Bull Stash Review: The Broker That Raises More Questions Than Answers

When you first land on the Bull Stash website, it gives off the polished vibe of a modern investment platform. Sleek design, bold promises, and of course — all the usual buzzwords like “financial freedom” and “secure trading.” But you know what’s funny? The shinier the surface, the more we want to scratch it. Because in this industry, polish is cheap — anyone can buy a nice template. What matters is what’s behind it.

That’s exactly why we decided to take a closer look and run Bull Stash through a real audit. Not just glancing over the homepage or trusting big promises, but checking what really stands behind this broker — domain data, licenses, reviews, and more. Spoiler alert: things don’t add up.

You’ll see that for yourself as we go through each piece. One by one, the image of a trustworthy broker begins to fall apart — replaced by a picture that looks a lot more like a well-dressed scam. From suspicious timelines to fake licenses and review manipulation… something just doesn’t sit right.

Let’s break it down.

Bull Stash Review: Broker Info That Doesn’t Inspire Confidence

Before you even start trading, it’s the basic details that should help you decide if a broker is worth trusting. But with Bull Stash, even the “general info” section feels like it was thrown together just to check a box — not to genuinely inform potential clients.

Here’s what we found:

Bull Stash – Broker Overview

| Parameter | Details |

| Account Types | Starter, Silver, Gold, VIP |

| Minimum Deposit | $250 |

| Leverage | Up to 1:500 |

| Contact Email | [email protected] |

| Phone Number | Not provided |

| Live Chat | Claimed, but mostly inactive |

| Regulation Claimed | Fake/Unverifiable license body |

| Website Language | English only |

| Deposit Methods | Credit card, crypto, bank wire |

A few things immediately jump out. First, the leverage is insanely high — up to 1:500. Regulated brokers in Europe or the US would never be allowed to offer that. But Bull Stash can, because… well, there’s no real oversight. High leverage sounds tempting to new traders, but it’s a classic trap: it can wipe out your funds in a flash — and guess who wins when you lose?

Then there’s the communication side. No phone number. The live chat button might be there, but it rarely responds. Basically, you’re on your own once your money is in.

For a broker that wants your trust (and your cash), they’re doing everything they can to stay conveniently out of reach. Why would a legit firm make it so hard to talk to a real human?

And that’s the thing — these gaps aren’t just technical oversights. They look like part of the plan.

