24 Yield Review – Is This Broker a Scam?

When looking for a reliable broker, traders expect transparency, solid regulation, and a proven track record. But what if a company only pretends to have these things? That’s exactly the case with 24 Yield—a broker that raises more red flags than trust signals.

At first glance, their website looks polished, they claim to be regulated, and their reviews seem decent. But once we dug deeper, things didn’t add up. A suspicious domain registration date, a fake regulatory license, and manipulated reviews—does that sound like a trustworthy broker?

Let’s break down the facts and expose the real risks of trading with 24 Yield.

24 Yield – General Broker Information

Here’s a quick breakdown of 24 Yield’s key details:

| Feature | Details |

| Website | 24yield.com |

| Established | 2020 (claimed) but domain registered in 2022 |

| Regulation | FSC (Offshore – Not Trusted) |

| ⚖️ License Type | The license cannot be trusted |

| Trading Platform | TradingView |

| Leverage | No information |

| Account Types | Explorer – $500, Pioneer – $10,000, Advanced – $50,000, Master – $100,000 |

| Restricted Countries | United States |

| Contact | Mail: [email protected] |

| ⭐ Trustpilot Score | 4.3 (Highly suspicious, likely manipulated) |

Key Red Flags:

- Website is too new for a broker claiming years of experience.

- Fake regulation with zero trader protection.

- Excessively high minimum deposit ($500 for the lowest account).

- No transparency about leverage, spreads, or real trading conditions.

Conclusion: These details only reinforce the suspicion that 24 Yield is a scam broker operating offshore with little to no oversight. Traders should avoid them at all costs!

