Cad Limited Review: Another Broker, or Another Scam?

At first glance, Cad Limited tries hard to look like a legit brokerage. Sleek branding, big promises, and a clean website — that’s the typical formula. But if you’ve seen as many shady projects as we have, you know: the real story always hides in the details.

So we started digging.

And it didn’t take long before things started falling apart. You know the type — companies that appear out of thin air, promise the world, but when you check their background, it’s like staring into a black hole. No license. No feedback. No past.

Cad Limited fits that pattern just a little too well.

In this review, we’re going to break it down piece by piece — from when (and how) they launched, to why they’ve got zero oversight, and what it means when not a single real person has anything to say about them.

Because in a market full of fakes and flashy traps, knowing what to look for is half the battle.

Cad Limited – Broker Profile Overview

Before diving deeper into the shady parts (which we’ve already done), here’s a snapshot of what Cad Limited claims to offer on paper. But just remember — a polished front doesn’t mean much when everything behind it is smoke and mirrors.

Here’s what we found:

| Category | Details |

| Types of Accounts | Not specified |

| Leverage | 1:500 |

| Support Email | [email protected] |

| Phone Number | +44 7520 636489 |

| Domain Registration | March 31, 2025 |

| Claimed Launch Year | 2023 |

| Regulation | None |

| Trustpilot Reviews | No reviews at all |

Some observations are worth pointing out.

First — leverage of 1:500. That’s way beyond what most regulated brokers are allowed to offer, especially in the EU or UK. Why? Because high leverage is extremely risky for traders — but very profitable for brokers, especially scammy ones. It’s a classic bait.

Second — no information on account types. Not even a basic “standard vs. VIP” breakdown? Either they forgot to include it (unlikely) or they want to keep it vague on purpose so they can adjust the “offers” depending on the victim.

So yeah, on the surface, Cad Limited tries to look “just like any other broker.” But the lack of detail in key areas is no coincidence — it’s part of the trick.

