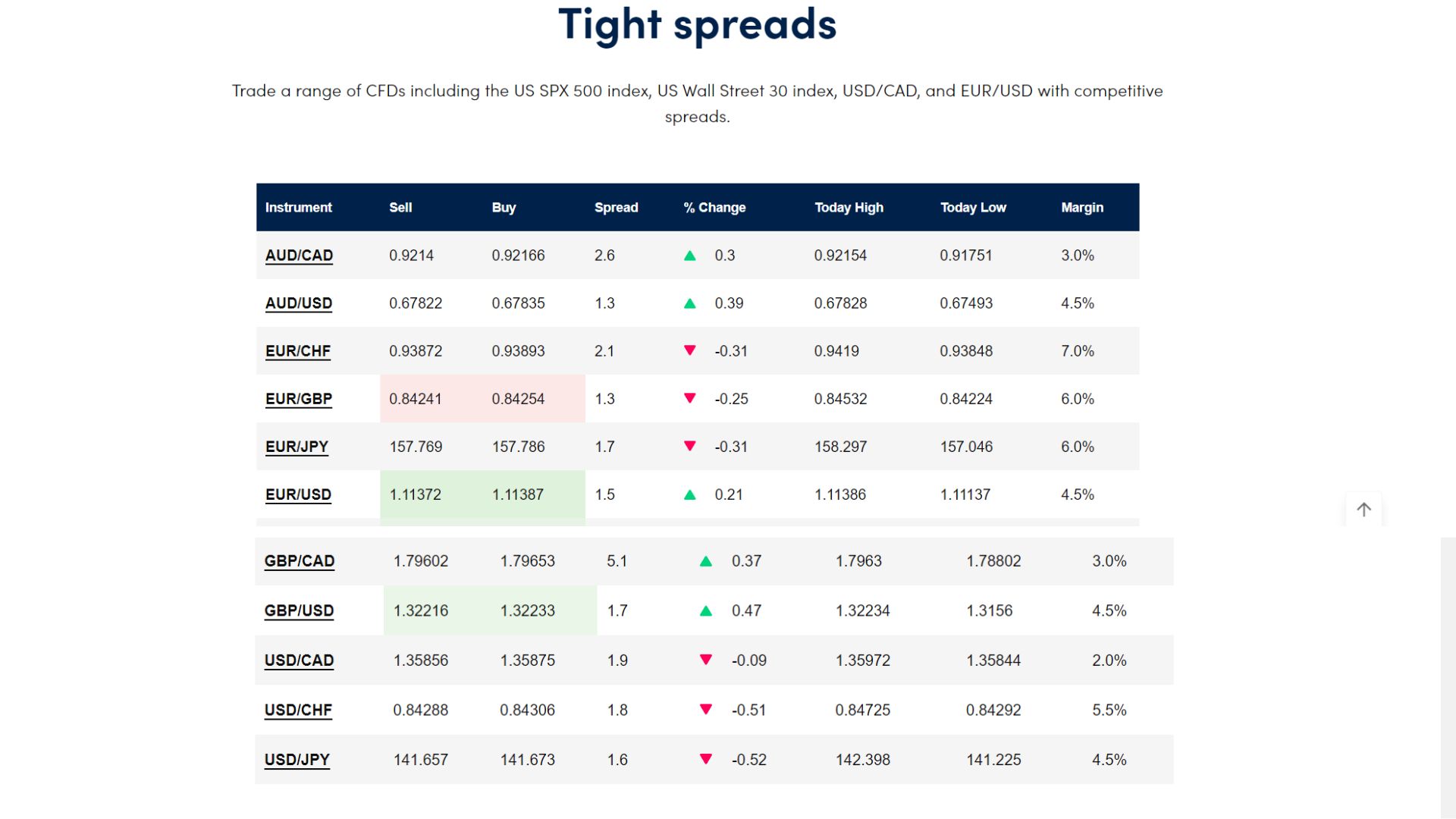

Speaking of spreads, OANDA is known for its transparent pricing model. The platform offers variable spreads, which can be as low as 0.1 pips on major currency pairs during peak trading hours. This pricing structure is highly competitive and appeals to traders looking to minimize their trading costs.