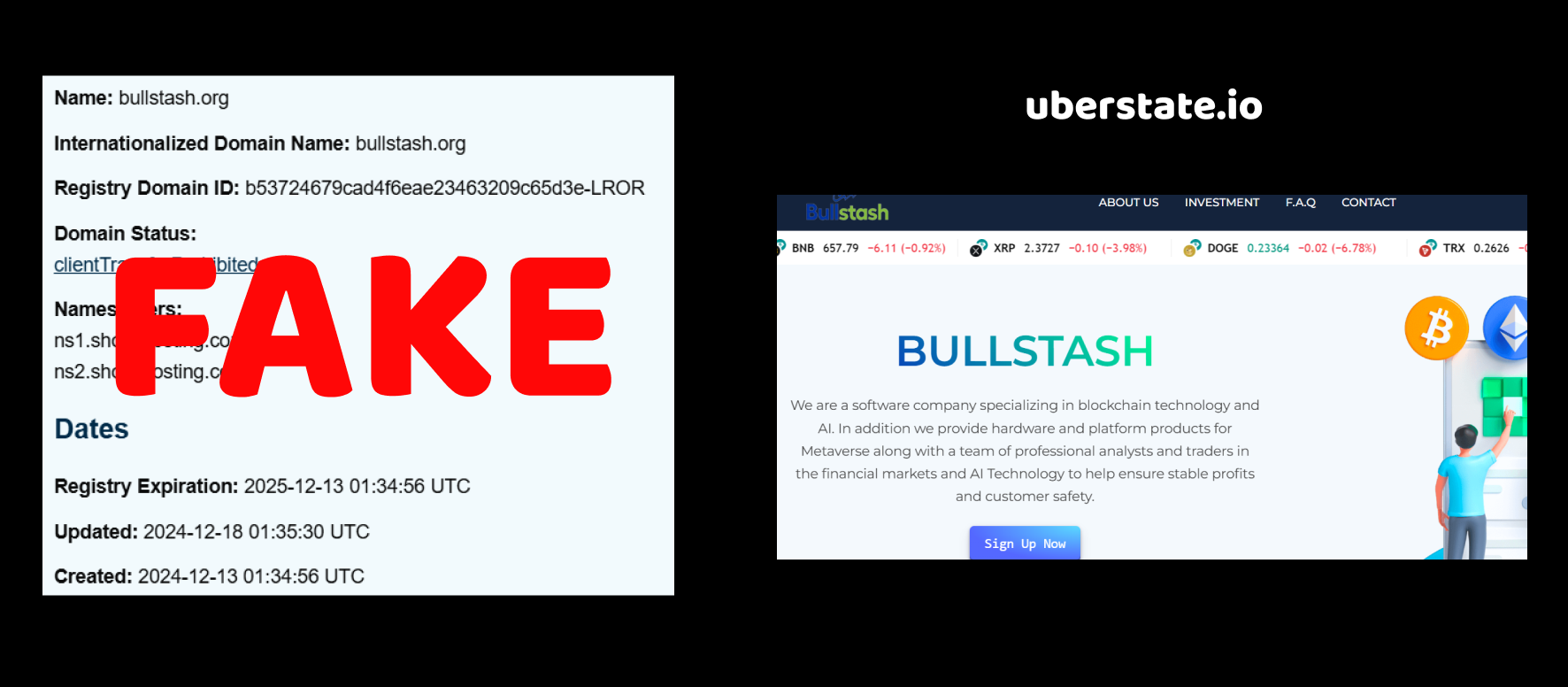

Bull Stash Review: The Creation Date Trap

At first glance, Bull Stash might seem like just another online broker in a sea of flashy promises. But once we took a closer look, something instantly raised a red flag — the domain registration date. You wouldn’t think that one tiny detail like this could reveal so much, but here’s what we found.

The brand claims its founding year as 2025. Sounds futuristic, right? Maybe a little too futuristic considering that the domain — the very web address this “broker” uses to exist online — was registered on December 18, 2024.

Now hold on a second… How does that work? How can a broker claim it was founded in 2025 if its domain already existed in 2024? Technically, it’s possible — if we assume they created the domain in advance for a future launch. But here’s the twist: why would a legitimate broker claim they already exist in 2025… while we’re still living in 2025?

It’s almost like they’re playing with timelines — trying to sound like a newly established platform that’s ahead of the curve. But why rush into the future? Why not just state the actual launch year? And more importantly — who benefits from this kind of confusion?

We’ve seen this tactic before. Scam brokers often fudge their “creation date” to appear newer and more relevant, especially when they’re trying to cover up past issues — or worse, avoid being linked to old failed projects under a different name.

So we asked ourselves: if this is their first step — already built on a contradiction — what kind of transparency can you expect going forward?

