Fortum Review — Another Broker, or Another Trap?

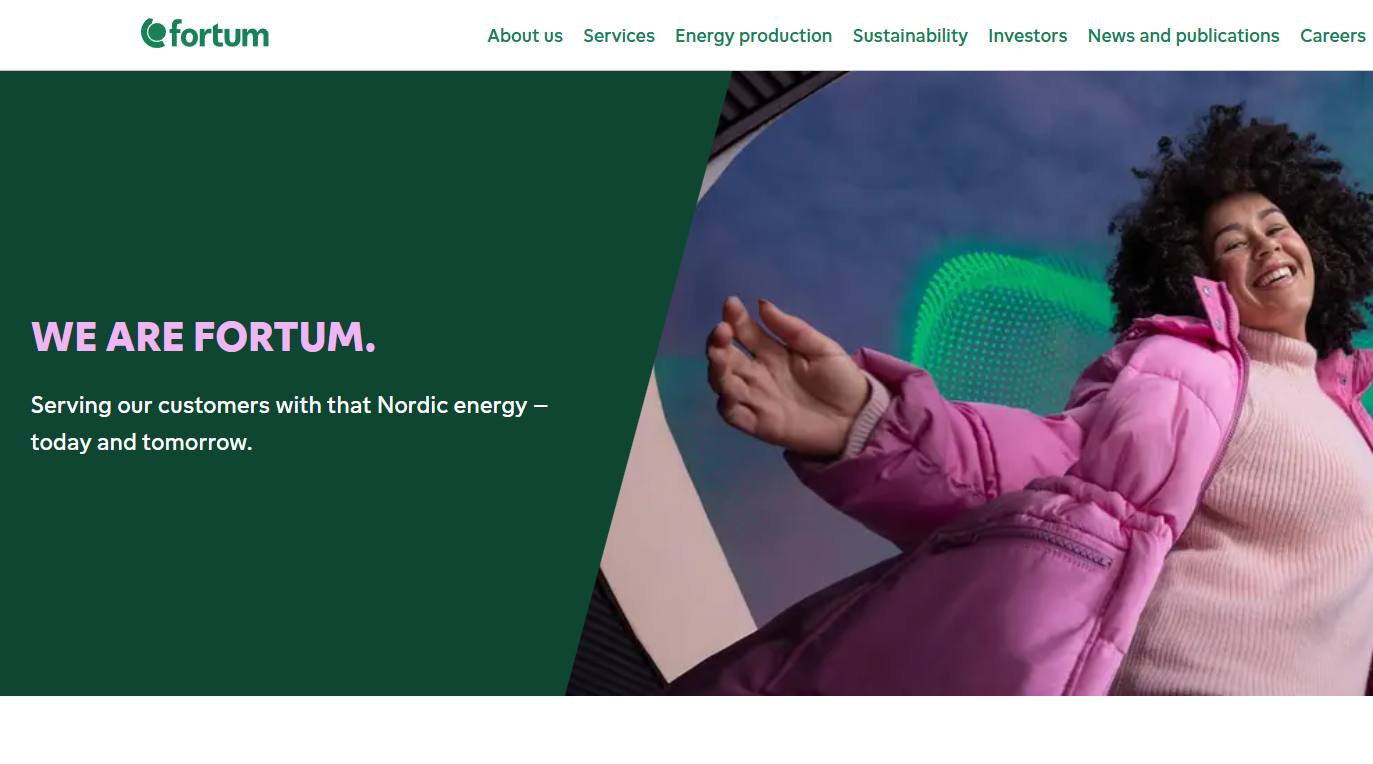

At first glance, Fortum tries hard to look like the real deal. Sleek website, confident promises, and the usual buzzwords — “secure,” “trusted,” “professional.” But we’ve seen this show before, and not every actor on the stage is who they pretend to be.

At first glance, Fortum tries hard to look like the real deal. Sleek website, confident promises, and the usual buzzwords — “secure,” “trusted,” “professional.” But we’ve seen this show before, and not every actor on the stage is who they pretend to be.

That’s why we didn’t just take their word for it.

We ran a full background check — the kind that peels away all the glossy layers and goes straight to the facts. And what we found raises more questions than answers.

Why does the domain say 2023, but the brand claims to exist since 2020?

Why is the only license from a regulator nobody serious uses?

