Money Farm LTD Review: Is This Broker Too Clean to Be True?

When a new broker pops up on the scene, especially one claiming to offer top-tier services and client satisfaction, it’s natural to be curious. Money Farm LTD is one of those names that recently started making the rounds — promising smooth trading, great support, and a platform built with “client trust” in mind.

But the more we looked into it, the more questions started piling up.

Because here’s the thing — when something looks too perfect in the financial world, it usually isn’t. Slick websites, flawless reviews, big promises… all of that is easy to manufacture. What really matters is what’s hiding beneath the surface. And in this case, what we found raises some serious red flags.

So let’s break it down. Piece by piece.

Money Farm LTD Review: Broker Snapshot — What They Claim to Offer

Before we dive into anything else, here’s a quick overview of what Money Farm LTD presents to potential clients. This is the kind of surface-level info they usually promote to appear professional and structured. But even here, some things feel either incomplete or intentionally vague.

Let’s take a look:

| Category | Details |

| Types of Accounts | Not specified |

| Leverage | Up to 1:400 |

| Contact Email | [email protected] |

| Website | moneyfarmltd.com |

| Year Claimed Founded | 2024 |

| Domain Registration Date | 2025-02-04 |

| License | None (Unregulated) |

And here’s the thing — even in basic company info, there’s very little transparency.

No breakdown of account tiers, no mention of spreads, fees, or trading conditions. Just a general leverage number and a generic support email. That’s it.

For a company that wants to be taken seriously in the financial world, the lack of key trading details is concerning. Because real brokers — the ones that play by the rules — don’t hide this kind of information.

So again, it makes you wonder:

If they can’t even be clear about what they offer, how can you trust them with anything more serious?

