Monaxa Review — What’s Really Behind This Broker?

The forex world is full of promises. Fast profits, easy withdrawals, “expert” support — you’ve heard it all before. And Monaxa joins the crowd with a flashy website, bold claims, and a Trustpilot page that, at first glance, seems too good to be true. But here’s the thing: when we started picking this broker apart piece by piece, what we found was far from reassuring.

The deeper we looked, the more the red flags started piling up. From suspicious domain activity to missing licenses and a wave of almost robotic 5-star reviews — it all felt too familiar. We’ve seen this pattern before: an operation that looks professional on the surface but falls apart the moment you start asking real questions.

So, what exactly is Monaxa hiding behind its polished front? Let’s walk through the facts — and figure out whether this is a broker you can trust, or just another trap set up to drain your wallet.

Basic Info About Monaxa

| Field | Details |

| Website | monaxa.pro |

| Leverage | up to 1:500 |

| Types of Accounts | Standard, Premium, ECN |

| Contact Email | [email protected] |

| License | Without license |

| Domain Registered | 2025-03-20 |

The 1:500 leverage is the first thing that stands out — dangerously high, especially for new traders. Brokers who offer this kind of leverage without regulation are usually not doing it to help you. They’re doing it because high leverage wipes out accounts faster, and fast losses mean quicker profits for them.

As for the account types — just the usual buzzwords: Standard, Premium, ECN. No real breakdowns, no fee structures, no comparison charts. It’s all so vague that it looks more like a placeholder than a functioning broker system.

And then there’s the contact section — or should we say, the lack of one. A single email address? No phone number, no physical office, no live chat? That’s not a support system — that’s a black hole. If something goes wrong, who are you supposed to turn to?

In short, Monaxa gives off the impression of a broker, but not the substance of one. All style, no structure. And that’s exactly what makes it dangerous.

