Preferred Capital Limited Review: Introduction

Today, we’re diving deep into the shady waters of Preferred Capital Limited, a brokerage that seems to be playing hide-and-seek with its own credibility.

Right off the bat, something about this broker just feels off—too neat, too quiet, and frankly, too secretive. But as we began digging deeper, the suspicion quickly turned into genuine skepticism. From odd domain dates to mysteriously absent licenses, this broker ticks every “red flag” box you could imagine.

Have you ever wondered why some brokers prefer staying invisible rather than proudly showcasing their credentials? Or why they seem hesitant to draw attention from the trading community? Well, the answer might lie somewhere between convenience and cunning strategy—because why would scammers risk extra scrutiny and unwanted exposure?

In this Preferred Capital Limited review, let’s carefully dissect the broker’s credibility piece by piece. Buckle up, as we’re about to unveil what this broker has been trying hard to keep hidden.

| Attribute | Details |

| Brand Name | Preferred Capital Limited |

| Website | preferredlimited.com |

| Trading Platforms | MetaTrader 5, MetaTrader Web Trader, MetaTrader iOS, MetaTrader Android |

| Account Types | No information |

| License | Without license |

| Leverage | Without license |

| Language | English |

| Trustpilot Reviews | No reviews |

| Other Reviews | No reviews |

| Date of Creation | 2025 |

| Domain Registration Date | 2025-03-24 |

| Contact Information | Tel: +91 1135982063, Email: [email protected] |

| Additional Information | No information |

This table summarizes the key details. It’s clear that Preferred Capital Limited doesn’t provide much transparency, especially when it comes to account types and regulation. Plus, the lack of reviews and licensing only adds to the suspicion surrounding its legitimacy. Let me know if you need further analysis on any other aspect!

