Aurum Markets Review — Another Shady Player in Disguise?

Every time a new name pops up in the world of online trading, it promises the same dream: easy profits, fast withdrawals, professional support. Aurum Markets is no exception. On the surface, it wraps itself in the usual glossy packaging—just enough to appear like a trustworthy, modern-day forex broker.

But once we started digging, things didn’t add up.

And you know how it goes—when one lie surfaces, more are usually buried right beneath it.

That’s exactly what happened here. From inconsistent dates to a total lack of regulation, and even a bizarre pattern in online reviews… this platform gave us red flag after red flag.

So let’s break down what we found—and figure out if Aurum Markets is really a place to grow your funds… or just another trap set by faceless scammers.

Basic Info Breakdown — Aurum Markets Brand Review

To get the full picture, we also gathered the core details about how Aurum Markets presents itself as a broker. Sometimes, it’s not what they say—but how they say it—that reveals the truth.

Here’s what we found:

| Field | Details |

| Broker Name | Aurum Markets |

| Account Types | Not specified |

| Leverage | Up to 1:500 |

| [email protected] | |

| Phone | +44 203 129 5290 |

| Website | aurummarkets.com |

| Domain Registration | 2025-01-12 |

| Claimed Launch Year | 2023 |

| License | None |

And here’s where things get sketchy.

First off, they promise high leverage (1:500), which is extremely risky and typically prohibited by most regulated brokers. That alone raises eyebrows. It’s the kind of leverage that attracts aggressive beginners—and drains their deposits fast.

Then there’s the contact info. A UK phone number and a generic email address. But no company registration number, no physical office address, not even a basic “About Us” page that proves who’s behind the curtain.

Even their account structure? Completely vague. They don’t mention account tiers, minimum deposits, spreads, or what exactly traders are getting. Isn’t that odd? Any serious broker wants to show what makes them better than the rest. But here—just radio silence.

Why so little transparency?

Because too much detail might make it easier for victims to realize something’s off—or track them down once they disappear.

So while on paper they try to sound like a real broker, this lack of concrete structure is just another brick in their carefully built illusion.