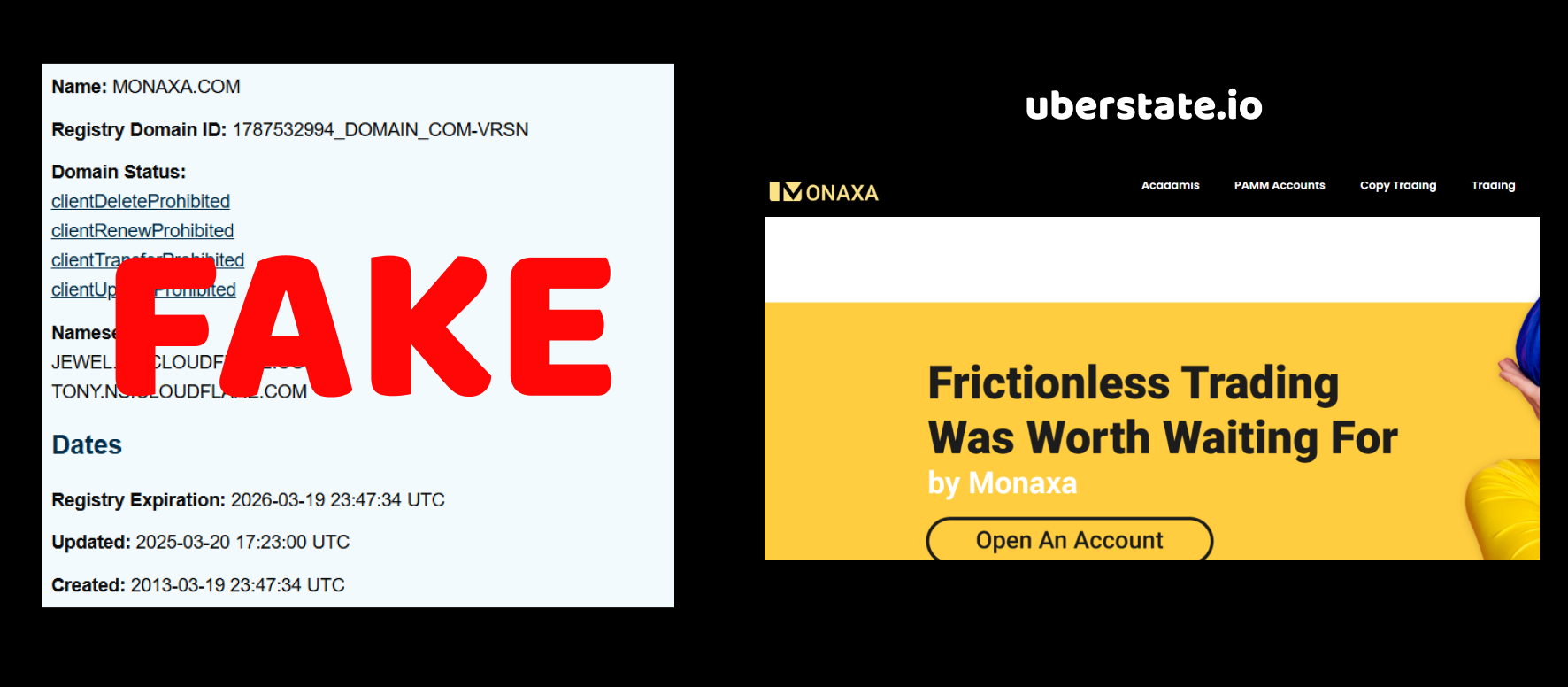

Monaxa Review — Argument 1: Domain Registration Date

When we finished checking the domain registration details for Monaxa, one thing immediately jumped out — the domain was purchased on March 20, 2025.

Now here’s the catch: that’s the exact same year the broker claims to have started operating. Seems harmless at first glance, right? But dig a little deeper and it raises serious questions.

Think about it: legitimate brokers usually prepare their groundwork months in advance. They secure a domain, build infrastructure, go through licensing procedures, and only then start offering their services. It’s a lengthy and expensive process. But in Monaxa’s case, the domain was bought in 2025, which suggests that the site likely didn’t even exist before this date. So where’s all the talk about prior experience, history, or trust built over time?

It gets weirder when brokers start loudly claiming they’re “trusted” or “experienced” — when in reality their website popped into existence just a couple of weeks ago.

And here’s a question worth asking: why would real professionals, who supposedly handle people’s money, wait until the last moment to register their site? Unless, of course, they’re not planning to stick around for long.

In this case, the registration date doesn’t just tell us when the site was created. It exposes the whole timeline of the so-called broker — and it doesn’t look good.

Monaxa Review — Argument 2: Lack of License

We looked into Monaxa’s regulatory status — and that’s when things went completely silent. No license. No registration with any recognized financial authority. Just… nothing.

Let’s be clear here: operating as a forex broker without a license is a massive red flag. Regulation exists for a reason — to protect traders from exactly the kind of schemes that shady platforms pull off. So when a broker like Monaxa avoids regulation altogether, it begs the question: what exactly are they trying to hide?

Some scams try to play smart. They’ll slap on fake licenses from non-existent regulators or obscure offshore “authorities” that sound official but mean absolutely nothing. But Monaxa didn’t even bother with that. Not a single mention of oversight, legal responsibility, or client protection. That level of confidence? Alarming.

And here’s the thing — why would a legitimate broker willingly skip regulation, knowing it’s one of the first things smart traders look for? The answer’s simple: because regulation brings consequences, and scammers don’t want to be held accountable.

No license means no audits. No transparency. No investor protection. If they freeze your funds or vanish overnight, there’s no authority to complain to. You’re on your own.

In Monaxa’s case, the absence of a license isn’t just a technical issue. It’s a deliberate choice. And that choice speaks volumes.