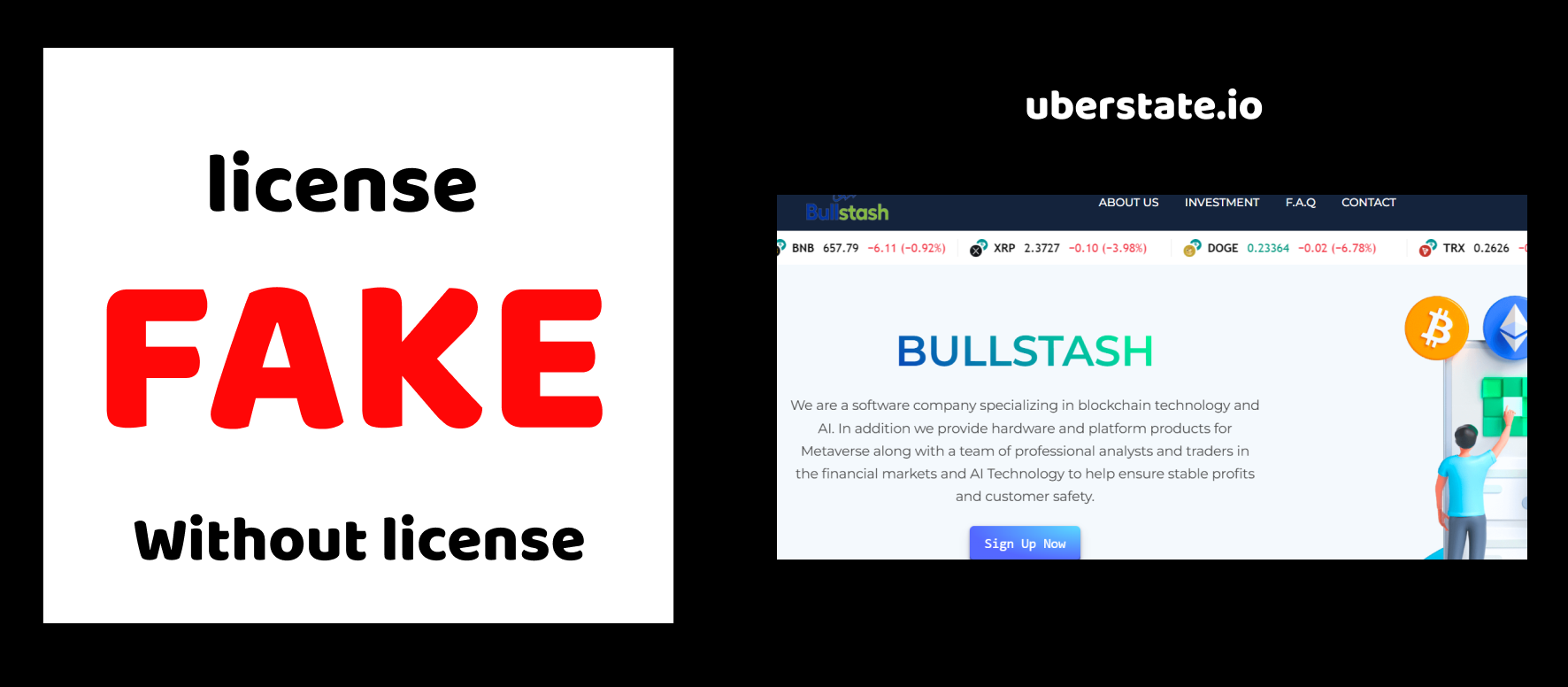

Bull Stash Review: The Fake License Illusion

When we moved on to the licensing details of Bull Stash, things got even more suspicious. Licensing is supposed to be the backbone of any financial broker — the stamp of legitimacy. It tells you who’s watching over them, making sure they’re not just playing casino with your money. But what we saw here? A classic smoke-and-mirrors trick.

Bull Stash claims to be licensed by a certain “authority.” But after digging into it, the supposed regulator turned out to be nothing more than a decorative label — a fake licensing body that carries zero legal power. That’s right: it’s one of those made-up “regulatory” organizations that exist solely to give shady platforms a professional look.

Let’s stop for a second and think. Why would a broker go through the trouble of forging or buying a fake license, instead of simply applying for a real one through a recognized regulator like the FCA (UK), CySEC (Cyprus), or ASIC (Australia)? After all, real regulation builds trust… unless your business model wouldn’t survive actual scrutiny.

And here’s what makes it even more ironic: brokers with fake licenses often parade those documents front and center, hoping no one will double-check. But we did. We compared names, checked the databases of real regulators, and verified if this “authority” even exists. Spoiler: it doesn’t.

So again — why the disguise? Why pretend to be under oversight when there isn’t any? The answer’s pretty straightforward. Because they don’t want oversight. Real regulators demand transparency, audits, investor protection policies. All the stuff that gets in the way of running a quick cash-grab operation.

Starting to see a pattern?

Should we dive into the user reviews next? That’s where it gets even messier.

