Fin Up Company review

Can you trust them… or is this just another trap?

When a broker claims to be a reliable partner in the financial markets, the least we can do is verify their story. And in the case of Fin Up Company, things started falling apart pretty quickly.

They talk the talk — promising long-term experience, regulated operations, and satisfied clients. But once we took a closer look, nothing quite added up.

So we asked ourselves: what is Fin Up Company really hiding?

Why does their story sound polished… but the details tell a different tale?

In this review, we’ll break it all down — step by step — from their suspicious domain age to the license that looks more like a decoration than a real legal document. Let’s see what’s behind the curtain.

Fin Up Company – General Broker Information

At first glance, Fin Up Company looks like a typical online broker — account tiers, contact details, high leverage, and a slick platform. But let’s not forget: scammers often look professional to seem trustworthy. The real story is in the details.

| Category | Details |

| Company Name | Fin Up Company |

| Website | finup-company.com |

| [email protected] | |

| Phone Number | +44 204 525 6634 |

| Leverage | Up to 1:500 |

| Account Types | Basic, Standard, Pro |

| Trading Platform | WebTrader |

| Minimum Deposit | Not specified |

| Languages | English |

| Regulation | IFMRRC (⚠️ Fake license) |

Now here’s something to think about —

why would a legit broker offer dangerously high leverage, remain vague about deposits, and hide behind a fake regulator?

Because it’s all about appearance. The goal isn’t long-term trading relationships — it’s quick cash from unsuspecting traders. And once the money’s in… good luck getting it back.

