Bux Berg Review – Is This Broker a Scam?

When choosing a broker, the last thing you want is to fall into a trap set by fraudsters. But how do you tell the difference between a legitimate platform and a well-disguised scam? That’s exactly what we’ll uncover in this Bux Berg review.

At first glance, Bux Berg presents itself as a professional and trustworthy brokerage. Sleek website? Check. Promises of high returns? Check. But if there’s one thing we’ve learned from investigating shady brokers, it’s this: looks can be deceiving.

So, what’s really going on behind the scenes? We dug deep into Bux Berg’s registration details, licensing, user reviews, and overall credibility—and what we found was anything but reassuring. From a suspiciously recent domain registration to a complete lack of regulation and questionable Trustpilot reviews, the warning signs are all there.

Is Bux Berg a broker you can trust, or just another scam waiting to disappear with your money? Let’s break it down.

General Information About Bux Berg

Here’s a quick breakdown of Bux Berg’s key details:

| Category | Details |

| Website | buxberg.com |

| Established | 2021 |

| Domain Registration | September 14, 2020 |

| Regulation | ❌ Unregulated |

| Restricted Countries | Hong Kong, North Korea, Iraq, United States |

| Leverage | No information provided |

| Trading Platforms | WebTrader, Mobile Trader, Tablet Trader |

| Account Types | – Beginner Account – $2,500

– Standard Account – $5,000 – Premium Account – $15,000 – VIP Account – $50,000 |

| Trustpilot Score | ⭐ 3.2/5 (Many complaints about withdrawals) |

| Total Reviews | 41 |

| Contact Info | Email: [email protected]

Phone: +1 800 787 5082 |

Key Takeaways:

- High minimum deposits ($2,500 just to start? That’s already suspicious).

- No proper trading software (no mention of MT4 or MT5, which are industry standards).

- Unregulated (meaning no financial protections for traders).

- Negative user experiences (many traders reporting withdrawal issues).

Would you trust a broker with no regulation, a history of blocked withdrawals, and a website registered just before launch? The choice is yours—but the warning signs are obvious.

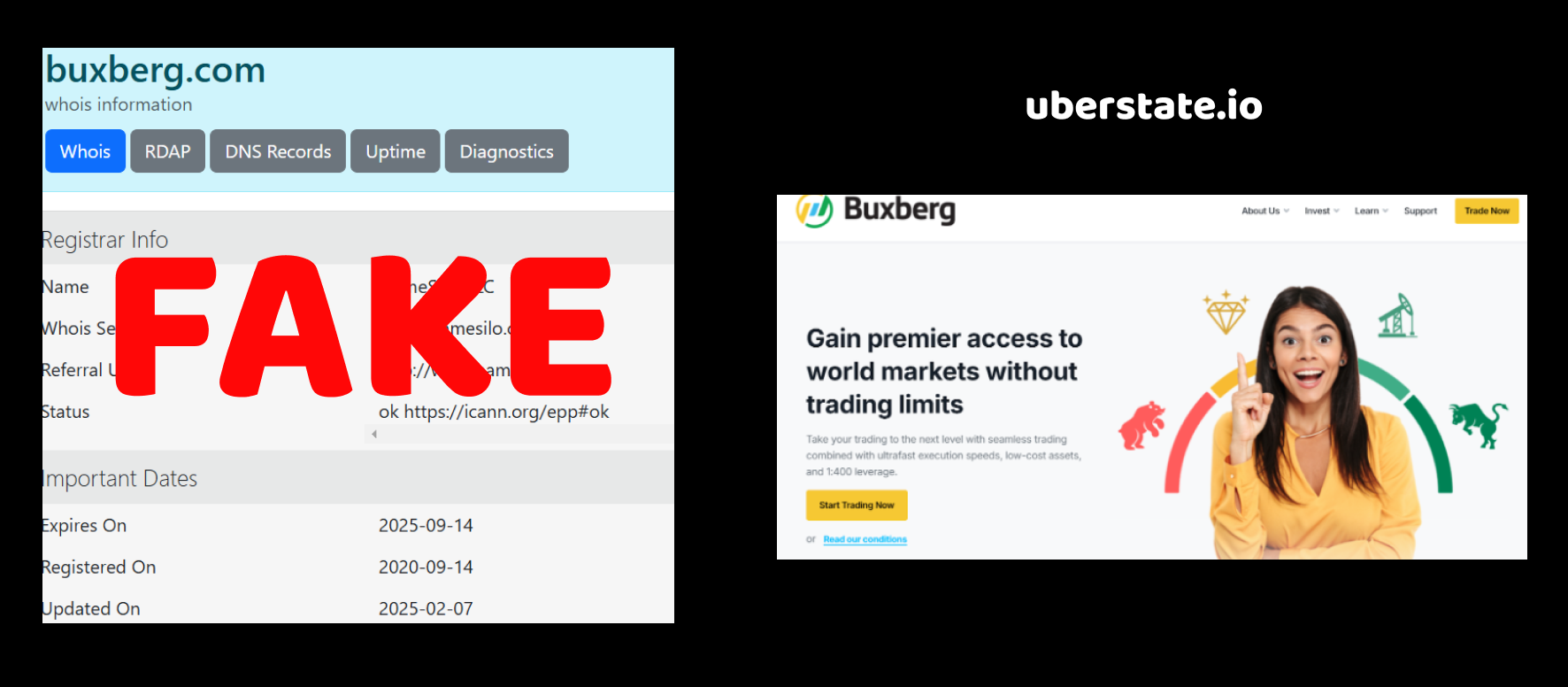

Bux Berg Review – Domain Registration Date

When analyzing Bux Berg, one of the first things we check is its domain registration date. Why? Because it often reveals whether a broker has a solid history or just popped up out of nowhere. And in this case, the results are… interesting.