And why do all the glowing reviews sound like they were written by the same person?

Let’s break it down — piece by piece. Because behind every smooth pitch, there’s a story. And in the case of Fortum, it might not be one you want to be a part of.

Fortum Broker Info

| Category | Details |

| Broker Name | Fortum |

| Website | fortum.cc |

| Domain Registered | May 22, 2023 |

| Claimed Founding Year | 2020 |

| Leverage | Up to 1:1000 |

| Account Types | Standard, Silver, Gold, VIP |

| Minimum Deposit | Not specified clearly |

| Regulator | MWALI International Services Authority |

| License Type | Fake |

| Trustpilot Score | 3.2 / 5 |

| Support Contacts | Only via email and website form |

| Headquarters | Not disclosed |

A few things instantly stand out. The leverage is dangerously high — up to 1:1000. That’s not something serious brokers offer to average users, especially under solid regulation. It’s the kind of leverage scammers use to lure in high-risk gamblers who don’t understand what they’re walking into.

The license? Already debunked.

The contact info? Barebones. No phone number, no clear address. Just a form and an email. That’s the kind of setup that lets a broker vanish overnight without leaving a trace.

And the account types? Classic tiered marketing — designed to push users into “upgrading” for imaginary perks.

Nothing here screams trustworthy. Quite the opposite.

