Market Rocks Review – Is This Broker Legit or a Scam?

When looking for a reliable broker, traders expect transparency, strong regulation, and a solid track record. Market Rocks claims to be a well-established broker, operating since 2010, but is that really the case? When we started digging deeper, we uncovered serious red flags—from a fake company history to an unreliable offshore license and suspicious user reviews.

Why would a broker that supposedly exists for over a decade only register its domain in 2023? Why is it operating under a questionable offshore license (M.I.S.A), which provides no real oversight? And why are there complaints about withdrawal issues despite their attempts to boost ratings with suspiciously generic positive reviews?

In this detailed investigation, we’ll expose everything you need to know about Market Rocks—so you don’t fall into their trap.

Market Rocks – General Information

| Category | Details |

| Website | marketrocks.com |

| Claimed Establishment Year | 2010 |

| Actual Domain Registration | September 26, 2023 |

| Regulation | M.I.S.A (Mwali International Services Authority) – Unreliable offshore license |

| Restricted Countries | Not clearly stated |

| Leverage | 1:200 |

| Available Accounts | Beginners Account – $10,000 deposit; Advanced & Pro Account – No clear details |

| Trading Platforms | WebTrader, Tablet Trader, Mobile Trading App |

| Customer Support – Email | [email protected] |

| Customer Support – Phone | +448000488474 |

| Trustpilot Score | 3.9 |

| Total Reviews | 29 |

| Bad Reviews | 4 (Main complaints: withdrawal issues) |

Now you can easily copy and paste this table wherever you need!