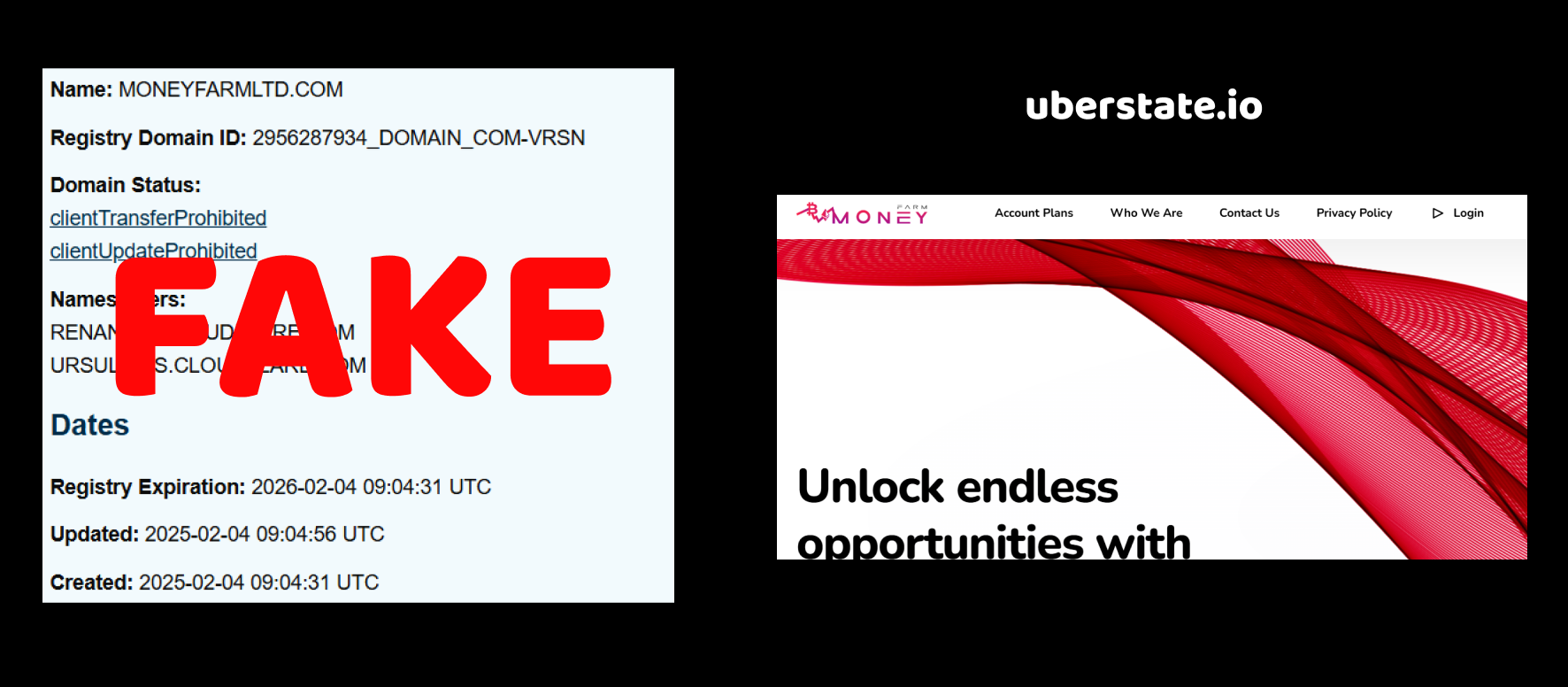

Money Farm LTD Review: The Mismatch in Domain Registration

Let’s kick things off with something that might seem minor at first glance — the domain registration date. But trust me, it says a lot more than it appears to.

According to their own claims, Money Farm LTD was founded in 2024. Sounds solid on paper, right? A year in the game should mean they’ve built some foundation — maybe a team, some infrastructure, a few clients. But here’s where things get weird.

When we dug into the technical records, we discovered that their domain — moneyfarmltd.com — was only registered on February 4, 2025.

Hold on a second… How does a company that supposedly launched in 2024 wait until 2025 to create its website?

Does that even make sense for a broker whose business depends almost entirely on an online presence?

It doesn’t. At all.

So either they were operating without a website for an entire year (which is ridiculous), or — and this is far more likely — they made up their launch date to look more experienced than they actually are. And that brings up a very real question: why would a legitimate company lie about its age?

After checking all the records and comparing the timelines, it became clear — there’s a serious gap between the story they tell and the facts we found. And this inconsistency with the domain date? That’s just the first red flag.

Money Farm LTD Review: Operating Without a License?

After the sketchy domain registration timing, we decided to dig deeper. And what we found next raises the stakes even higher — Money Farm LTD is operating without any valid license.

Let that sink in for a second.

No license. No regulation. No oversight.

In the world of financial services — especially forex and trading — being regulated isn’t just a “nice to have.” It’s absolutely essential. Regulation is what protects clients from fraud, ensures transparency, and gives you at least some guarantee that the company isn’t going to vanish overnight with your money.

But when we checked Money Farm LTD, there was no mention of regulation by any reputable authority — not FCA (UK), not CySEC (Cyprus), not ASIC (Australia), not even offshore regulators like FSA (Seychelles) or IFSC (Belize). Zero. Nothing.

And no, a vague “we follow industry standards” message on their website doesn’t count. That’s just marketing fluff. Real brokers proudly list their license numbers and link to the regulator’s database for verification. Money Farm LTD offers none of that.

Now ask yourself:

Why would a broker avoid regulation if they’re offering legitimate financial services?

Could it be that regulation means accountability? Maybe they don’t want to deal with audits, capital requirements, or client protection rules. Or — and here’s the more troubling possibility — maybe it’s just not in their interest to be traceable.

When we wrapped up the license check, it was obvious — this isn’t a case of “we’re still applying” or “pending approval.” No, this broker is flying completely under the radar. And for a company that asks people to trust them with their money, that’s a huge, flashing red warning sign.