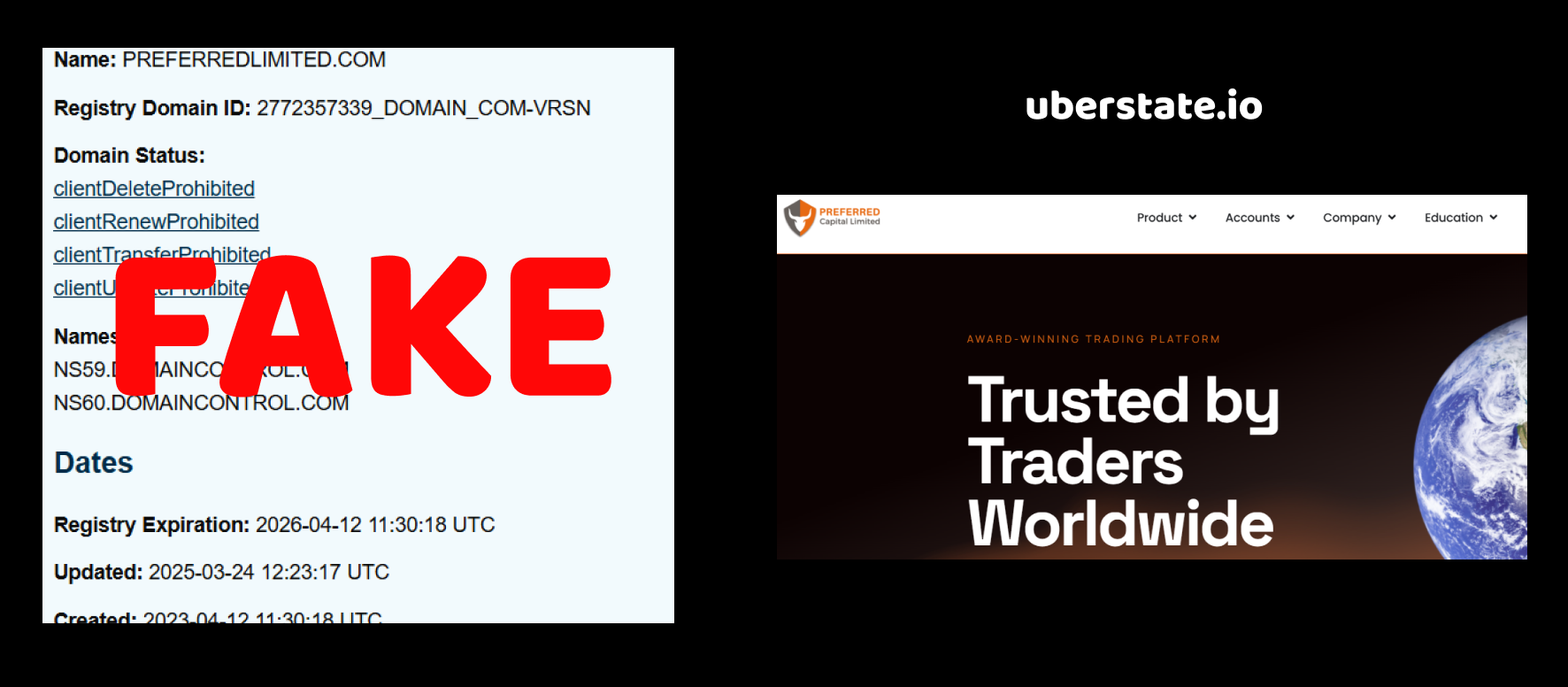

Preferred Capital Limited Review: Domain Date Analysis (Argument 1)

Let’s start unraveling the Preferred Capital Limited puzzle with the basics—domain registration dates. You gave me some crucial details: the brand was supposedly created in 2025, and their website domain was registered on March 24, 2025.

Right off the bat, something feels off, doesn’t it? Let’s think about this logically. Serious financial institutions, genuine brokers, or investment firms often plan months, sometimes even years ahead. Websites, especially those belonging to trustworthy brands, typically have domain registrations that precede their official launch by quite some margin.

But with Preferred Capital Limited, the domain registration date matches almost exactly the brand creation date. Does this seem normal? Honestly, no—it looks suspicious. It’s as if the creators were rushing to get online quickly, perhaps to set up shop and vanish equally quickly. Why wouldn’t a legitimate broker plan their digital presence more strategically and earlier?

In short, this “coincidence” screams lack of credibility. It feels more like a hasty setup rather than a carefully planned launch by a reputable broker. This kind of pattern frequently emerges with scams—quickly get in, get as much money as possible, and vanish without leaving many tracks.

Preferred Capital Limited Review: License Analysis (Argument 2)

Alright, so we’ve tackled the suspicious date scenario, but what about their legitimacy from a regulatory standpoint? Let’s delve deeper—Preferred Capital Limited operates without any license. Yep, you heard it right: no license at all.

But why does that matter so much?

A valid regulatory license isn’t just some bureaucratic stamp—it’s the strongest assurance investors have that a broker is accountable. A licensed broker has to follow strict rules: transparency in finances, compliance audits, regular reports to oversight bodies. If they violate these conditions, penalties are severe and public.

But here, we have none of this. Preferred Capital Limited has skipped this crucial step altogether. Isn’t it strange that a broker claiming to handle potentially millions in client funds doesn’t bother getting even the simplest form of regulatory approval?

Why take such a risk? Well, ask yourself—why would scammers even want regulatory scrutiny? That would only blow their cover faster, wouldn’t it?

And here’s another angle—without a license, Preferred Capital Limited isn’t accountable to anyone. There’s literally no institution to run to if your money vanishes overnight. No legal recourse, no regulatory complaint procedure—nothing.

This choice to operate unlicensed speaks volumes. Legitimate brokers proudly display their regulatory affiliations because it builds trust. Yet here, the silence about licensing is deafening. Clearly, Preferred Capital Limited doesn’t seem interested in building trust at all.