Suspicious Start: Cad Limited Review

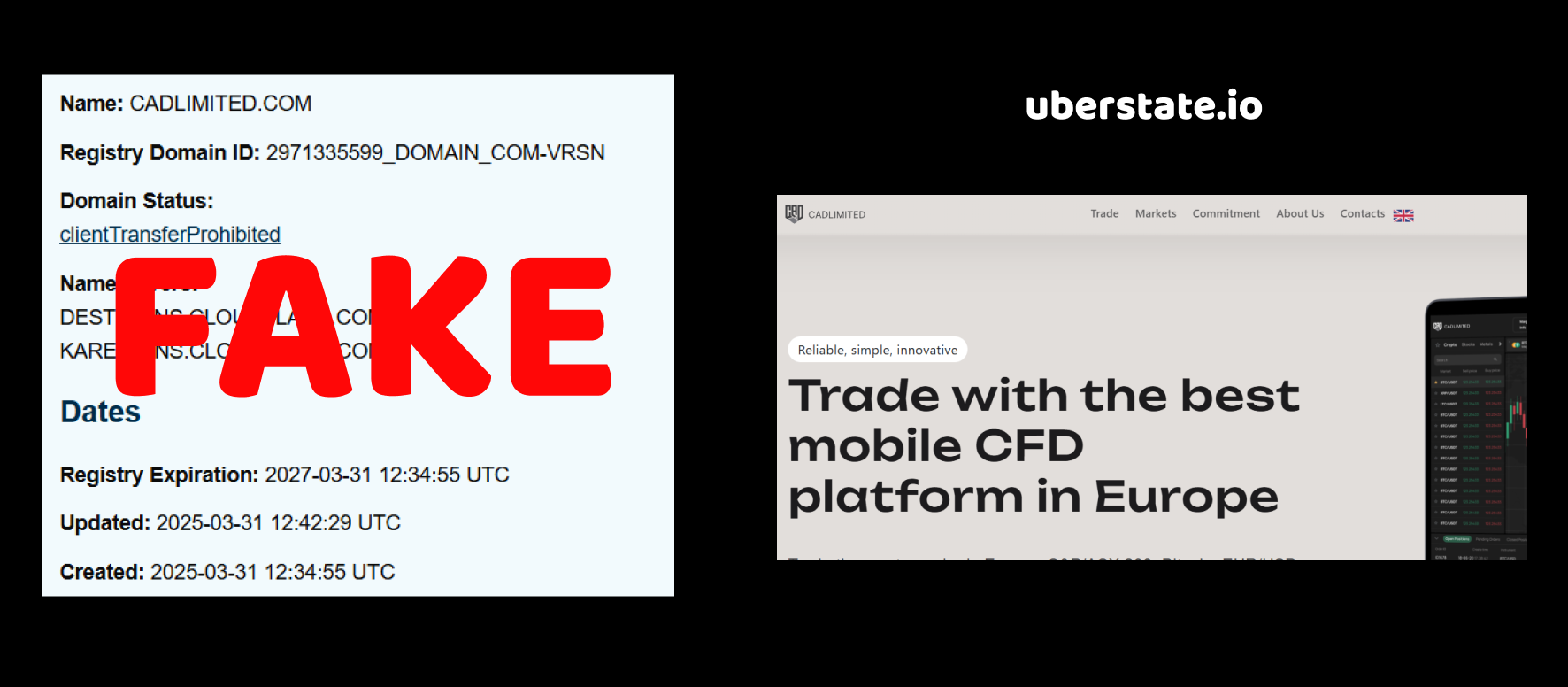

Let’s kick things off with something that seems minor — but actually says a lot. The domain registration date.

After digging into the records, we noticed a major red flag: Cad Limited claims to have launched in 2023, but their website domain was only registered on March 31, 2025. That’s a two-year gap.

And that’s not a typo. So now the question is: how was this broker operating without a website for two full years? Doesn’t that sound suspicious?

Think about it — a modern broker without a digital presence? In an industry where everything is online? Either they’re lying about when they started, or they weren’t operational at all until recently. And if that’s the case, why pretend otherwise?

It’s a classic trick: make it seem like the company has more “experience” than it really does, just to gain your trust faster. But why would a legit company need to fake that?

The timeline just doesn’t add up. And when the foundation is already shaky, what does that say about everything built on top of it?