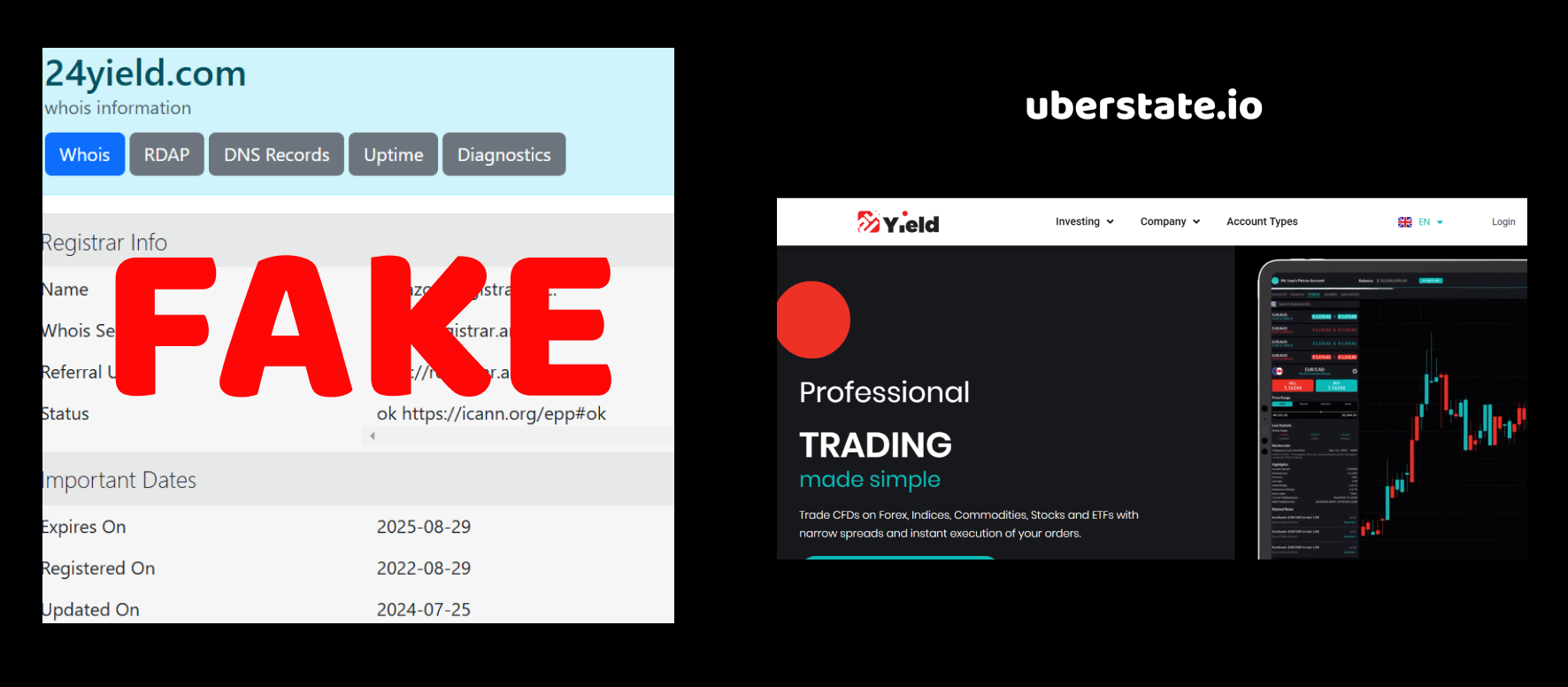

24 Yield Scam Investigation – Domain Creation Date

Let’s talk about 24 Yield. One of the first things we check when investigating brokers is the age of their domain. Why? Because a company claiming years of experience should have an online presence that backs up those claims. And guess what? 24 Yield doesn’t.

Here’s what we found:

- The company claims to be established in 2020.

- But the domain was only purchased on August 29, 2022.

Now, ask yourself: how can a broker claim to be operating since 2020 if their website didn’t even exist until 2022? That’s a red flag.

This is a common trick among scam brokers. They fabricate a history to appear more legitimate and trustworthy. A genuine company, operating for years, would have a website that reflects its longevity—older registration, an extensive web history, and a solid reputation. But 24 Yield? It just popped up out of nowhere in 2022.

Why does this matter? Because shady brokers often create new websites under different names once they get exposed. If 24 Yield was truly around since 2020, why wouldn’t they have had their domain registered back then? Exactly—because it likely didn’t exist yet.

If they’re already lying about something as basic as their age, what else could they be lying about? Stay tuned—we’re just getting started with this one.