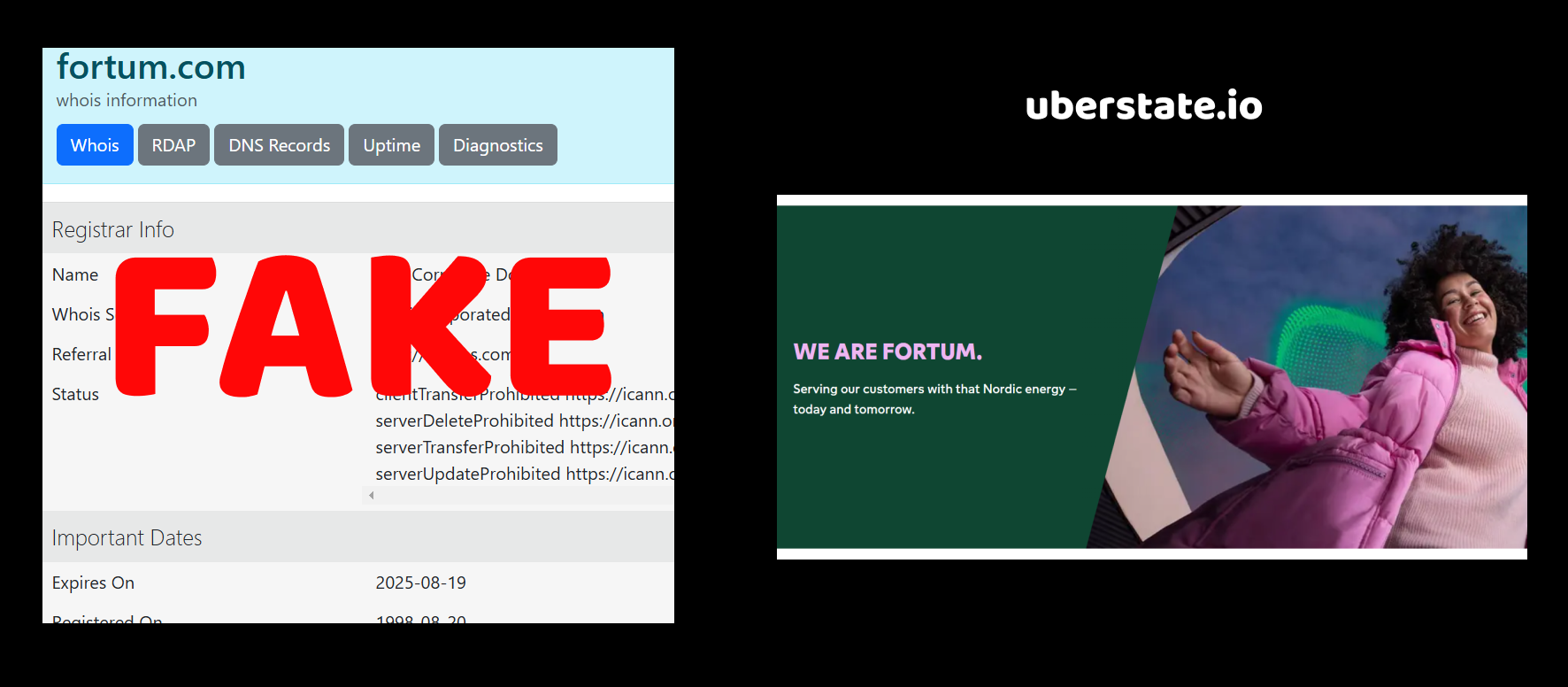

Date of Domain Registration

When we started checking the basics, one red flag popped up right away. Fortum positions itself as an established, trustworthy trading platform. It talks big — as if it’s been around for years, with a solid history and a loyal client base.

But when we looked up the actual domain registration date, the illusion started to crack. The domain was registered on May 22, 2023.

Sounds fresh? That’s because it is.

Now here’s the strange part — according to their branding, the company was allegedly founded in 2020. That’s a 3-year gap between the claimed start and the actual moment they bought the domain.

So what were they doing all those years without a website? Trading by pigeon mail? Or maybe they had a different domain before? But guess what — there’s zero evidence of any previous online presence tied to this brand.

And that raises the question:

Why would a legitimate company wait three years to register their main website?

More likely, this whole 2020 narrative is just smoke and mirrors — a convenient story to gain users’ trust. But the digital footprint tells the real story: Fortum’s actual existence began much later than they claim.

License — Or Should We Say, “License”?

After looking into who supposedly regulates Fortum, we hit another classic trick from the scammer playbook. The website claims to operate under a license from an entity that—on paper—sounds official. But when we took a closer look, things started to fall apart.

Fortum is allegedly licensed by the MWALI International Services Authority. Sounds exotic, right? Maybe even legit? But here’s the catch: MWALI is not a recognized regulator in the world of forex and financial markets. It’s based in the Comoros Islands — a jurisdiction that’s become infamous for selling licenses like candy to shady brokers.

Let’s break this down:

- MWALI does not conduct due diligence on financial firms.

- It provides zero oversight on how brokers treat their clients.

- And in case things go south? Don’t expect any protection or support.

So why would Fortum choose such a regulator? It’s simple:

Scam brokers love weak regulators. They don’t ask questions. They don’t intervene. They give the illusion of legality without any of the responsibility.

And let’s be real — if Fortum were truly a global, reliable broker, why not get licensed by FCA, CySEC, or ASIC? Why settle for a rubber-stamp license from a tropical island no serious investor has ever heard of?

Unless, of course, they don’t want regulation — they want the appearance of it.

That’s not a safety net. That’s just smoke and mirrors.