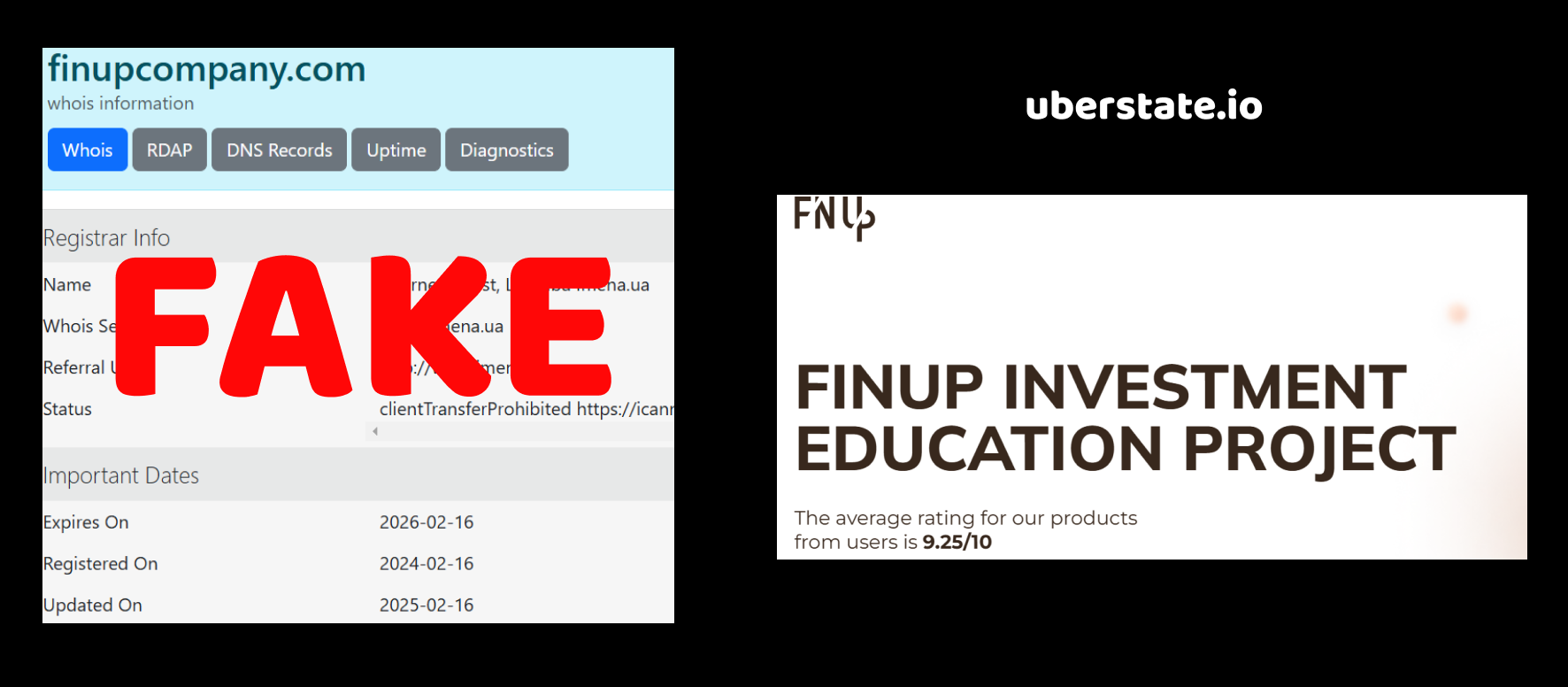

Argument 1 – Website creation date

When we started digging into Fin Up Company, the first thing we checked was the domain registration date. Sounds boring? Maybe. But trust me, this tiny detail has exposed more shady brokers than you can imagine.

Domain registration date: September 22, 2023

Claimed year of establishment: 2016

And here’s where things get weird. They confidently state that they’ve been around since 2016… yet their website was only registered in late 2023?

Why would a company that’s supposedly been in business for 7 years not have an online presence until just a few months ago?

Even if they had an older domain, there’d be some trace — archived versions, redirects, anything. But here? Nothing. Just a fresh, brand-new domain pretending to carry a long history. That’s not just suspicious — it’s a classic red flag.

Because let’s be honest… what kind of legitimate financial institution waits seven years to make a website in the digital age?

Or better question — why would scammers invent a fake launch date? Simple: it creates an illusion of trust. But illusions don’t hold up under scrutiny.

Argument 2 – License (or the illusion of one)

Let’s talk regulation — or rather, the lack of it. Because when we checked what license Fin Up Company operates under… well, things got messy.

License status: Fake

Stated regulator: IFMRRC

Now, here’s the kicker: IFMRRC isn’t a real regulator. It’s a self-proclaimed organization that doesn’t have any legal authority in the financial world. Anyone can pay a small fee and get a shiny certificate from them. It’s the regulatory equivalent of printing a driver’s license at home.

Real regulators — like the FCA (UK), ASIC (Australia), or CySEC (Cyprus) — enforce strict rules, require audits, and actively protect investors. But IFMRRC? They offer no protection, no oversight, and no consequences for misconduct.

So the question is: why would a legitimate broker avoid real regulation and instead opt for a fake license from a no-name entity? The answer’s pretty obvious.

And let’s not forget: fake licenses are not just a red flag — they’re practically a neon sign that screams “run.”

Because real brokers don’t hide behind imaginary regulators. Scammers do.

