Crests Capital Review — Is This Broker Really What It Claims to Be?

In the flashy world of online trading, new brokers pop up like mushrooms after the rain. But not all of them grow for the right reasons. Some exist purely to drain your wallet and disappear without a trace. One name that recently caught our attention is Crests Capital — a platform that promises everything: professional support, high-speed trading, and secure investments. Sounds amazing, right?

But the question is — can you trust them?

After going through their site, checking databases, digging into reviews, and verifying background info, we quickly realized: something doesn’t feel right. At all.

So if you’re even thinking about opening an account with them — read this Crests Capital review to the end. Because what we found could save you from making a very expensive mistake.

Crests Capital Review — Broker Profile Overview

Before diving deeper into their shady practices, let’s take a look at the general information this broker provides. On the surface, Crests Capital tries to appear like a standard online trading platform. But when you lay out the facts, the picture becomes clearer — and far more questionable.

Here’s what we found:

| Parameter | Details |

| Website | crestscapital.com |

| Account Types | Basic, Silver, Gold, Platinum |

| Leverage | Up to 1:400 |

| Contact Email | [email protected] |

| Phone | +442038857289 |

| Regulation | ❌ Not regulated |

| License Type | None |

| Date Domain Purchased | October 14, 2024 |

And here’s what jumps out right away:

— Leverage up to 1:400 is dangerously high for unregulated brokers. Why offer that level of risk to inexperienced traders?

— Multiple account tiers with vague names, but no clear breakdown of features. That’s classic manipulation — make the user believe that paying more = safer trading.

— No regulation, no license, no transparency. They didn’t even bother listing a fake regulatory body.

Honestly, everything here looks like it was thrown together just to look professional. But dig beneath the surface, and there’s zero substance.