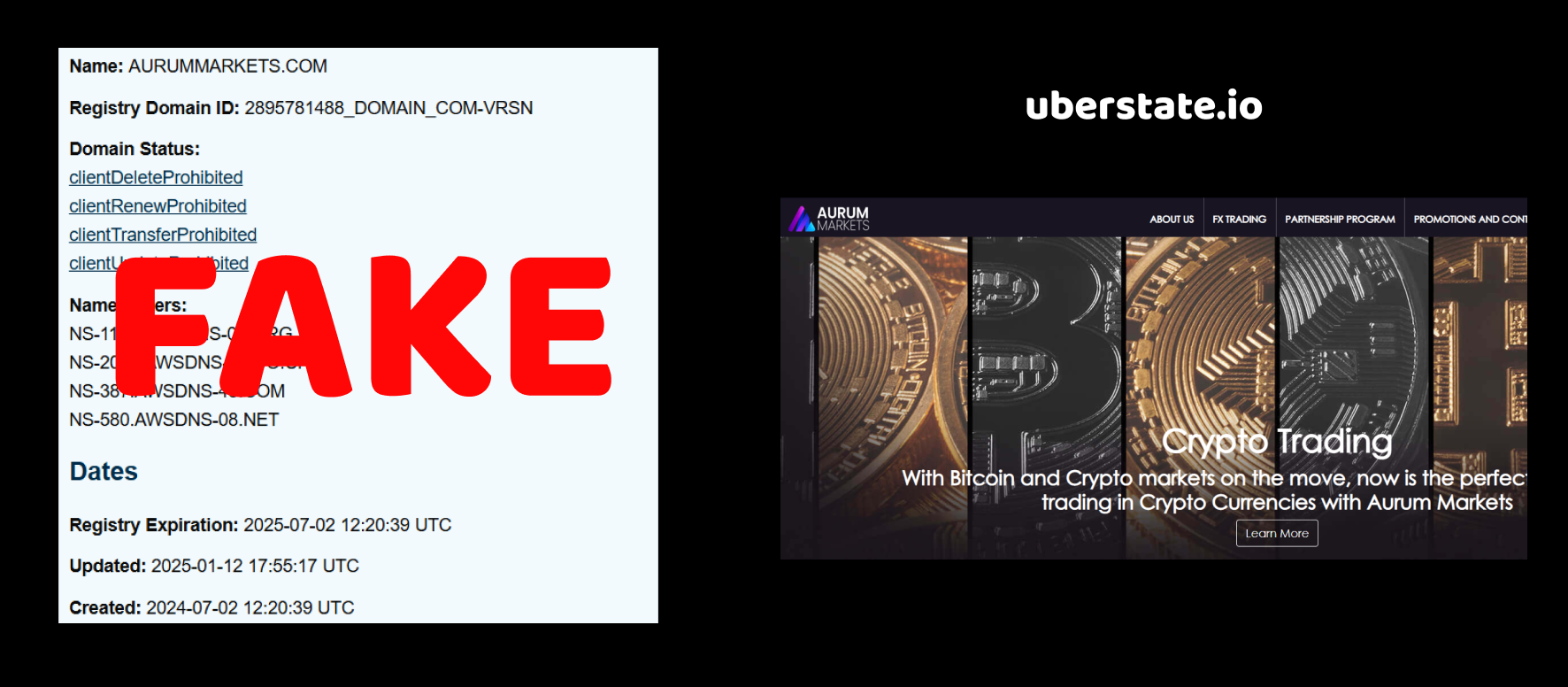

Strange Timeline in the Aurum Markets Review

When we checked the timeline of Aurum Markets, something immediately felt off. The brand itself claims to have been established in 2023—but then we took a closer look at their domain registration date. Turns out, the domain was only purchased on January 12, 2025.

Now ask yourself: how can a brand exist and operate in 2023 if its website didn’t even exist back then?

It’s not just a minor inconsistency. It’s a red flag. A serious one. Because websites are the face of any brokerage—especially those claiming to offer financial services online. If they didn’t even have a domain in 2023, how were they acquiring clients? Through telepathy?

We’ve seen this before. Fake brokers love backdating their launch year to look more established. Why? Because trust matters. And they know full well that a site claiming to be just a few months old will raise doubts. So what do they do? They invent a fake past.

But again—why lie about the launch date? Unless there’s something they don’t want you to notice. Something like: they just popped up recently, are probably hiding behind fake contact info, and have no real track record.

And let’s be honest: legit companies don’t have to lie about their age.