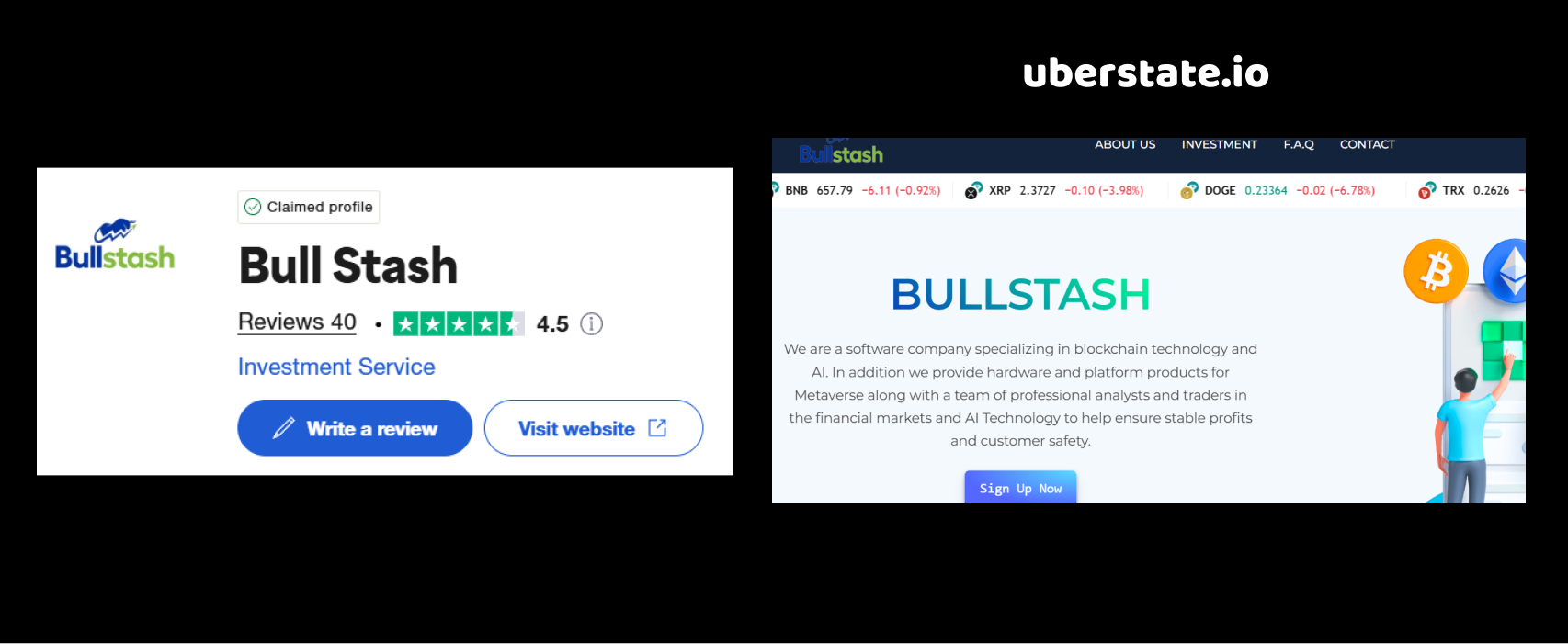

Bull Stash Review: Trustpilot Reviews That Smell Like a Setup

We didn’t just stop at licenses and launch dates. Next, we turned our attention to what real users were saying. Or at least, what looked like real users. On Trustpilot, Bull Stash has a score that’s hovering below 4 — already not a great sign for a financial service that supposedly handles other people’s money. But that’s just the beginning of the weirdness.

At first glance, some reviews are glowing. Suspiciously glowing. And when we started reading them one by one, something stood out immediately: they all sounded the same.

Think about it — how often do dozens of random people from different parts of the world all write in the same tone, same structure, same weirdly enthusiastic language? Phrases like “Best broker ever!!”, “Amazing customer service!!!”, “Fast withdrawals guaranteed!!!” flood the page like they were written by the same copywriter. And it’s not just the wording — the timing of these reviews is also odd. Many are clustered close together, posted within short time frames, like someone was racing to flood the page with positivity.

That’s a common tactic used by shady platforms trying to bury bad feedback under a mountain of fake praise. And speaking of bad feedback — there are critical reviews, and they tell a different story. Users talk about withdrawal problems, ignored support tickets, and sudden account freezes. You know, the kind of stuff that actually happens when a broker doesn’t play fair.

But guess what? These negative reviews often get labeled as “not based on an experience” or get drowned in automated responses from the company — another classic strategy to silence critics and inflate trust.

So here’s the question: if Bull Stash is so confident in its service, why does it need to artificially pump its ratings? Why not just let real traders speak for themselves?

Next up — want the rundown of their account types and contact info? Let’s see how transparent they really are.

Bull Stash Review: Final Verdict – Red Flags at Every Turn

After digging into Bull Stash from every angle, we kept coming back to the same conclusion — this isn’t a platform you can trust. And not just because of one or two shady details, but because the entire structure feels artificial, like it was built more for show than for real trading.

Start with the creation date — a broker that claims it was founded in 2025, while its domain was registered in 2024. That kind of timeline might work in sci-fi, but in finance? It’s just weird. Then there’s the license, which turned out to be fake — not issued by any real regulator. No oversight, no accountability, just a fancy-looking badge with no weight behind it.

And the reviews? That’s where the mask slips even more. A low Trustpilot score smothered by robotic, over-the-top praise that clearly came from a script. And underneath that pile of fake positivity? Real user complaints about frozen accounts and ghosted support.

Add to that the generic “about us” section, lack of transparent company info, and the aggressive marketing tactics, and you get the full picture. This isn’t a broker trying to build trust — it’s one trying to imitate it. And when a company spends more time pretending to be legit than actually being legit… you’ve got your answer.

So the final question is: would a real broker go to such lengths to fake trust? Or is this just another disposable scam, built to squeeze out quick money and vanish?

You already know the answer.