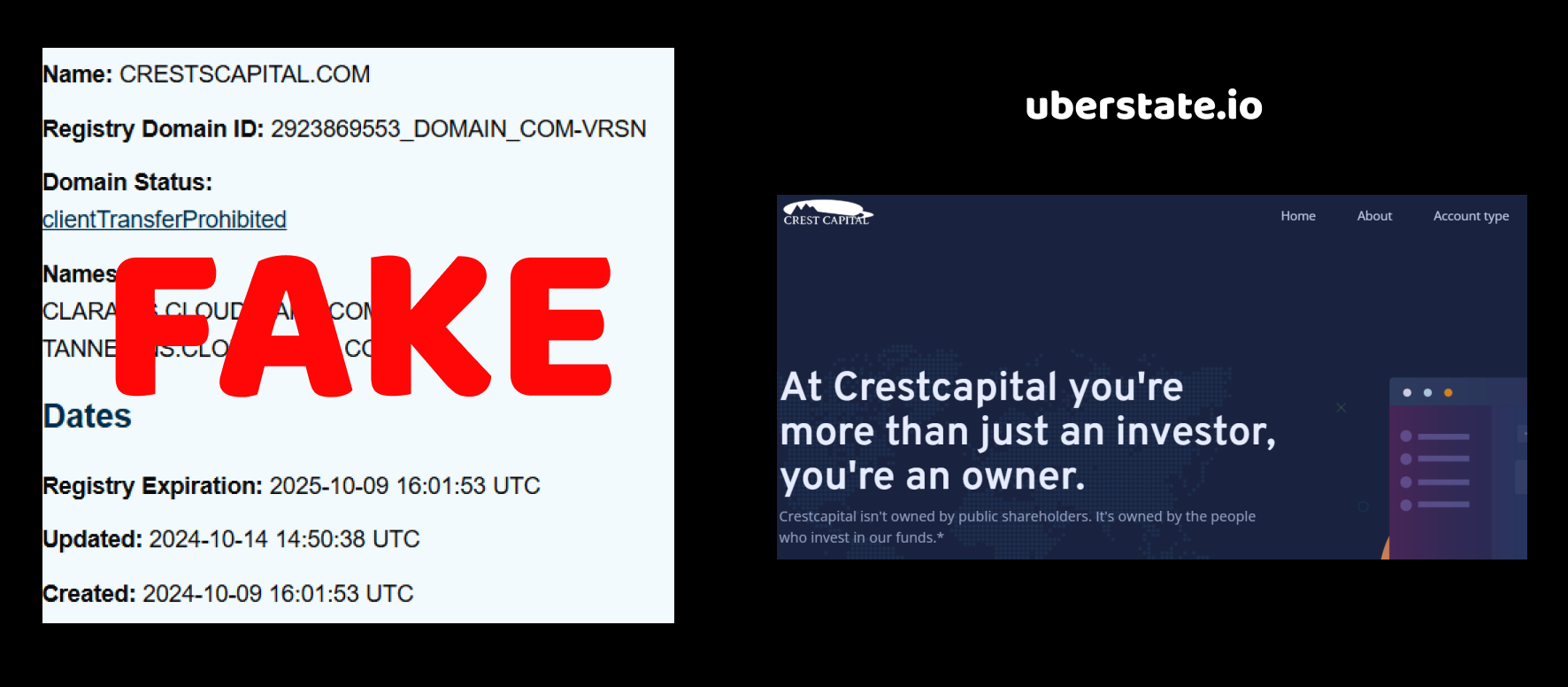

Crests Capital Review: Argument 1 — Domain Creation Date

When we started digging into Crests Capital, one of the first red flags popped up where you’d least expect it — the domain registration date.

Turns out, the domain was purchased on October 14, 2024, while the company claims to have started operating in 2025. At first glance, this might not seem like a big deal. But let’s pause and think: they registered the domain just a couple of months before launching the business?

That’s not how real brokers usually operate. Legitimate financial companies often spend years building infrastructure, preparing licensing, developing trading platforms — and yes, securing their domain names well in advance. But here, everything appears rushed. No online footprint before late 2024. No gradual buildup. Just a domain, then — boom — “we’re a brokerage now!”

Crests Capital Review: Argument 2 — No License

Now here’s where things really start to unravel. We checked every possible database, regulator, and public record — and guess what? Crests Capital doesn’t have any license. Not even a fake one.

And that’s saying a lot. Most scam brokers at least try to pretend they’re regulated. They slap on some random offshore license — Belize, Vanuatu, “St. Financials of Nowhere” — just to calm down unsuspecting clients. But Crests Capital? They didn’t even bother.

That raises a very uncomfortable question: why would a broker avoid regulation altogether? Regulation, even the weak kind, means some level of accountability. It makes it riskier for scammers to operate because there’s at least a small chance of legal consequences.

So when a company completely skips this step, it usually means only one thing — they don’t want anyone looking over their shoulder. They want to do whatever they want with your money, and they don’t want to answer for it.

And here’s the kicker: on their site, there’s no section about licensing, no registration number, no mention of any authority — nothing. A clean slate. That’s not how legitimate brokers operate. That’s how ghost companies look before they disappear with your funds.