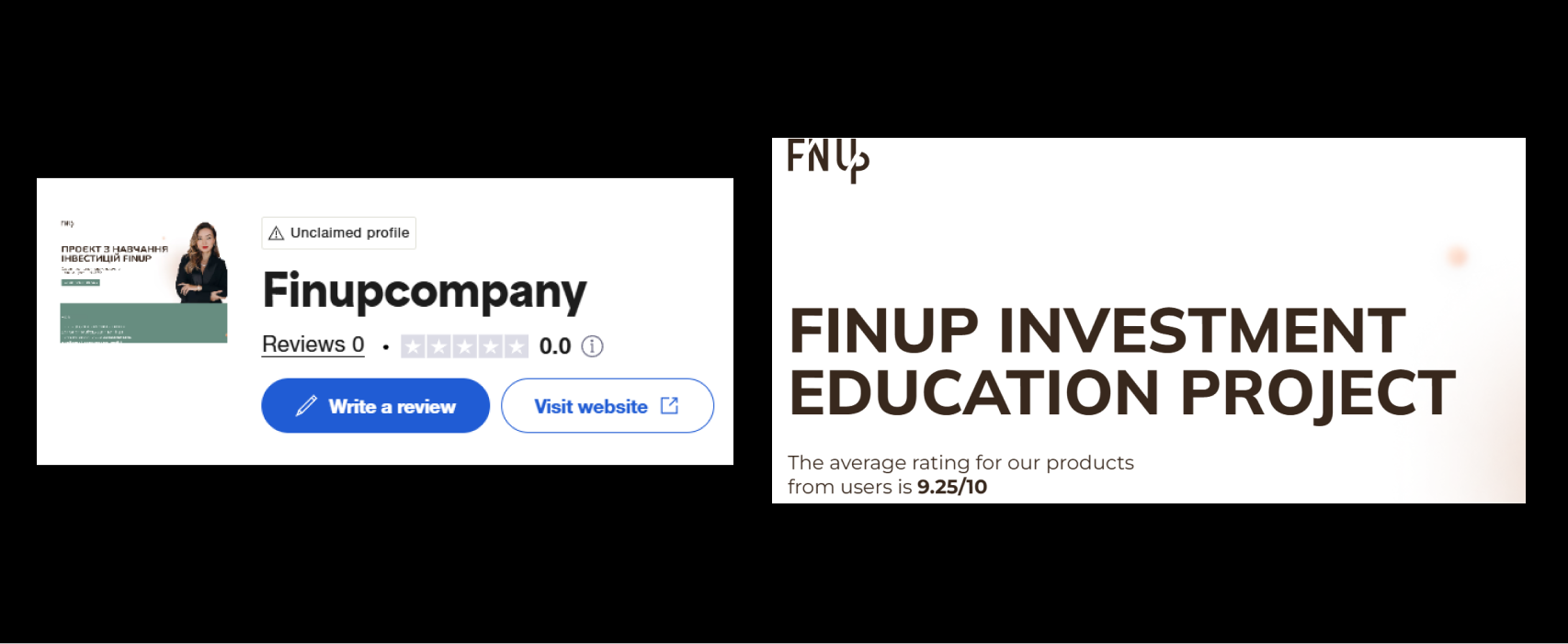

Argument 3 – Reviews that just don’t feel right

We took a closer look at Fin Up Company’s Trustpilot page — and here’s what we found.

⭐ Trustpilot score: 3.2 out of 5

Not exactly impressive. But what stood out even more than the mediocre rating was how the reviews were written.

Almost all the positive comments were posted in a short span of time. Same tone. Same structure. Same generic praise like:

“Great service! Fast withdrawals! Very reliable broker!”

Really? All that enthusiasm — and not a single typo, personal story, or even mention of specific instruments traded?

This is the hallmark of fake reviews. Organic feedback is messy, emotional, full of detail. Real clients talk about their trading experience — the good and the bad. But here? It feels like someone sat down, opened ten accounts, and started copy-pasting.

Worse yet, the negative reviews (and yes, there are quite a few) tell a completely different story:

Withdrawal issues

Unresponsive support

Sudden account restrictions

So the question becomes: who are these five-star reviewers really helping? Because it’s not the victims who lost their funds. It’s the people behind the scam, trying to bury the truth under fake praise.

In short, the reviews aren’t reassuring — they’re part of the con.

Final verdict – Is Fin Up Company legit?

After analyzing every layer of Fin Up Company, the truth became painfully clear — this isn’t a company built on trust, transparency, or long-term service. It’s a facade.

Let’s recap what we uncovered.

They claim to have launched in 2016, yet their domain was only registered in late 2023. That’s not just a mismatch — it’s a timeline that doesn’t make sense unless someone is rewriting their history.

Then there’s the so-called license. Instead of being regulated by a serious financial authority, they’ve gone for the IFMRRC — a “regulator” that sounds official but offers no actual oversight. Basically, it’s like framing a piece of paper and calling it protection.

And finally — the reviews. A flood of generic 5-star comments with no substance, mixed in with angry 1-star reviews talking about frozen accounts and stolen funds. If that doesn’t scream manipulation, what does?

So ask yourself:

Why would a real broker need to fake their age, hide behind a fake license, and pay for reviews?

Because they’re not interested in long-term clients.

They want quick deposits, fast disappearances, and as little accountability as possible.

Fin Up Company isn’t just questionable — it’s dangerous.