Money Farm review – too many red flags to ignore

When someone stumbles upon a broker like Money Farm, their first thought might be, “Finally, a solid, time-tested company.” After all, they boast about being in the business since the 90s, they’ve got a slick website, and a decent-looking Trustpilot score. Looks convincing… at first.

But we’ve seen this movie before.

Behind the shiny facade often hides a very different reality — and that’s exactly what we uncovered during our investigation of this brand. Every layer we peeled back revealed something strange, something inconsistent, or just flat-out shady. From the suspicious founding date to the complete lack of a license, and the artificially sweetened reviews… Money Farm gave us every reason to dig deeper.

So we did.

And what we found paints a picture that’s far from trustworthy.

| Parameter | Details |

| Account Types | Not specified |

| Contact Email | [email protected] |

| Phone Number | +44 203 769 8783 |

| Maximum Leverage | 1:500 |

| Jurisdiction / Registration | Not specified |

| License | Not available |

Something’s off with Money Farm – review

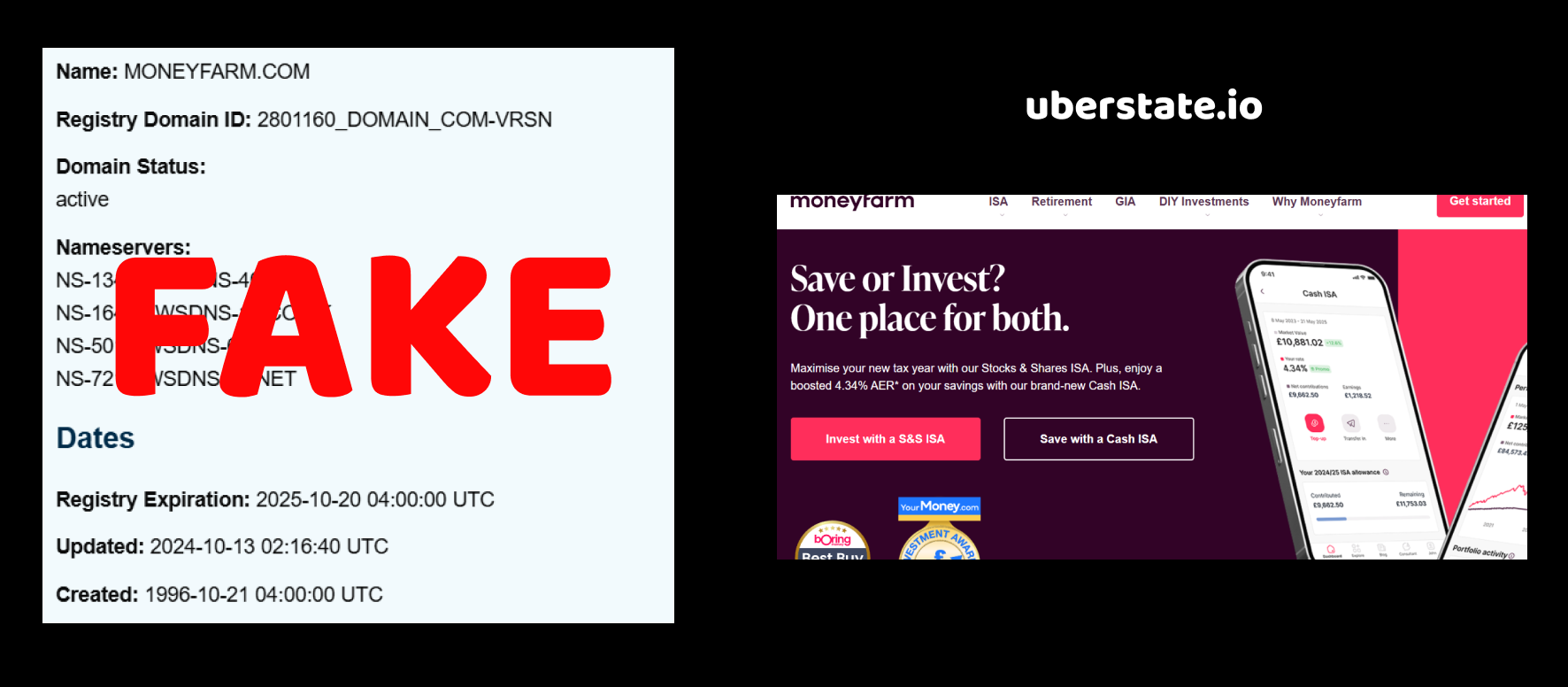

When we took a closer look at Money Farm, the first thing that caught our attention was a simple, yet incredibly telling detail — the timeline. Their supposed year of foundation is listed as 1994, which, at first glance, might give off an impression of reliability. You know, like — “we’ve been in the game for decades, trust us.”

But then comes the twist.

After checking the domain registration data, we discovered that their website was only registered on October 21, 1996. That’s a two-year gap between the claimed foundation date and the moment they even bought the domain.

Now think about it — what kind of financial organization starts operating without even having a website, especially back in the 90s when the internet was already gaining traction in the business world? It’s not like they were running a local bakery.

Could it be that the “1994” figure was just thrown in there to appear more trustworthy? Longer history = more credibility, right? Well, only if it’s real. But here, that credibility crumbles as soon as you scratch the surface.

And here’s the kicker — this kind of manipulation is something we’ve seen over and over again with shady brokers. They invent a backstory to build trust. But if you’re really that old and experienced… why is your online presence missing for the first two years?