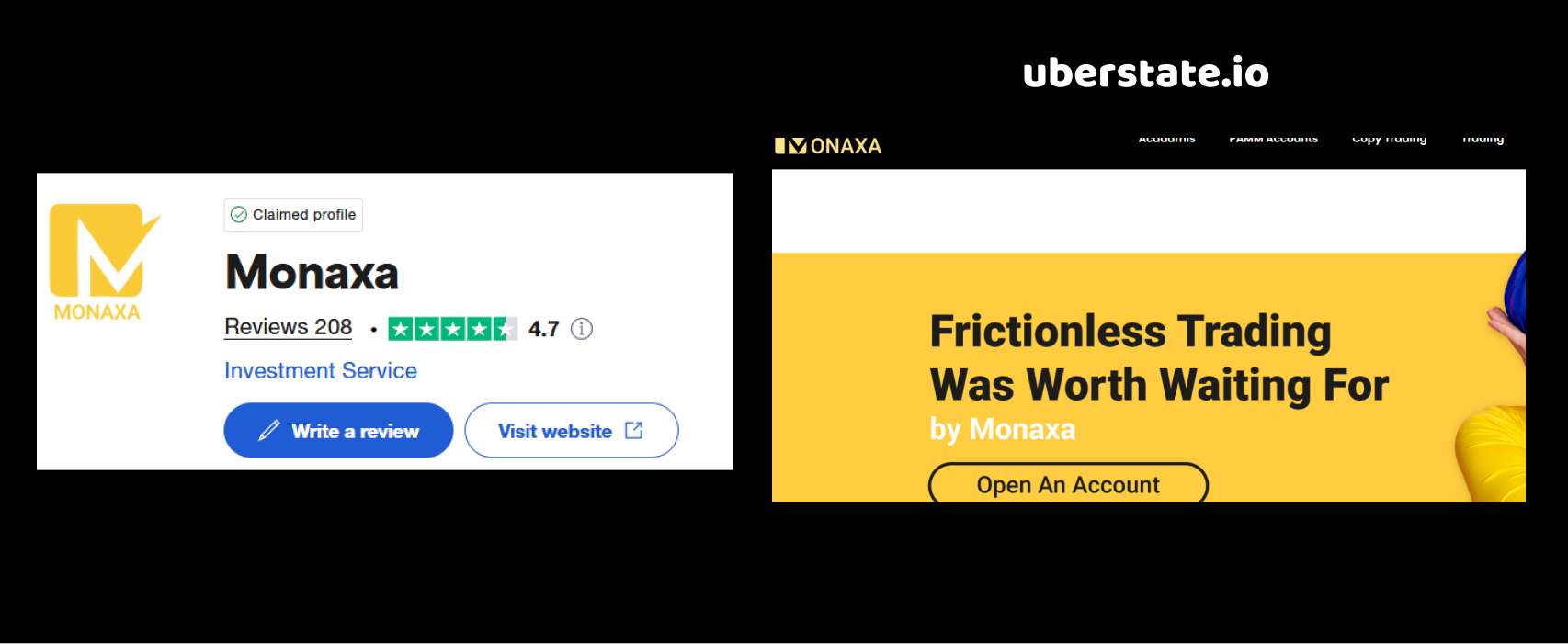

Monaxa Review — Argument 3: Suspicious Trustpilot Reviews

At first glance, Monaxa seems to be doing pretty well on Trustpilot — a rating of 4.7 out of 5 based on 208 reviews. Sounds impressive, right? But once we started digging into those reviews, the picture quickly changed.

Out of those 208 comments, 10 are negative. That’s nearly 5% of users openly calling the platform out — in a space where most people don’t even bother writing reviews unless something went seriously wrong. But here’s where it gets interesting…

The positive reviews all read the same. Not word-for-word copies, but the style? Identical. Short, overly enthusiastic, vague praises like “great service,” “fast withdrawals,” “best broker I’ve used.” No actual details, no mention of instruments traded, no screenshots, no context — just filler phrases anyone could write in 30 seconds. And the accounts posting them? Most of them are brand-new, with only one review posted ever — for Monaxa. Coincidence? Not likely.

This kind of pattern usually means just one thing: the reviews are fake or bought. Real users tend to write emotionally, describe specific problems or successes, and often mention both pros and cons. That’s what makes their feedback believable. But here — it’s like the same person wrote all the good stuff, switched accounts a couple hundred times, and clicked “submit.”

Also, if Monaxa really is as good as they claim, why do the few honest reviews paint such a different story? Several users mention not being able to withdraw funds or being ghosted by support after asking tough questions. And let’s be honest — if just 10 people took the time to write about serious issues, how many others got scammed and stayed silent?

When fake praise drowns out real warnings, it’s not just dishonest — it’s dangerous. And Monaxa’s review section feels like exactly that kind of setup.

Final Verdict on Monaxa — The Truth Beneath the Surface

After going through everything — the timing of the domain registration, the complete absence of a license, and the clearly manipulated review section — the picture becomes painfully clear. Monaxa isn’t some misunderstood new broker trying to find its footing. It’s a setup designed to look safe, while staying far away from any real accountability.

The site appeared out of nowhere in 2025, offering financial services without bothering to secure a license from any legitimate authority. And the Trustpilot page? Stuffed with overly polished fake reviews, probably written in bulk to drown out the real experiences — the ones where people mention withdrawal issues, vanished support, and lost funds.

And here’s the key question: why would real financial professionals operate in the shadows? Why fake credibility if you have nothing to hide?

Because scams don’t need loyal clients. They just need enough people to fall for it before disappearing. That’s why they don’t invest in real regulation, real service, or transparency. They invest in appearance — just enough to get your deposit.

Monaxa fits the scam blueprint almost too perfectly. And once you see the signs, it’s hard to unsee them.