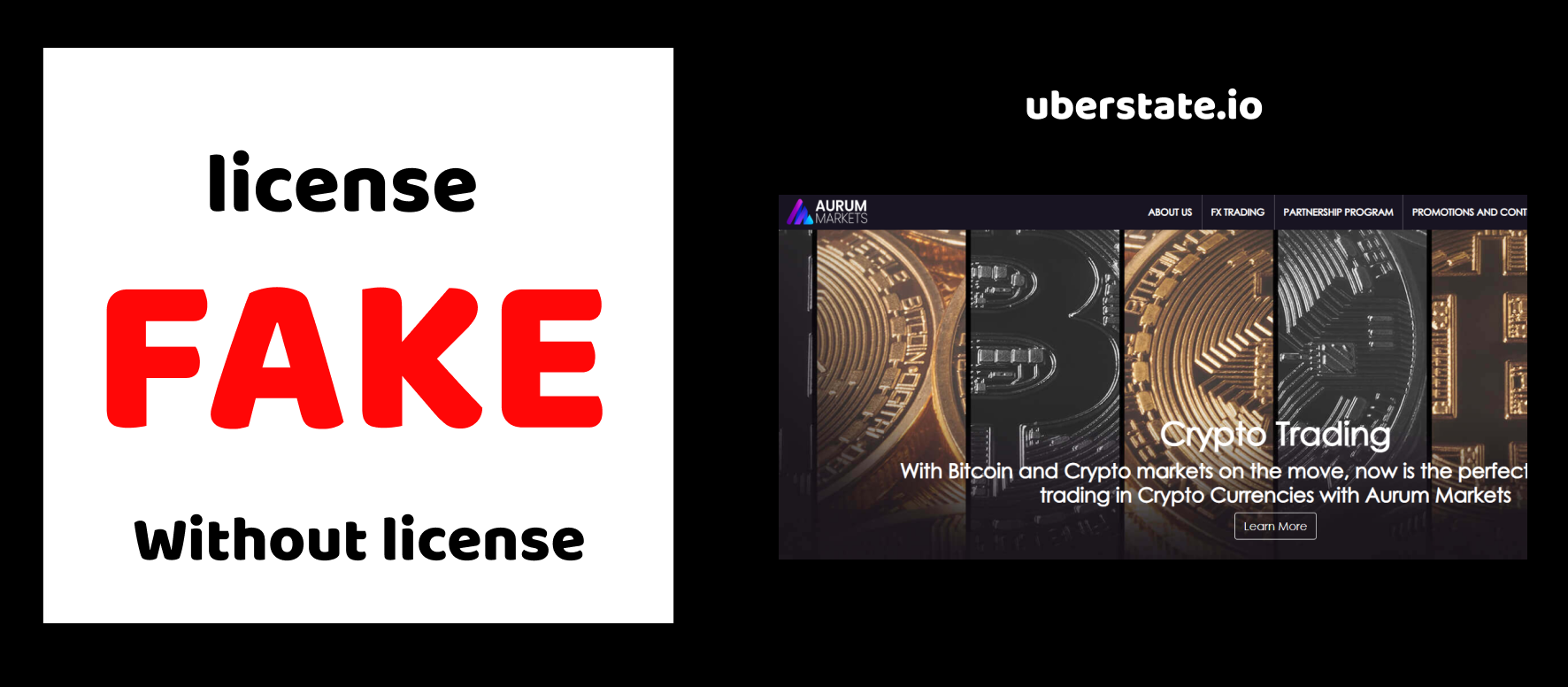

No Regulation in Sight — Aurum Markets Review

After digging into the regulatory background of Aurum Markets, we found… nothing. Literally. No license, no registration with any recognized financial authority. They operate completely without any regulatory oversight.

Think about that for a second.

We’re not talking about some offshore license from a palm-tree island regulator with zero enforcement power (though that would already be shady). We’re talking about zero licensing at all. No FCA, no CySEC, no ASIC, not even the usual fake watchdogs scammers love to flash around. Just a blank space where a license should be.

So here’s the big question: why would a broker choose to stay unlicensed? Regulation isn’t just a bureaucratic checkbox. It’s a system of checks and balances—something that keeps brokers from running off with your money.

But here’s where it gets even more suspicious. If Aurum Markets is offering leveraged trading, account management, or handling deposits and withdrawals (which they are), then they’re providing financial services. And in most jurisdictions, doing that without a license is flat-out illegal.

And yet… no license.

Could it be they know regulators would shut them down in a heartbeat if they even tried to apply?

Because let’s be real—scammers don’t want regulators breathing down their necks. They want freedom. The kind that lets them vanish the moment things get hot.