Operating in the shadows: Money Farm – review

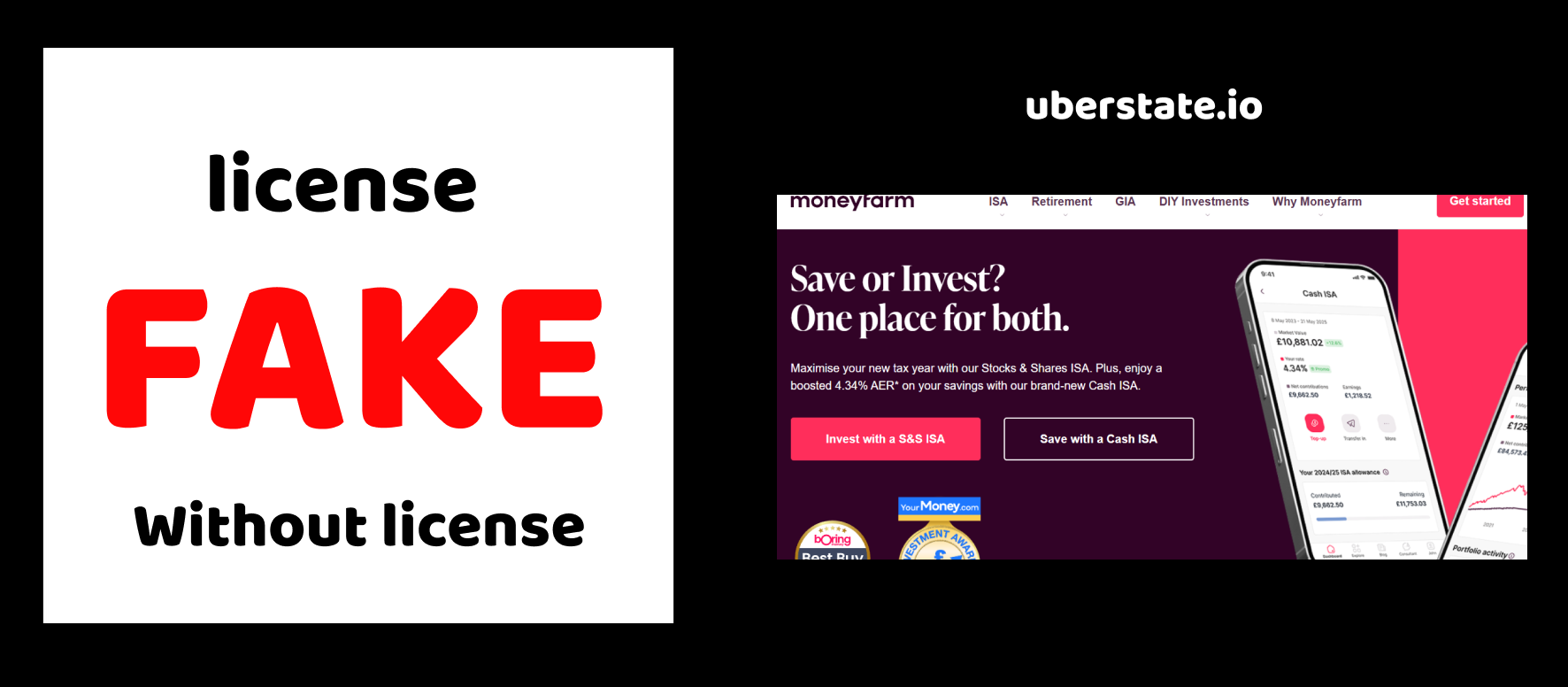

One of the first things we always check when investigating a broker is whether they’re properly licensed. It’s basic stuff. You’re dealing with people’s money — so naturally, there should be some authority overseeing your operations, right?

Well, with Money Farm, we hit a brick wall.

There is no license. At all.

No mention of regulation, no registration with any known financial authorities — just silence. That alone is a massive red flag. Because let’s be honest, what kind of legitimate broker operates without any regulatory oversight?

And here’s the uncomfortable truth — unlicensed brokers are a scammer’s paradise. No rules, no audits, no accountability. They can promise you the moon, take your deposit, and disappear overnight. Who’s going to stop them? Exactly. No one.

If they really were a serious financial institution, why wouldn’t they go through the legal process to get licensed? Why would they deliberately avoid regulation?

The answer’s simple: regulation gets in the way when your actual business model depends on scamming people.

And here’s another question — why would a “broker” who claims to exist since 1994 still not have a license after all these years? Doesn’t that sound bizarre?

Spoiler: it’s not a broker. It’s just a front.