For traders interested in testing the platform before committing real capital, OANDA offers a free demo account. The demo account is an excellent way for beginners to familiarize themselves with the platform’s features and for experienced traders to refine their strategies in a risk-free environment.

Regulation and Security

OANDA operates under a robust regulatory framework, ensuring that it adheres to the highest standards of financial transparency and security. The platform is regulated by several top-tier financial authorities, including the US Commodity Futures Trading Commission (CFTC), the UK Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC).

This multi-jurisdictional regulation provides traders with peace of mind, knowing that their funds are protected and that OANDA is subject to strict oversight. Furthermore, OANDA employs advanced security measures, including encryption and two-factor authentication, to safeguard users’ accounts and personal information.

Customer Support

Customer support is a critical aspect of any trading platform, and OANDA excels in this area. The platform offers 24/5 customer support through various channels, including live chat, email, and phone. The support team is known for being responsive and knowledgeable, capable of assisting with a wide range of queries, from technical issues to account management.

In addition to direct support, OANDA provides an extensive library of educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders looking to improve their trading skills and stay informed about market developments.

Advantages of OANDA.com

- Comprehensive Range of Instruments: OANDA offers a vast selection of trading instruments, including forex, indices, commodities, shares, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore multiple markets from a single platform.

- User-Friendly Trading Platforms: OANDA’s platforms, including the web-based OANDA Trade, the desktop application, and the mobile app, are designed with usability in mind. These platforms provide powerful tools and features while remaining accessible to traders of all skill levels.

- Transparent Pricing and Competitive Spreads: OANDA’s commitment to transparency is evident in its pricing model. The platform offers competitive spreads, with no hidden fees or complex account structures, making it an attractive option for cost-conscious traders.

- Regulatory Compliance and Security: OANDA is regulated by top-tier financial authorities, ensuring that it operates with the highest standards of transparency and security. This regulatory oversight, combined with advanced security measures, makes OANDA a trustworthy platform for traders worldwide.

- Educational Resources and Market Analysis: OANDA’s extensive educational resources and market analysis tools are invaluable for traders looking to enhance their skills and make informed trading decisions. The availability of webinars, tutorials, and expert analysis helps traders stay ahead of the market.

- Reliable Customer Support: OANDA’s customer support team is available 24/5 and is known for its responsiveness and expertise. Whether you have a technical issue or need assistance with your account, OANDA’s support team is readily available to help.

Potential Drawbacks

- Limited Account Options: While OANDA’s single account type simplifies the setup process, some traders may prefer more options, such as accounts with fixed spreads or higher leverage. The lack of tiered accounts may be a limitation for those looking for specific trading conditions.

- No Negative Balance Protection in Some Regions: Although OANDA offers negative balance protection in certain regions, it is not universally available. This could be a concern for traders operating in regions where this protection is not provided, as it could lead to greater risk during volatile market conditions.

- Limited Cryptocurrency Offering: While OANDA does offer cryptocurrency trading, the selection is relatively limited compared to specialized crypto exchanges. Traders looking for a broader range of digital assets may need to consider other platforms.

- Inactivity Fees: OANDA charges an inactivity fee for accounts that have been dormant for an extended period. While this is a common practice among brokers, it is something to be aware of if you do not plan to trade regularly.

Comparison with Other Platforms

When compared to other trading platforms, OANDA stands out for its transparency, regulatory compliance, and user-friendly interface. Platforms like MetaTrader and cTrader, while popular, may require more technical expertise, making OANDA a more accessible option for beginners.

In terms of market offerings, OANDA competes closely with brokers like IG and Forex.com, both of which offer a similar range of instruments. However, OANDA’s commitment to transparency and its straightforward pricing model give it an edge, particularly for traders who value cost-effective trading.

Conclusion

OANDA.com is a well-rounded trading platform that caters to a diverse range of traders, from beginners to seasoned professionals. Its comprehensive market offerings, competitive pricing, and robust regulatory framework make it a reliable choice for anyone looking to trade forex, commodities, indices, shares, or cryptocurrencies.

While there are some areas where OANDA could improve, such as offering more account types or expanding its cryptocurrency selection, the platform’s overall strengths far outweigh these drawbacks. OANDA’s commitment to transparency, security, and customer support solidifies its position as a leading player in the online trading industry.