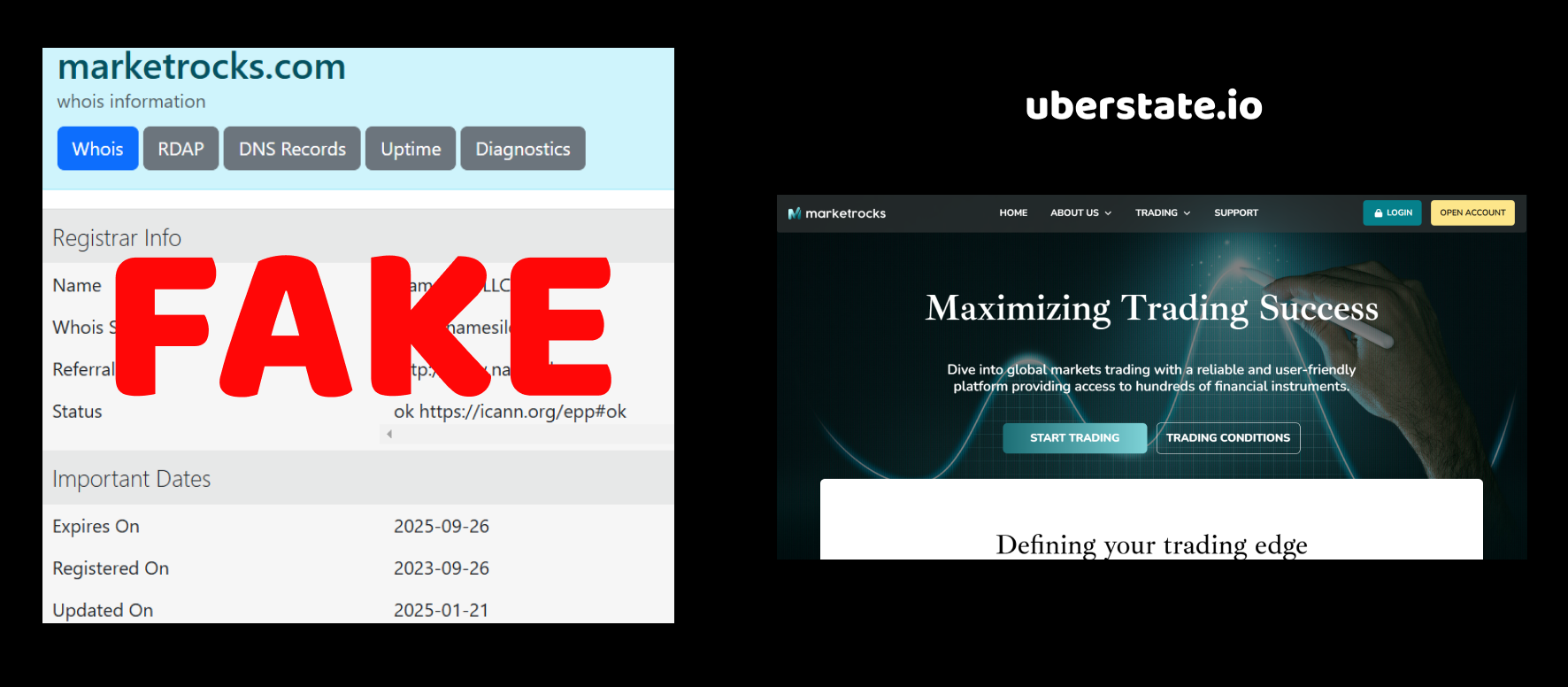

Market Rocks – Argument 1: Domain Creation Date

Here’s where things start getting suspicious. According to the broker’s claims, Market Rocks has been around since 2010—a solid 14 years of experience, right? But wait, when we checked the domain registration date, we found something odd. The domain marketrocks.com was actually purchased on September 26, 2023.

Think about it—how can a company that supposedly existed since 2010 only register its website in 2023? A legitimate, well-established broker would have had an online presence long before now. This mismatch is a classic red flag for scam operations. Many fraudulent brokers fabricate a long history to appear trustworthy, but the internet never forgets. Their actual domain purchase date exposes the lie.

Why would a company wait 13 years to get a website? It doesn’t make sense. The more likely scenario? Market Rocks is a recently created scam trying to pose as an old, reputable broker to attract unsuspecting traders.