No License, No Security: Cad Limited Review

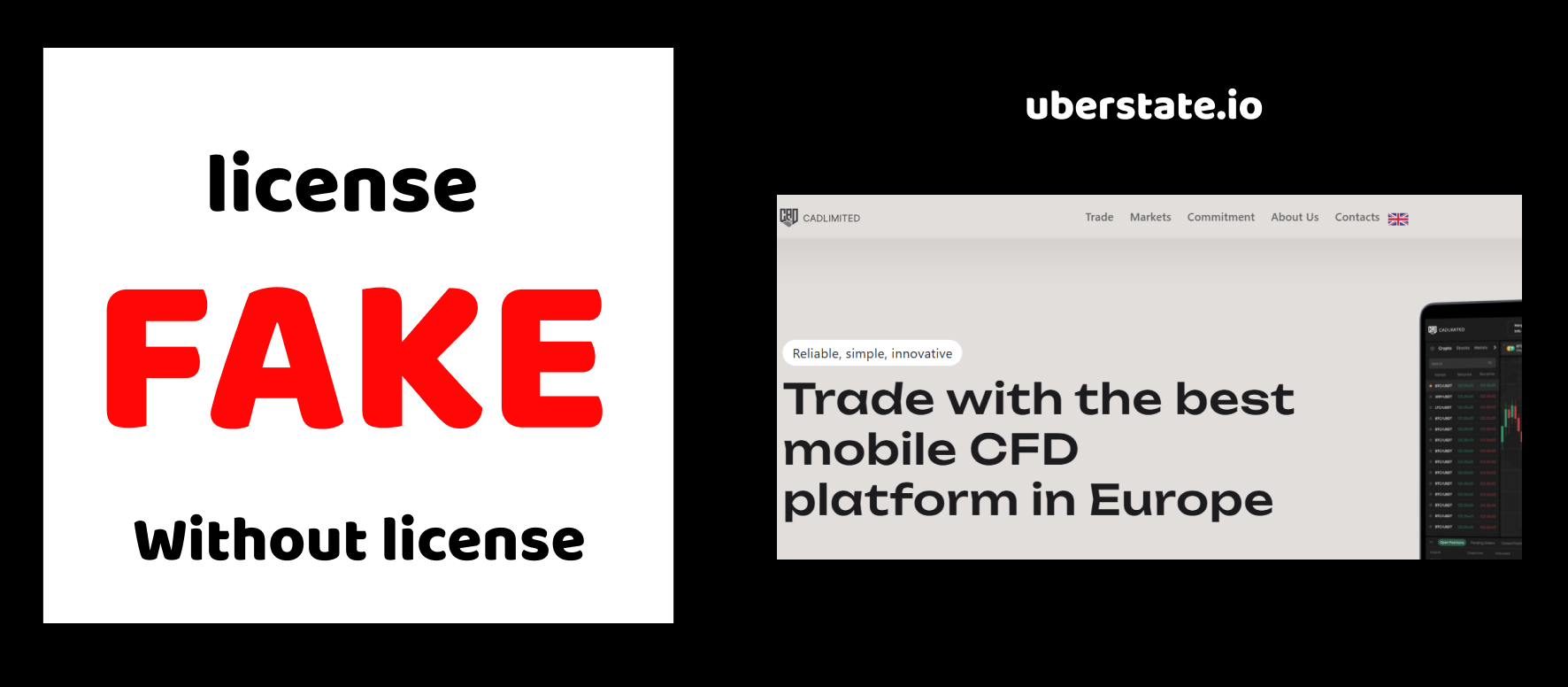

Alright, now let’s talk about the license — or better said, the complete absence of it.

When we checked for any kind of regulatory oversight connected to Cad Limited, we found… nothing. No license, no registration, no mention in any official financial regulator’s database. Just silence.

And here’s the thing — any serious broker must operate under a financial license. It’s not optional. That license is what holds them accountable, forces them to follow rules, protects client funds, and provides a clear process in case of disputes.

So what happens when a broker skips this step entirely?

Let’s be blunt — it means they can do whatever they want with your money. You deposit funds? They can vanish. You complain? There’s no regulator to turn to. You want to sue them? Good luck — most unlicensed brokers hide offshore or behind fake entities.

Now think logically — why would a broker choose to operate without a license, when getting one is the main way to gain trust?

Because a license is a liability for scammers. They don’t want anyone watching them. They don’t want restrictions. They want control — total control over your funds, with zero accountability.

So yeah, when a broker like Cad Limited skips the licensing part altogether, we have to ask:

What are they trying to avoid?

