Astoria Capital Markets Review: A Deeper Look Into Potential Red Flags

In the world of online trading, it’s crucial to separate the trustworthy brokers from the ones that are just looking to take advantage of unsuspecting traders. Today, we’re going to take a closer look at Astoria Capital Markets, a broker that may seem appealing at first glance but, as we dig deeper, raises several red flags. Is this platform a legitimate player in the market, or does it fall into the dangerous category of scams waiting to exploit those who don’t do their due diligence?

From questionable registration practices to a lack of proper licensing, and even suspicious online reviews, we’ll walk you through the warning signs that suggest Astoria Capital Markets might not be what they claim to be. So, let’s break down the key points and uncover what’s really going on behind the scenes.

| Category | Details |

| Account Types | Multiple account types offered, but specifics unclear or vague. |

| Leverage | Leverage is offered, but exact ratio is not clearly stated. |

| Customer Support | Limited contact details; no reliable ways to reach support. |

| Website Domain | Domain purchased on 2024-07-05, after the platform’s supposed creation in 2023. |

This table summarizes the broker’s basic offerings, and as you can see, the lack of clarity on key details like account types and leverage, along with limited customer support, raises several questions about the platform’s transparency and legitimacy.

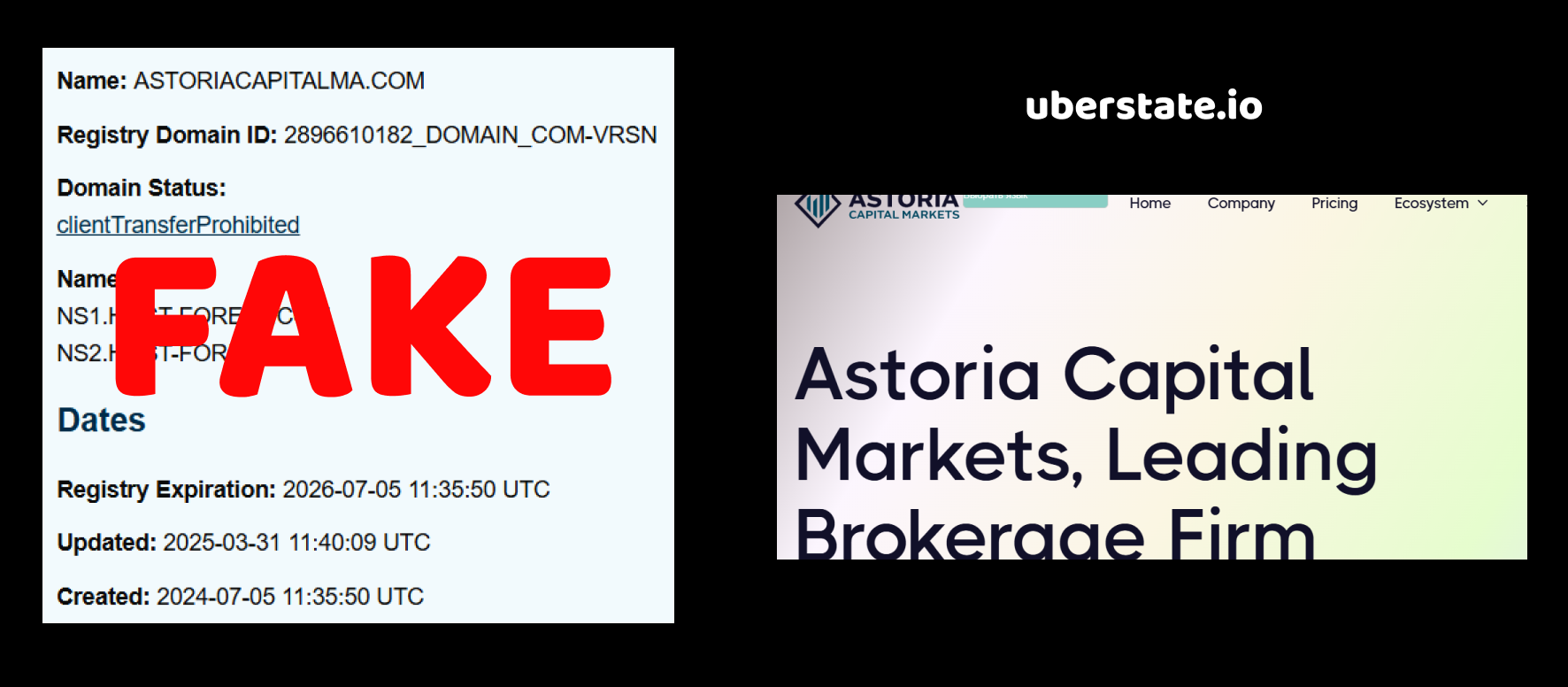

Astoria Capital Markets Review: Creation Date Raises Concerns

When investigating Astoria Capital Markets, one of the first things that stands out is the date the domain was purchased. While the website claims to be operational in 2023, the domain itself wasn’t registered until July 5, 2024. Now, isn’t that a little strange? If a broker was truly active and operational in 2023, why wait until mid-2024 to secure a domain?