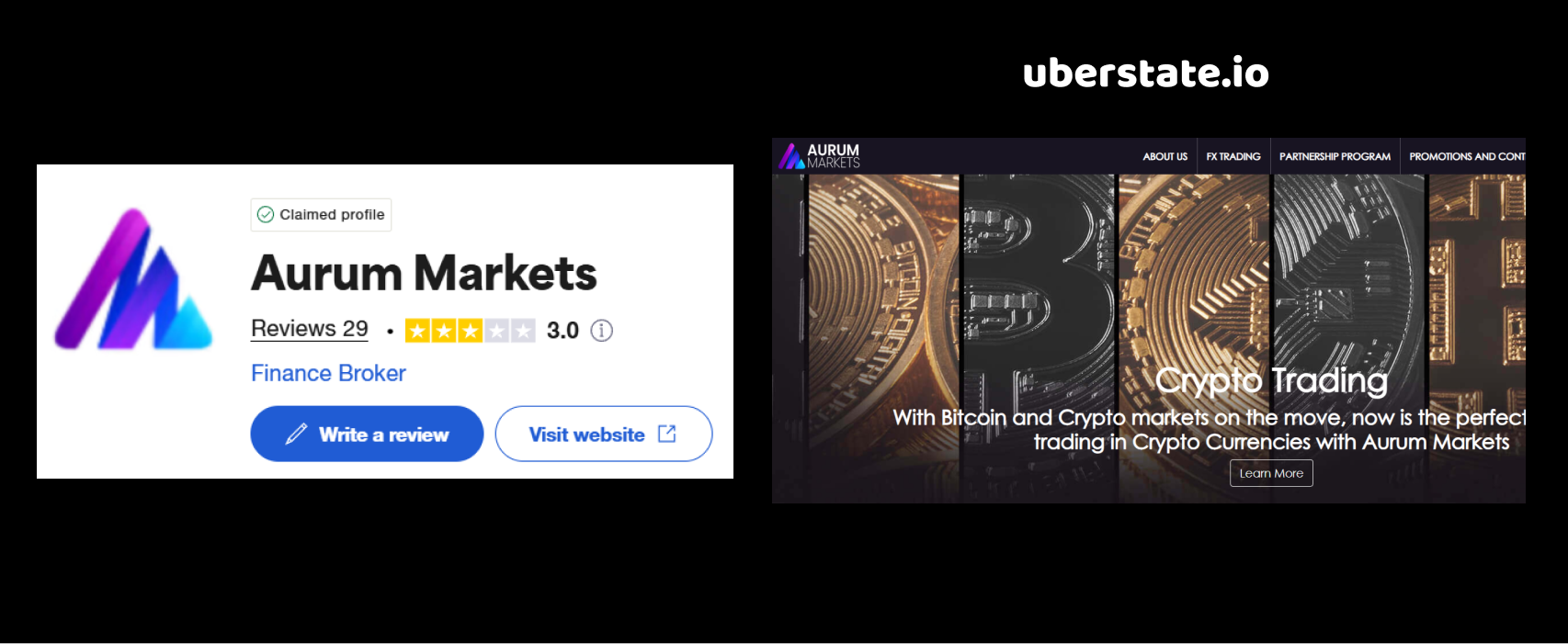

Suspicious Reviews Pattern — Aurum Markets Review

When we examined how Aurum Markets is rated by real users, the picture became even clearer. On Trustpilot, their overall score is just 3 out of 5. That’s already mediocre, but let’s not stop at the surface. We went deeper.

There are only 29 reviews total. That’s incredibly low for a broker claiming to operate since 2023. But even worse—12 of those are outright negative. That means over 40% of the feedback is from angry clients who felt scammed, ignored, or worse.

And here’s where it gets strange.

The positive reviews all look the same. Repetitive wording, overly enthusiastic tone, vague praise with zero specific details about platform features or trading experience. Just generic fluff like “great service,” “excellent broker,” “highly recommended.”

You know what that looks like?

Paid or fake reviews. The kind of stuff someone writes when they’re trying to drown out the real voices of frustrated users.

Meanwhile, the negative comments? Much more detailed. People complaining about withdrawal issues, unresponsive support, and suspicious behavior once they tried to take money out. One review even mentions that the broker became aggressive and pushy after the user asked for their funds back.

It’s a pattern we’ve seen many times before. A flood of short, artificial praise—trying to balance out the damning reviews from actual victims. If they were really a legit company, would they even need to fake positivity?

Seems like the feedback they can’t control… tells a much uglier story.

Final Verdict — Aurum Markets Brand Review

After going through every piece of the puzzle, the picture of Aurum Markets becomes disturbingly clear. We’re not just talking about one or two warning signs. This platform is a full package of classic scam indicators, carefully wrapped in the illusion of professionalism.

Let’s recap what stood out:

— They claim to exist since 2023, yet the domain was only bought in January 2025. That’s not a small oversight — that’s deliberate deception.

— They operate without any financial license, not even a fake one. So why would any serious broker avoid regulation altogether?

— Their Trustpilot profile is a minefield. Dozens of reviews look scripted, while nearly half the total feedback is openly negative. That’s not normal. That’s reputation management… the dirty kind.

Put it all together, and it’s clear: Aurum Markets doesn’t even try to hide the cracks. They rely on users being too busy—or too desperate—to notice them.

But here’s the thing. Real brokers don’t need to lie about their launch date. Real brokers don’t fear licenses. And real brokers don’t bury bad reviews under a pile of fake cheerleaders.

So ask yourself: if this is how they behave publicly… what do you think happens when they have your money?

Aurum Markets is not a platform. It’s a warning sign.

You’ve seen what’s under the hood. Now it’s up to you to stay one step ahead.