No Voices, No Trust: Cad Limited Review

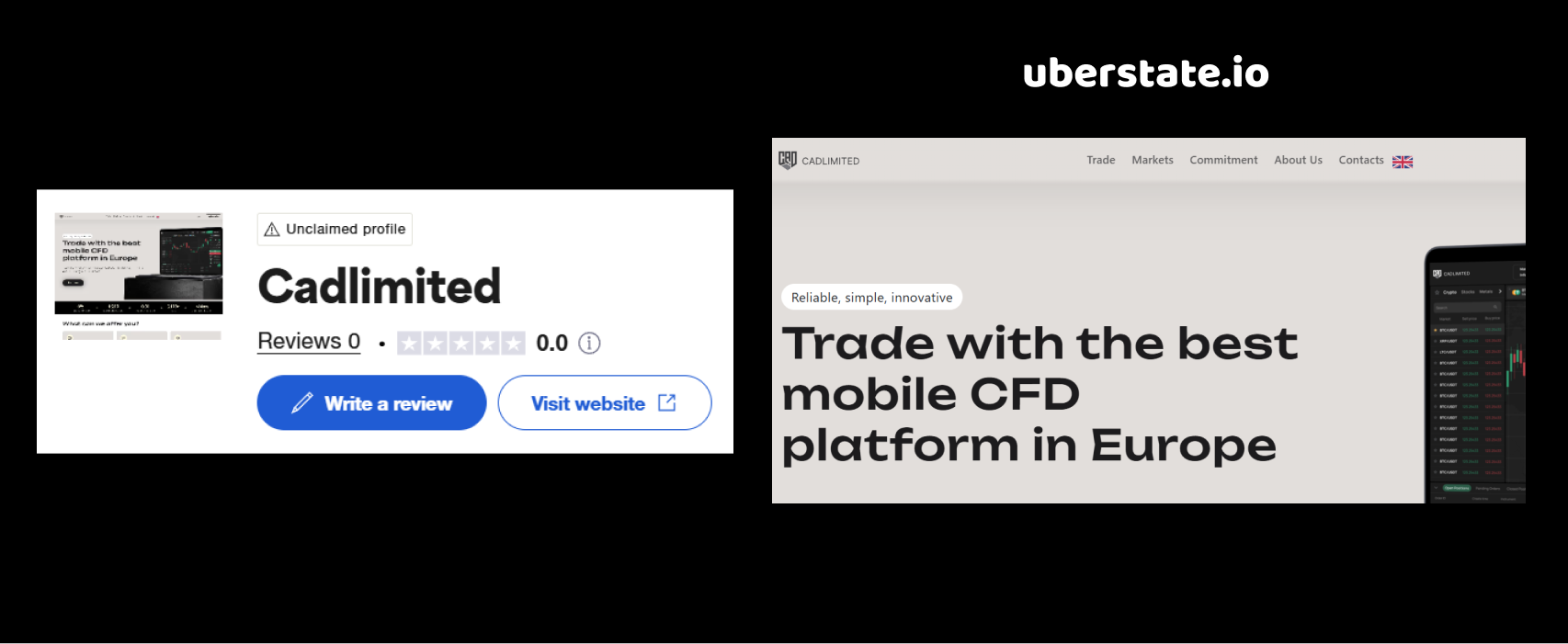

Now let’s look at what real users are saying about Cad Limited… oh wait — no one is saying anything at all.

That’s right. There are no reviews. Not a single verified user experience on platforms like Trustpilot or Sitejabber. Not even a whisper in forums where traders usually share warnings or insights.

And let’s be honest — in 2025, how does a broker manage to exist in complete silence? Even brand-new platforms get feedback, complaints, spam — something. But Cad Limited? Total vacuum.

So what does that mean?

Either no real people have ever used their services (which is a red flag on its own), or the reviews are being wiped or never posted in the first place. And both scenarios raise the same unsettling thought:

Is this even a real brokerage — or just a polished shell meant to collect deposits?

Reputable brokers don’t need to hide from reviews. In fact, they rely on them to build reputation. But Cad Limited? It’s as if they appeared out of nowhere, hoping no one asks too many questions.

Because let’s be real — a broker with nothing to hide usually has a trail of clients backing them up. So why does Cad Limited have no digital footprint whatsoever from real users?

That silence is louder than any 1-star review.

Final Verdict: Cad Limited — A Broker Built on Red Flags

After going through everything, one thing becomes crystal clear: Cad Limited doesn’t just raise red flags — it waves them in your face.

They claim to have started in 2023, yet their website wasn’t even registered until 2025. So what were they doing before that — trading telepathically? No license, no regulation, no accountability. That means your funds are walking straight into a black hole with zero legal protection.

And then comes the silence. No reviews, no trace of real users, no community talk. It’s as if this broker exists in a vacuum — or was never meant for real trading at all, just for fast, anonymous cash grabs.

This isn’t a project that’s simply “new” or “overlooked.” No, this is calculated invisibility. The kind scammers thrive in. They hide behind fake timelines, avoid regulators, and skip community presence altogether. Why? Because the fewer eyes on them, the easier it is to vanish when things go wrong.

So here’s the bottom line:

Cad Limited has all the classic signs of a scam operation.

No history. No oversight. No trust.

And in this business, when a broker hides this much — they’re usually hiding something big.