This gap in time certainly raises questions. Why would a broker delay such a critical step as purchasing a domain for their business? Could it be that they wanted to appear legitimate by setting up the site first and then covering their tracks later with a domain registration? This isn’t just a minor detail; it’s an important piece of the puzzle that makes us question the broker’s real intentions. After all, legitimate businesses usually secure their domain right from the start, not after their supposed launch.

This could very well be a tactic to avoid early scrutiny, but for us, it’s a major red flag. When a domain purchase happens after the supposed creation of the platform, it’s definitely something to dig deeper into, and in this case, it just doesn’t add up.

Astoria Capital Markets Review: Lack of License is a Major Red Flag

Another critical factor to consider when evaluating Astoria Capital Markets is their lack of a legitimate license. The broker claims to operate in the financial markets, yet there is no clear or valid license backing their operations. This is a significant concern because legitimate brokers are typically regulated by well-known financial authorities. But what happens when a broker doesn’t provide evidence of such regulation?

You might ask, why would a broker risk operating without a license? Is it because they don’t want to be held accountable for their actions? After all, licensed brokers are subject to strict regulations that protect the interests of traders. They have to follow rules about transparency, handling of funds, and client protection. So, why take the risk of operating without this layer of security and oversight?

It’s not uncommon for scam brokers to either operate without a license or use fake or untrustworthy licenses that offer no real legal protection. And when a broker like Astoria Capital Markets cannot show a valid license from a reputable regulatory body, we must be cautious. Without proper licensing, traders are exposed to significant risks, including the potential loss of their funds without any recourse.

In short, the absence of a license isn’t just an oversight—it’s a clear indication that Astoria Capital Markets is playing in dangerous waters, where there is no safety net for their clients. And this is a huge warning sign for anyone thinking about trusting them with their money.