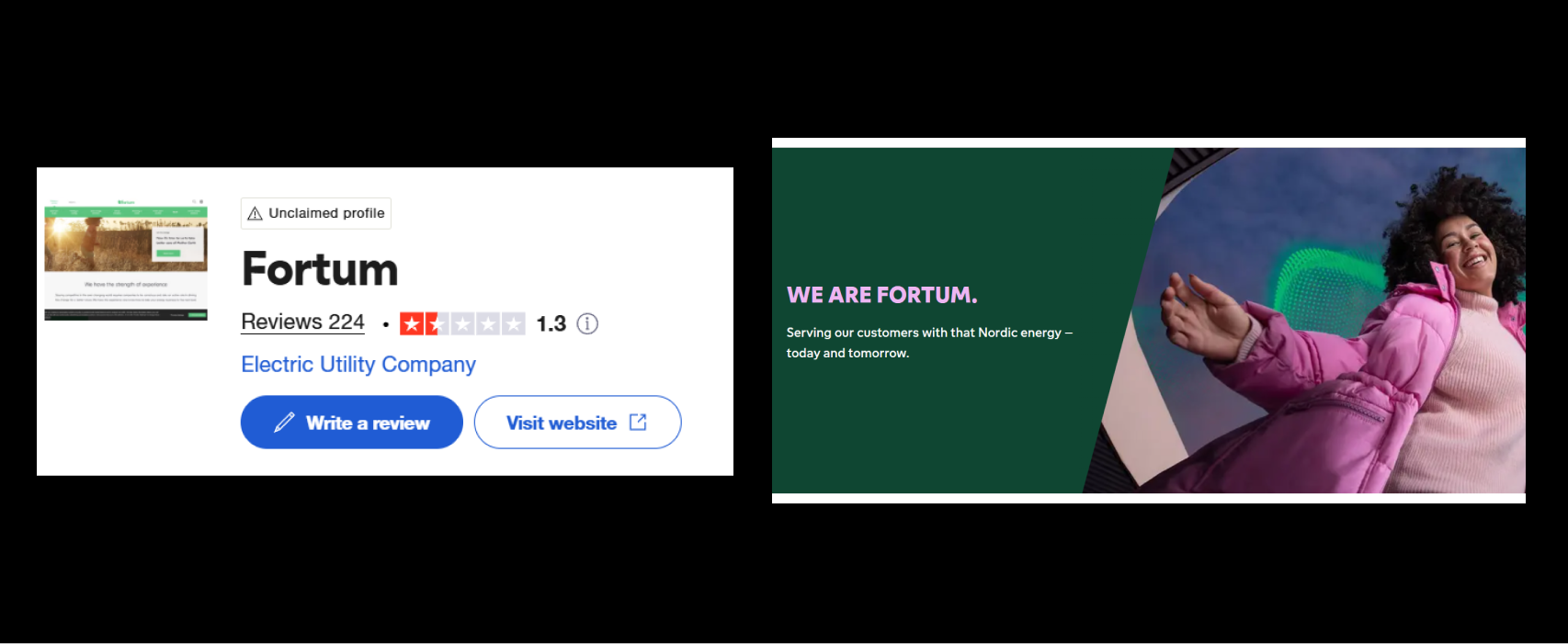

Reviews — Too Fake to Trust

When we finished checking Fortum’s presence on Trustpilot, one thing became crystal clear: this broker is trying way too hard to look loved.

Let’s start with the score: 3.2 out of 5. Not disastrous, but definitely far from trustworthy. Especially when you consider that many real brokers with solid reputations easily hit 4.5 and above. But here’s the juiciest part — scroll through the positive reviews, and they all read like they were copy-pasted from the same script.

You know the type:

- “Best platform ever! Fast withdrawals and excellent support!”

- “Highly recommend Fortum to all my friends. Very professional!”

Short. Vague. All written in the same tone. Zero detail, no mention of real trading experience or specifics. It’s almost like… they never actually used the platform?

And here’s something even weirder:

- Most of the 5-star reviews are crammed within a tight timeframe — just days apart.

- Many are from accounts with only one review ever written — and surprise, it’s for Fortum.

Now think about it: why would a legit broker need to flood review platforms with low-effort praise from ghost accounts?

Because real traders probably aren’t leaving many glowing reviews.

And the few negative ones? Those feel real. They talk about withdrawal issues, poor customer service, and unreachable support — the kind of complaints scam brokers rack up like clockwork.

In the end, the review section doesn’t build trust. It destroys it. Because if a company’s reputation needs to be manufactured… what does that say about the product?

Final Verdict: Is Fortum Just Another Scam in Disguise?

After putting Fortum under the microscope, the story practically writes itself — and it’s not a pretty one.

First, the domain age exposes the lie. They claim to be in business since 2020, but the website only appeared in mid-2023. Why invent a fake timeline? Because reputation takes time to build — unless you just make one up.

Then there’s the so-called license — a piece of paper from MWALI, a “regulator” that’s basically a permission slip for scams. No oversight, no responsibility, and definitely no protection for traders. What kind of serious broker chooses that route?

The reviews only pile on more doubt. A sea of five-star fluff, written in the same robotic tone, dropped by accounts that exist solely to boost the rating. Real traders talk about delayed withdrawals, vanished support teams, and total silence when it matters most.

And finally, when you dig into the actual platform details — what do you find? A generic setup, inflated promises, and the kind of language built to lure in anyone who doesn’t ask too many questions.

But here’s the thing:

Why would a legitimate broker go through so much effort to look legitimate instead of just being legitimate?

Because Fortum isn’t here for the long haul. It’s not building trust — it’s simulating it. And that’s the biggest red flag of all.

So if you were wondering whether Fortum is a safe place to trade… ask yourself:

Why would scammers want clients who might see through them?

They don’t. And that tells you everything.