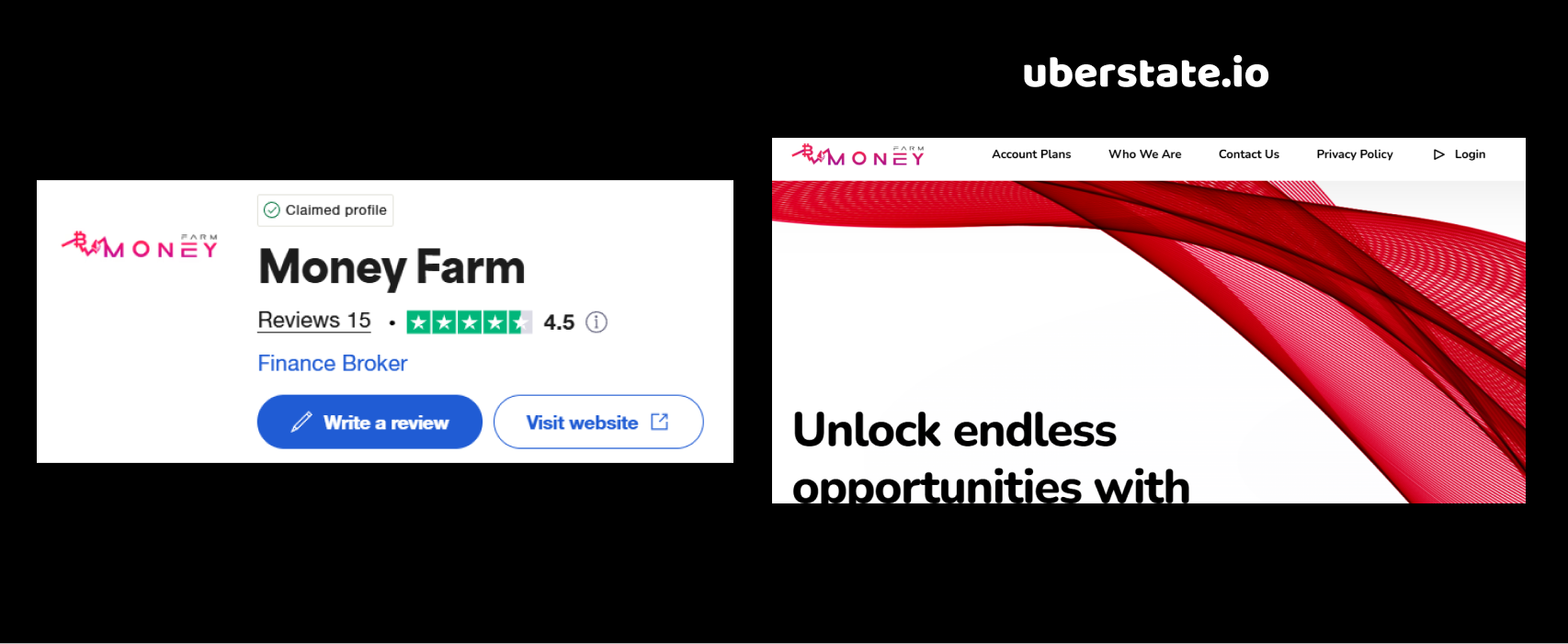

Money Farm LTD Brand Review: The Suspiciously Perfect Reviews

Alright, let’s move to the next layer — user reviews. At first glance, you might think everything looks just fine. Money Farm LTD boasts a 4.5 rating on Trustpilot. Not bad, right? And with 16 reviews, you’d expect at least a mix of opinions — some happy clients, a few issues, maybe the occasional red flag.

But nope.

Every single one of those 16 reviews is positive. Not a single bad or even neutral comment. That’s where things start to smell off.

Because let’s be honest — no broker, especially a new one, delivers a flawless experience to every client. Ever. People complain about delayed withdrawals, support issues, trading glitches… even if the company is legit. So the complete lack of criticism? It just doesn’t add up.

And it gets better (or worse, depending on how you look at it). When we read through the comments, a strange pattern emerged.

All reviews follow a very similar structure and tone — short, overly enthusiastic, vague praise like “great service!” or “amazing support!”. No one’s talking about actual trading experience, no one mentions specific tools, platform features, or even issues that were resolved. It’s all just shallow compliments.

That kind of uniformity is usually a dead giveaway.

So what’s going on here?

Are we really supposed to believe that this brand-new broker has managed to impress every single client without a single hiccup?

Or is it more likely that these reviews are artificially inflated — written by the same hand, or worse, bought in bulk?

When we wrapped up our review analysis, one thing was clear: this review section looks polished, not honest. And if they’re faking feedback just to build trust — what else might they be faking?

Final Verdict: Why Money Farm LTD Should Make You Think Twice

After putting all the pieces together, the image of Money Farm LTD becomes disturbingly clear — and not in a good way.

First, the domain registration date flat-out contradicts their official story. They claim to have been founded in 2024, but their website didn’t even exist until February 2025. That’s not a small mistake — it’s a fundamental inconsistency. Either they operated in the shadows for a year (highly unlikely for an online broker), or they’re just trying to make the company seem older and more established than it actually is. And when a company starts lying about its age, what else might they be hiding?

Then comes the complete lack of a legitimate license. No regulatory body oversees their operations. No accountability, no investor protection, no legal framework. That’s not a minor technicality — that’s a deliberate choice. A choice that benefits only the people behind the scenes, not the clients who are putting their money on the line.

And just when you think it couldn’t get more suspicious, you land on the reviews. A suspiciously clean 4.5 Trustpilot score with 16 glowing comments and not a single piece of criticism. Sounds great… until you actually read them. All the reviews are painfully generic, short, and clearly written in the same tone. Not one person mentions actual trading, real issues, or how the broker resolved a problem. It looks more like a paid review campaign than genuine user feedback.

So ask yourself:

Why would an honest broker need to fake its age, dodge regulation, and inflate its reviews?

Why go through all that effort, unless the real goal is to build a facade — one that lures in unsuspecting clients before disappearing with their funds?

In the end, Money Farm LTD doesn’t look like a trustworthy financial service provider. It looks like a script — one we’ve seen play out too many times before in the scam world.