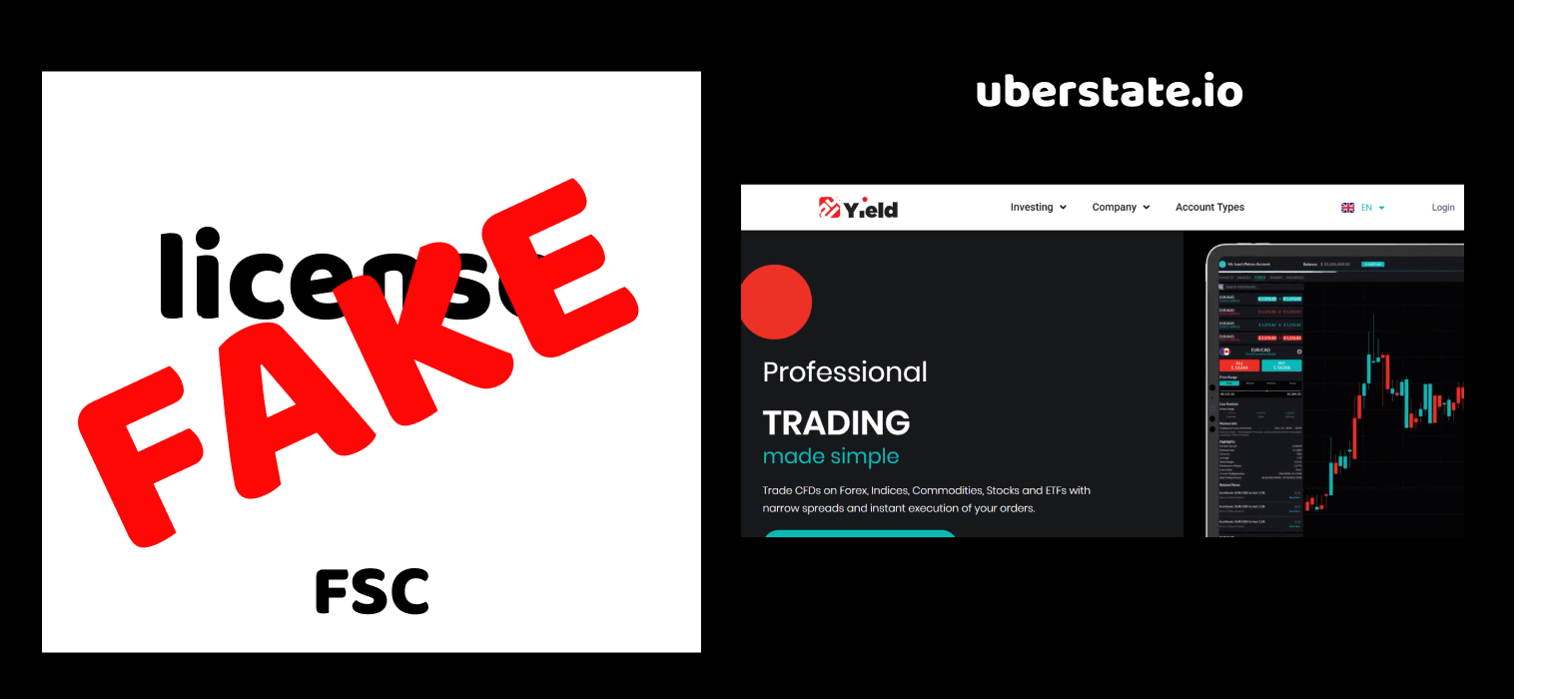

24 Yield Scam Investigation – Fake Regulation

Regulation is the backbone of a trustworthy broker. A real financial company needs a valid license from a recognized financial authority. But 24 Yield? They claim to be regulated, but the reality is far from it.

Here’s what we found:

- Regulation: FSC (Financial Services Commission)

- License Type: The license cannot be trusted

Now, let’s break this down. FSC sounds official, right? But there’s a catch—there are multiple FSCs, and many of them are offshore, weak, or completely meaningless when it comes to investor protection.

What’s Wrong with This “Regulation”?

- FSC licenses from offshore zones (like Belize or Mauritius) are not real safeguards. These regulators have little to no power over brokers, and if things go south, you won’t get your money back.

- It’s a common scam tactic—fake brokers often register under lax regulators where compliance is minimal, and oversight is practically nonexistent.

- There’s no official confirmation of 24 Yield being regulated by any top-tier regulator like FCA (UK), CySEC (Europe), or ASIC (Australia).

Think about it: If 24 Yield were a legitimate broker, why wouldn’t they get a strong, reputable license instead of hiding behind an offshore FSC registration? Because they don’t want oversight.

Conclusion? Their “regulation” is just a smokescreen to trick traders into thinking they’re legit. But when push comes to shove, you’ll have zero legal protection if they decide to disappear with your money.