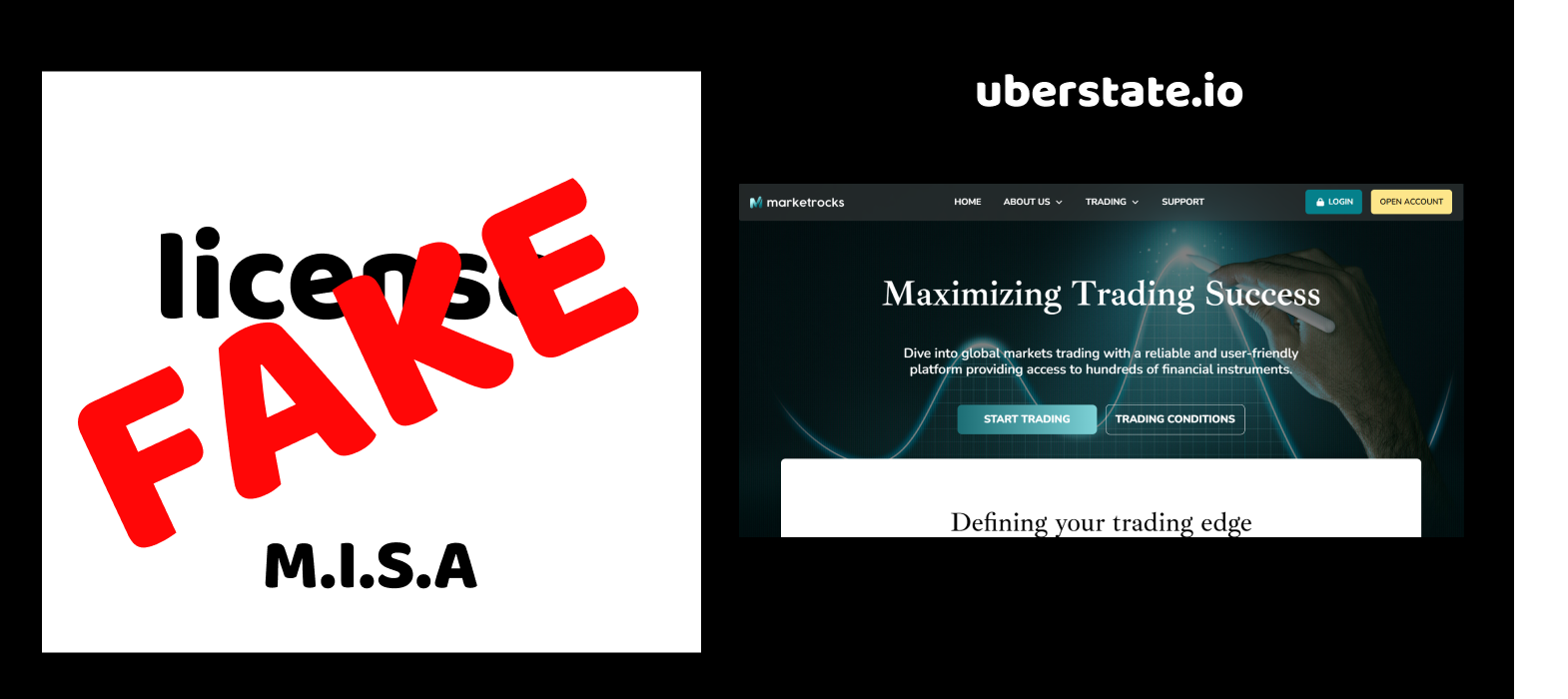

Market Rocks – Argument 2: Fake or Unreliable License

Now, let’s talk about regulation—the key factor that separates legitimate brokers from outright scams. Market Rocks claims to be regulated by M.I.S.A (Mwali International Services Authority). Sounds official, right? But here’s the problem—M.I.S.A is a known offshore regulator that provides zero real oversight.

Why does this matter? Because real regulators, like the FCA (UK), ASIC (Australia), or CySEC (Cyprus), enforce strict rules to protect traders. They ensure brokers operate transparently, maintain segregated client funds, and don’t manipulate trades. Meanwhile, offshore regulators like M.I.S.A? They barely exist on paper and offer no protection if the broker decides to disappear with your money.

This so-called “license” is essentially a paid certificate that any scam broker can buy to look legitimate. And let’s be real—why would a serious, trustworthy broker choose an offshore regulator with no real enforcement power? Because they don’t want to follow strict financial rules. Instead, they operate from jurisdictions where they can do whatever they want—like freezing withdrawals, manipulating trades, or even shutting down overnight with no consequences.

So, what does this tell us? Market Rocks is completely unregulated in any serious financial jurisdiction. The M.I.S.A license means absolutely nothing when it comes to trader protection. In short, your money is not safe here.