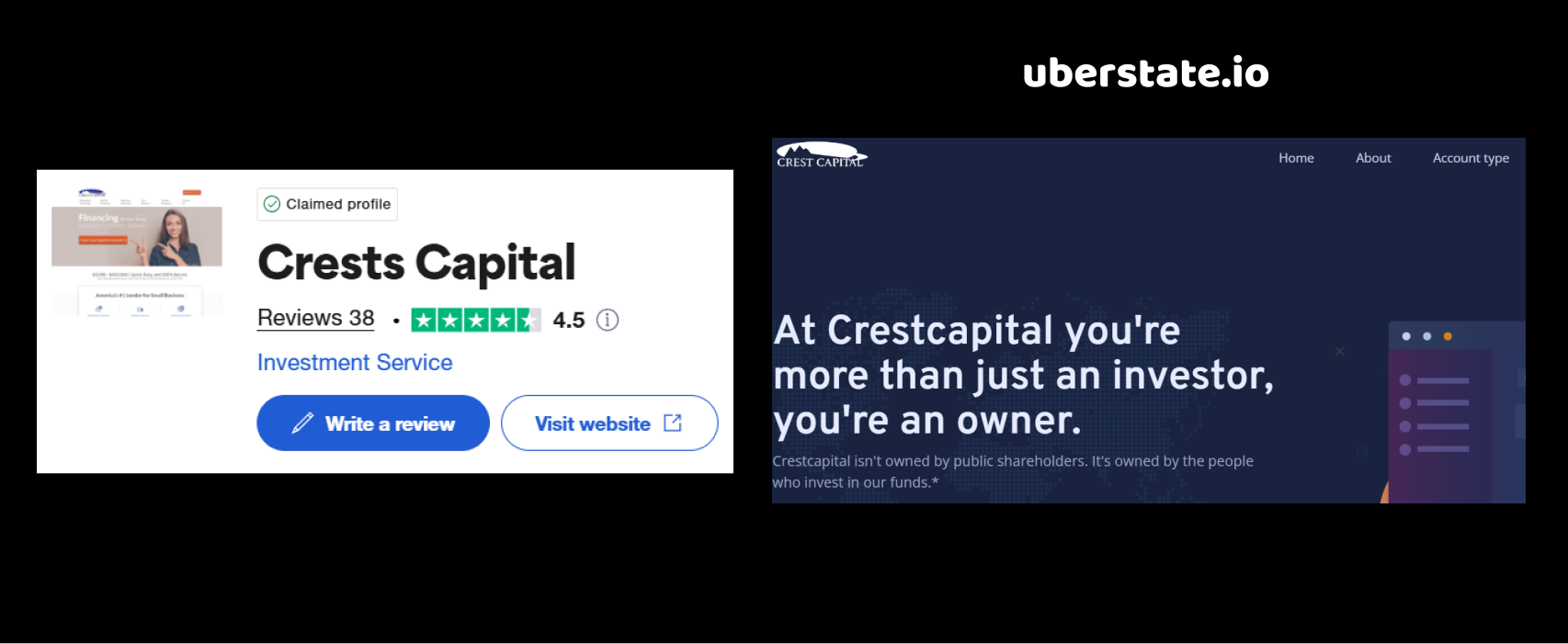

Crests Capital Review: Argument 3 — Suspicious Trustpilot Reviews

At first glance, Crests Capital seems to have a decent reputation — a 4.5 rating on Trustpilot. That would usually sound reassuring… if you didn’t look deeper. But once we did, the whole picture changed.

Here’s what stood out immediately: there are only 38 reviews total. That’s not much at all, especially for a financial service supposedly operating internationally. And out of those 38, only 1 review is negative.

Now let’s be honest — in the real world, even the best companies get their fair share of criticism. Technical issues, delays, misunderstandings — something always pops up. But here? Practically all the feedback is glowing. Not just positive — suspiciously perfect.

And there’s another detail that really caught our attention: the writing style of the reviews. Most of them sound almost identical. Same sentence structure. Same tone. Same “too-good-to-be-true” praise like “fast withdrawals,” “great customer service,” or “best broker ever.” It’s like someone was following a script.

So what does this tell us? Most likely, these reviews are fake or heavily manipulated. Bought or written by the same person under different names — a classic move in the scam playbook. Because if your service is real, why would you need to flood the internet with robotic praise?

Something just doesn’t add up. And in finance, when things feel off — they usually are.

Final Verdict — The Truth About Crests Capital

After going through every corner of this so-called brokerage, it’s pretty clear: Crests Capital is not a platform you can trust. Let’s piece everything together.

First, their domain was registered just months before the claimed launch date. That might seem like a small thing, but it signals there’s no real background, no team, no buildup — just a rushed setup. Real brokers don’t pop out of thin air like that.

Then comes the fact that they’re completely unlicensed. Not even an offshore registration, not even an attempt to fake legitimacy. That’s not just reckless — it’s intentional. No regulation means no responsibility, and no limits on what they can do with your money.

And the cherry on top? Their Trustpilot page looks polished, but it doesn’t hold up under scrutiny. 38 reviews, nearly all suspiciously glowing, with identical language and the same copy-paste praise. Only one negative comment? Come on. Real businesses don’t have that kind of rating unless they’re massaging it.

So ask yourself:

Why would a real broker avoid regulation, have no public history, and fill their review page with bots?

Because they’re not interested in long-term clients — they’re interested in quick money grabs.

If something looks too good to be true in the forex world, it usually is. And Crests Capital? That’s exactly the case.