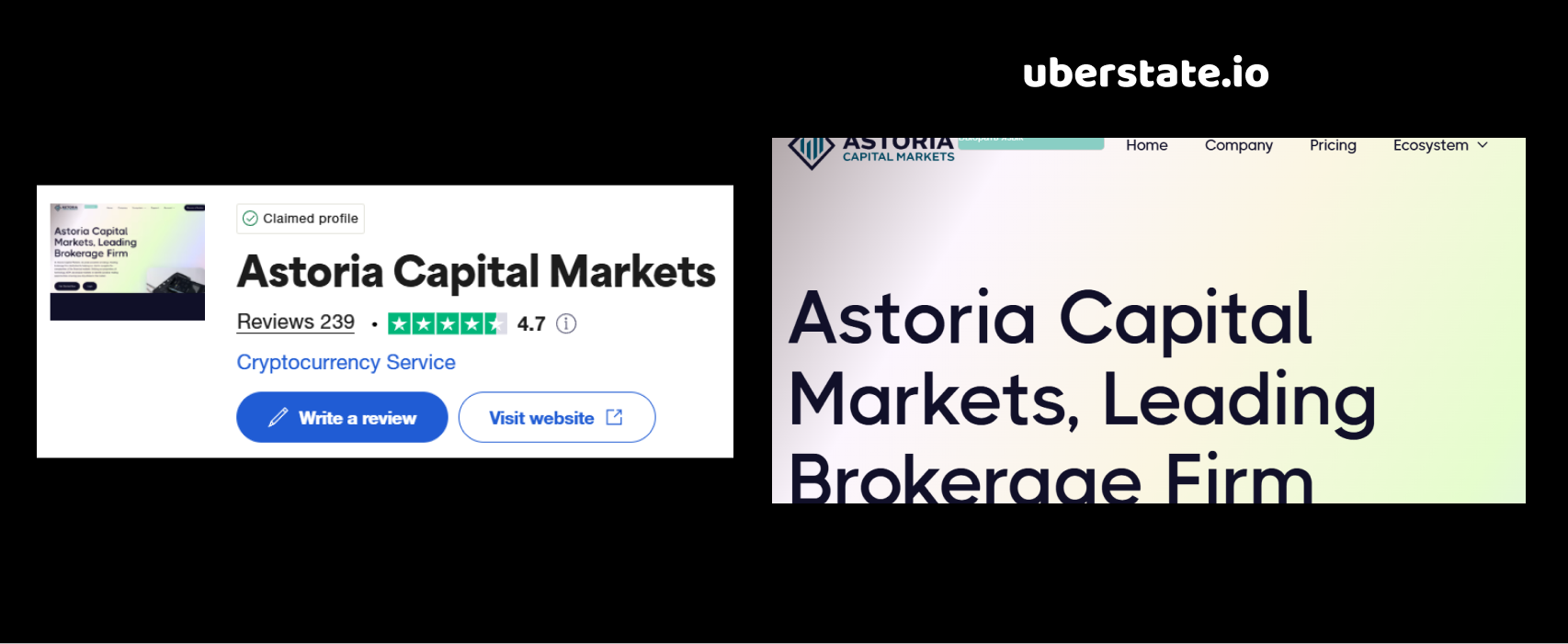

Astoria Capital Markets Review: Trustpilot Rating and Review Manipulation

When analyzing Astoria Capital Markets, the next thing that stands out is their Trustpilot rating. On the surface, a score of 4.7 might seem impressive. After all, that’s a relatively high rating, right? But let’s dive deeper into what this rating actually means.

For starters, the number of reviews is 239, which isn’t a massive amount when compared to well-established brokers. So, how meaningful is that rating really? Here’s the kicker: 13 of those reviews are negative, which is about 5% of the total. This percentage might not sound alarming, but if we look closely, we can see something troubling.

The pattern of reviews is striking. The positive reviews all follow a very similar format—nearly identical language, almost as if they’ve been written by the same person or manipulated to paint an overly rosy picture of the broker. And if you pay close attention to the negative reviews, you’ll notice that they are significantly more detailed, highlighting specific issues such as withdrawal problems, poor customer service, and delays. This kind of disparity between positive and negative reviews is a classic sign of review manipulation.

Isn’t it odd that a broker would have such glowing reviews that look almost like they were written to manipulate potential clients into trusting them? And when there’s a significant gap in quality and authenticity between the positive and negative feedback, it raises suspicions about whether those positive reviews are genuine at all. When looking at reviews, it’s important to assess not just the quantity but the quality of the feedback. And in this case, Astoria Capital Markets might just be trying to pull the wool over your eyes with inflated ratings.

Astoria Capital Markets Review: Conclusion and Final Thoughts

After a thorough analysis of Astoria Capital Markets, it becomes increasingly clear that this broker exhibits several key warning signs of being a potential scam. Let’s recap the critical points:

- Suspicious Domain Registration: The domain purchase date for Astoria Capital Markets occurred in mid-2024, well after the platform’s supposed creation in 2023. Why would a legitimate broker delay this essential step? This delay raises questions about the broker’s true intentions and stability.

- Lack of License: The absence of a valid regulatory license is a huge red flag. Legitimate brokers are typically licensed by trusted financial authorities, ensuring they operate under strict rules designed to protect traders. Astoria Capital Markets’ lack of transparency in this regard suggests a lack of accountability, leaving clients vulnerable.

- Manipulated Reviews: While a 4.7 Trustpilot rating might initially appear reassuring, closer inspection reveals that many of the positive reviews are suspiciously similar in language and tone. With 13 negative reviews pointing out issues like poor customer service and withdrawal problems, it’s hard to ignore the possibility that the positive reviews are artificially inflated to mask the platform’s true reputation.

Given these factors, it’s clear that Astoria Capital Markets does not inspire confidence. From suspicious domain practices to a lack of regulation and potentially manipulated reviews, this broker fails to meet the standards expected from legitimate financial institutions. Traders are strongly advised to proceed with caution and consider alternative, well-regulated brokers with a proven track record.