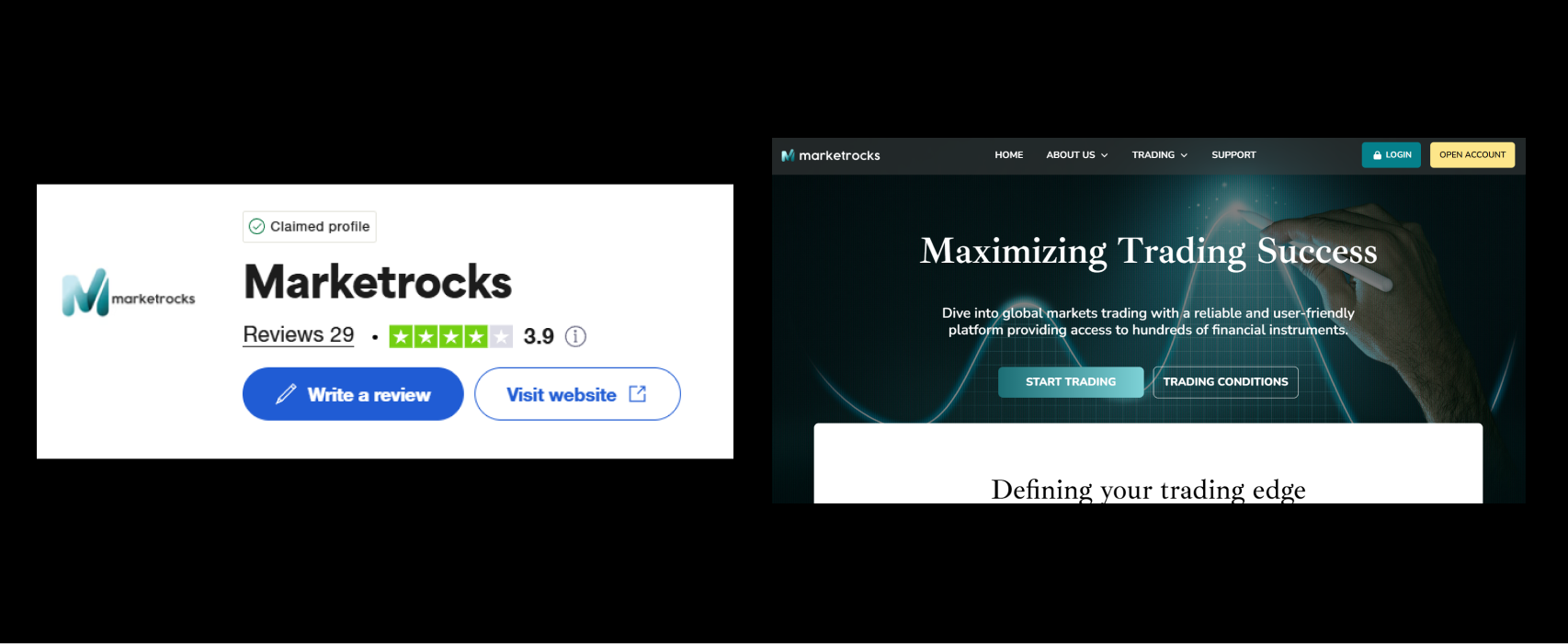

Market Rocks – Argument 3: Suspicious Reviews on Trustpilot

Now, let’s take a look at what actual users are saying about Market Rocks. Trustpilot shows a score of 3.9, which might seem decent at first glance. But when we dig deeper, things start looking shady.

1. Mixed Reviews with Signs of Manipulation

Market Rocks has 29 total reviews, out of which 4 are negative. That’s not a huge number, but here’s where things get interesting—the positive reviews all follow the same pattern. They are written in a generic, overly enthusiastic style with little to no details about actual trading experiences. This is a classic sign of fake, paid-for reviews meant to boost a broker’s reputation artificially.

2. The Timing of Reviews

Another red flag? Most of the positive reviews were posted within a short period. This suggests the broker engaged in a review-pumping strategy, where they flood the platform with fake feedback to bury real user complaints. Legitimate brokers receive reviews organically over time—not in sudden waves.

3. Negative Reviews Talk About Withdrawal Issues

Now, let’s focus on the bad reviews. The main complaint? Withdrawal problems. Some users report that after making decent profits, they suddenly couldn’t access their funds, with customer support either ignoring them or giving vague excuses. Sound familiar? That’s a textbook scam tactic—letting users deposit and trade but blocking withdrawals when they try to cash out.

Final Thought on Reviews

A Trustpilot score alone doesn’t tell the whole story. When we look at how the reviews are written and what the negative reviews are about, it becomes clear—Market Rocks has likely manipulated its ratings, and real traders are struggling to get their money back. If a broker is truly trustworthy, they won’t need to flood review sites with fake praise to cover up scam complaints.

Final Verdict – Market Rocks is a High-Risk Broker

After a thorough investigation, it’s clear—Market Rocks is not a broker you can trust. The evidence speaks for itself:

❌ Fake company history – They claim to have been around since 2010, but their domain was only registered in September 2023. A legitimate broker wouldn’t need to lie about its history.

❌ Unreliable offshore regulation – Market Rocks is “regulated” by M.I.S.A (Mwali International Services Authority), which is nothing more than a rubber-stamp offshore entity that offers zero protection for traders. If this broker vanishes with your money, you have no way to get it back.

❌ Suspicious Trustpilot reviews – The broker has a 3.9 rating, but many positive reviews look fake, written in the same style, and posted within a short period. Meanwhile, real traders complain about withdrawal issues—a classic sign of a scam broker.

❌ Shady trading conditions – A $10,000 deposit requirement for a “beginner” account? No support for trusted platforms like MetaTrader? These conditions are designed to trap traders into depositing large sums, but withdrawing funds is another story.

Should You Trade with Market Rocks?

Absolutely not. Market Rocks fits the pattern of an offshore scam broker, using deception and fake reviews to lure in unsuspecting traders. The risks far outweigh any potential benefits. If you value your money, avoid this broker at all costs.

Looking for a legitimate broker? Stick with well-regulated firms under FCA, ASIC, or CySEC supervision—not an offshore scam operation like this one.