Fake praise and angry customers? Let’s look closer at Money Farm – review

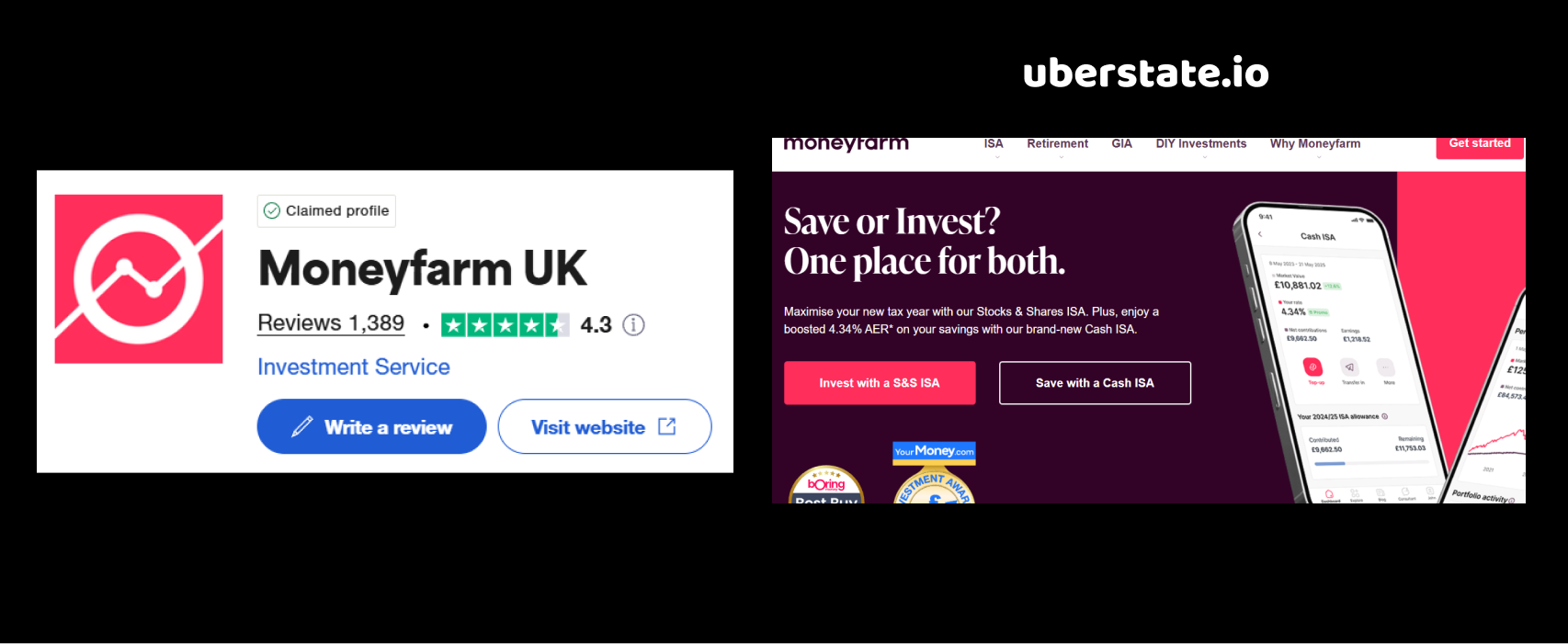

At first glance, Money Farm might seem to be doing alright on Trustpilot. I mean, a 4.3 score doesn’t sound too bad, right?

But numbers can lie — especially when they’re polished to look pretty.

We didn’t stop at just the rating. We dug deeper.

Here’s what we found: out of 1387 total reviews, 168 are bad. That’s over 12% of users who flat-out say this broker scammed them, froze their funds, or just ghosted after deposit. That’s not a minor hiccup. That’s a pattern.

But wait — what about the positive reviews? Shouldn’t they balance things out?

Here’s the twist. The positive reviews read like they were copy-pasted. Same tone. Same structure. Short, vague praise like “great experience,” “fast withdrawal,” or “best broker ever.” No details, no actual story behind them. You can spot this type of writing from a mile away — because it doesn’t come from real people. It comes from fake accounts.

Even worse, some reviews are posted in bulk — multiple 5-star ratings dropped within minutes of each other. That’s classic review manipulation. If your service is really that good, why the need to fake feedback?

And here’s the question no one’s asking — if the broker is “legit,” why are they investing time and effort into boosting their score with obviously fake reviews… while still racking up nearly 170 negative ones?

Let’s be honest: real clients complain. Bots praise.

Final thoughts – what’s really going on with Money Farm?

After finishing the deep dive into Money Farm, we were left with one clear impression — this is not a broker you want to trust with your money.

Let’s piece it all together.

They claim to have been around since 1994, but their domain wasn’t even registered until 1996. Why would any serious financial company wait years to establish an online presence — especially in an industry that depends on credibility and transparency? That already feels off.

Then we get to the license — or better yet, the complete absence of one. There’s no regulator behind Money Farm. No official oversight. Nothing that legally obligates them to play fair or protect your funds. And let’s be real: why would any honest broker refuse to be regulated?

And those glowing Trustpilot reviews? They don’t hold up. A quick scan shows clear signs of manipulation — short, generic praise, repetitive language, and suspicious posting patterns. All while over 160 real users are out there leaving damning reviews about frozen withdrawals, ignored support, and vanishing accounts.

So ask yourself — would a legitimate, trustworthy broker:

- Fake their founding date?

- Operate without a license?

- Pad their reviews while real clients cry for help?

We’ve seen these patterns time and time again, and they almost always lead to one outcome: people getting scammed, accounts getting locked, and savings disappearing.

Money Farm isn’t offering financial services. They’re offering a well-disguised trap.

And once you fall in — there’s no getting your money back.