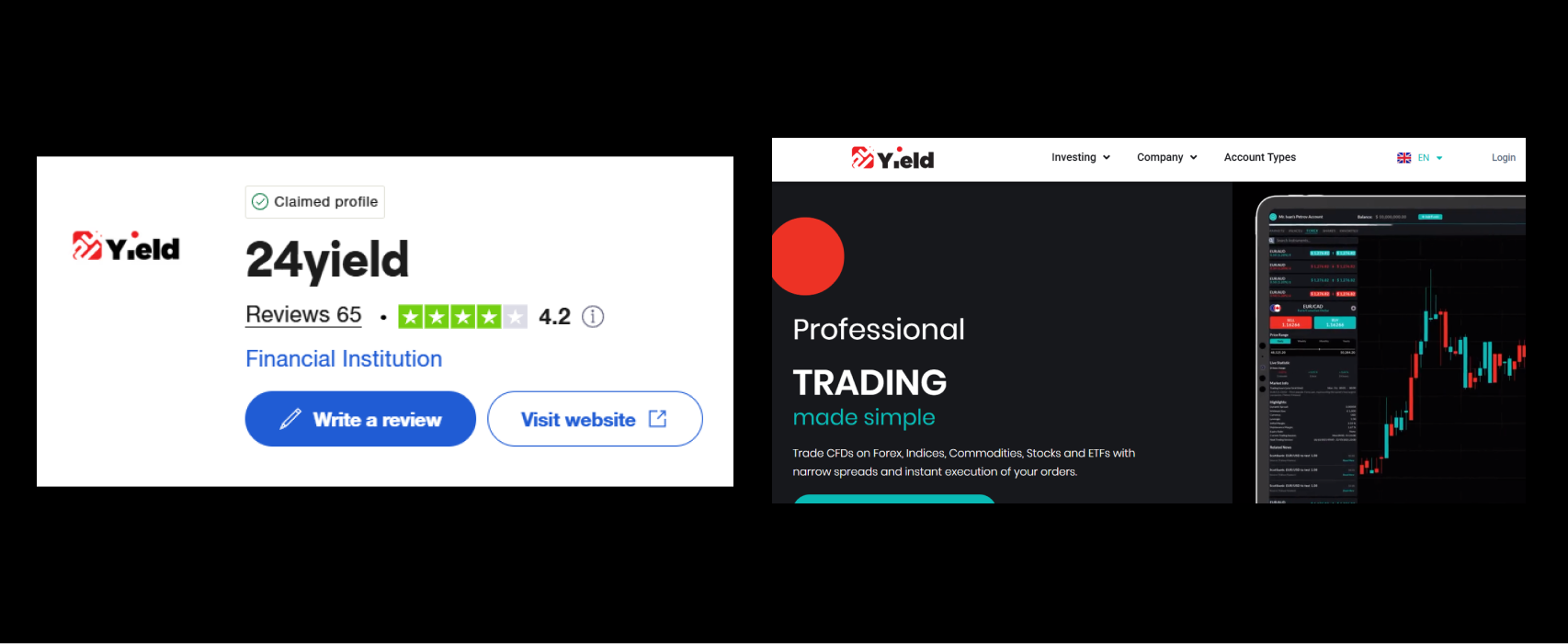

24 Yield Scam Investigation – Fake & Manipulated Reviews

If a broker is legitimate, their reputation should speak for itself. But when we checked 24 Yield’s reviews, things didn’t add up.

Here’s what we found:

-

Trustpilot Score: 4.3 ⭐

-

Total Reviews: 60

-

Bad Reviews: 8

At first glance, this looks like a decent rating. But let’s look closer—because something’s off.

Signs of Fake Reviews

-

Too Many Overly Positive Reviews in a Short Timeframe

-

When a broker has dozens of glowing reviews but barely any organic discussion online, it’s a huge red flag.

-

Scam brokers pay for fake reviews to drown out real complaints.

-

-

Similar Writing Style Across Multiple Reviews

-

Legitimate users write in different styles and provide real trading experiences.

-

Fake reviews? They often use generic praise like “best broker ever,” “fast withdrawals,” and “great support”—with no actual details.

-

-

Bad Reviews Get Buried

-

There are 8 negative reviews, but we bet they tell the real story.

-

Scammers flood platforms with fake positives so real complaints get pushed down.

-

Think about it: If 24 Yield were truly a top-tier broker, why would they need to manipulate their reputation? A legit company would have thousands of organic reviews, not a suspicious mix of forced positivity and hidden complaints.

Conclusion? Their reviews are highly questionable, and the bad ones likely expose the real issues—slow withdrawals, hidden fees, and account manipulation.

Final Verdict – 24 Yield is a Scam

After analyzing 24 Yield from multiple angles, the evidence is clear—this broker cannot be trusted. Every aspect of their operation screams fraud, and here’s why:

-

Fake history – They claim to be around since 2020, but their domain was only registered in 2022. If they were legit, why lie about their age?

-

Worthless regulation – They hide behind an offshore FSC license, which offers zero real protection for traders. If they disappear with your money, you have no legal recourse.

-

Manipulated reviews – Their Trustpilot score is artificially boosted with fake positive reviews, while real complaints are buried. This is a classic scam tactic.