Bux Berg was established in 2021, according to their own claims. But when did they actually purchase their domain? September 14, 2020. At first glance, this might seem reasonable—buying a domain before launching a business is common. However, there’s something odd here.

Most reputable brokers have domain histories dating back much further than their official launch. They often buy domains, develop their platforms, and establish credibility before announcing their services. But Bux Berg? Their domain was bought just months before their so-called launch. This raises a big red flag. It suggests that they might have been in a rush to set up shop, which isn’t what you’d expect from a trustworthy financial institution.

Another issue? There’s no significant web presence for Bux Berg before 2021. If this broker was truly planning a long-term operation, wouldn’t we find traces of their development before the official launch? Social media, financial press mentions, or even early-stage announcements? But there’s nothing.

So, what does this tell us? Bux Berg fits the profile of brokers that pop up quickly, operate for a short time, and then disappear—often leaving traders empty-handed. A serious broker invests time and credibility into its brand, while scam brokers rush to get online and start luring victims.

Would you trust a financial company that appears out of nowhere?

Bux Berg Review – License and Regulation

Now, let’s talk about regulation—or in this case, the complete lack of it. Regulation is one of the biggest indicators of whether a broker can be trusted. If they aren’t licensed by a recognized financial authority, you’re essentially gambling with your money. And Bux Berg? They don’t even try to hide the fact that they are completely unregulated.

No License, No Protection

Our analysis confirms that Bux Berg operates without any financial license. This means:

-

They are not monitored by any official regulatory body.

-

They do not have to follow financial laws designed to protect traders.

-

If something goes wrong, you have no legal recourse.

For comparison, legitimate brokers are regulated by authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). These organizations ensure that brokers follow strict rules, maintain segregated client funds, and process withdrawals fairly. Bux Berg, on the other hand, operates in the shadows, free to manipulate trades and block withdrawals at will.

Why Would a “Serious” Broker Avoid Regulation?

Ask yourself: why wouldn’t a genuine broker obtain a license? It’s not that difficult—if they meet the legal requirements. But that’s exactly the issue. Bux Berg likely doesn’t want oversight because that would prevent them from engaging in shady activities like:

-

Market manipulation (manually interfering with trades).

-

Withholding withdrawals under false pretenses.

-

Vanishing with client funds when the operation shuts down.

Legit brokers invest in proper licensing to prove they are safe to trade with. Meanwhile, scammers avoid it because they know they wouldn’t pass even the most basic regulatory checks.

So, if Bux Berg isn’t regulated, who is holding them accountable? No one.

Would you trust an unlicensed doctor to perform surgery on you? Then why trust an unlicensed broker with your money?

Bux Berg Review – Suspicious Reviews on Trustpilot

One of the easiest ways to spot a shady broker is by analyzing their reviews. And guess what? Bux Berg’s Trustpilot profile raises multiple red flags.

Trustpilot Score: 3.2 – Not Exactly “Trusted”

A score of 3.2 out of 5 is already a warning sign. For a financial service, anything below 4.5 should make you think twice. But it’s not just the rating itself—it’s the quality and pattern of the reviews that reveal the real picture.

A Mix of Fake Positives and Angry Complaints

When we checked their reviews, something became clear:

-

There are glowing 5-star reviews, all written in the same overly enthusiastic style.

-

At the same time, there are serious complaints about withdrawal issues, account freezes, and disappearing funds.

This is a classic tactic. Fake positive reviews are used to bury the real complaints, making the broker look more trustworthy than they actually are. But if a broker was truly good, why would they need to manipulate their ratings?

Signs of Fake Reviews

Let’s break it down:

✅ The 5-star reviews sound generic, like they were copy-pasted. Many don’t mention any real trading experience—just vague praise like “Amazing broker, great support!”

❌ The 1-star reviews are long, detailed, and tell real horror stories. Users complain about being unable to withdraw their funds, having accounts blocked for no reason, and getting ghosted by customer support.

So, which ones do you believe? The repetitive, overly positive comments—or the frustrated traders providing detailed warnings?

The Most Common Complaints

-

Withdrawal issues – Users report that when they try to withdraw profits, they are suddenly required to provide “extra verification” that never gets approved.

-

Account freezes – Some traders say their accounts were closed without explanation after they requested withdrawals.

-

Zero support – Multiple users complain that Bux Berg’s support team stops responding once a client asks for their money back.