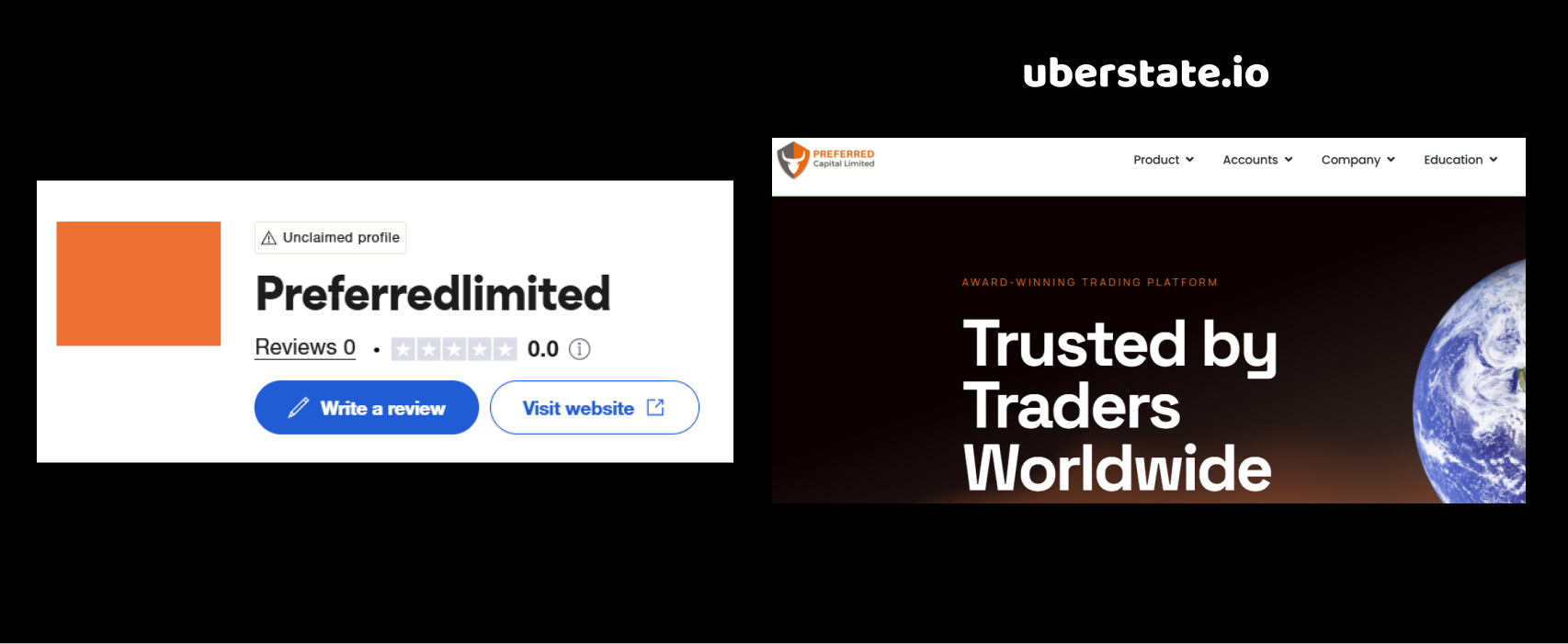

Preferred Capital Limited Review: Trustpilot Reviews Analysis (Argument 3)

Next, let’s focus on another critical piece of the puzzle—reviews. Here’s an intriguing point: Preferred Capital Limited has no reviews on Trustpilot at all.

Let’s pause right there. We’re dealing with a broker who claims to operate legitimately in a highly competitive industry, yet nobody seems to be talking about them. Isn’t this peculiar?

Think about it for a moment—typically, even the smallest or newest brokers quickly attract some attention, positive or negative. Traders always leave a footprint online. Whether praising exceptional customer service or venting frustration over delayed withdrawals, users always express themselves somewhere.

But with Preferred Capital Limited? Absolute silence.

This lack of feedback isn’t just unusual—it’s suspicious. A broker genuinely operating and serving clients would inevitably generate reviews. If there’s business happening, clients share their experiences—good, bad, or mixed. Complete silence raises one glaring question: Are there any actual clients at all?

Perhaps there’s a more cynical reason behind the total absence of reviews. Could it be that Preferred Capital Limited doesn’t actually want real traders? Why attract clients who can quickly expose questionable practices? Keeping a low profile might seem safer if your aim isn’t exactly honest trading.

Yet again, Preferred Capital Limited makes choices that legitimate brokers simply don’t. A total lack of online footprint can’t be a mere oversight—it feels intentional, calculated even.

Preferred Capital Limited Review: Final Verdict

After carefully sifting through each suspicious detail surrounding Preferred Capital Limited, the big picture starts to come into sharp focus—and it’s far from reassuring.

Think about it for a second: A broker launching a website exactly when the brand is supposedly established, skipping licensing altogether, and managing to fly under the radar without even a whisper from clients? These aren’t isolated oddities—they’re clear signals that scream caution.

Let’s recap the highlights (or rather, red flags):

- Domain registration—timed suspiciously close to brand creation. Legitimate brokers plan meticulously; scammers improvise.

- Zero regulatory licenses—conveniently escaping oversight and accountability. Why would a genuine broker ever willingly choose this route?

- No reviews anywhere—total silence online. Ask yourself again: why wouldn’t legitimate customers speak up if everything was above board?

At this point, Preferred Capital Limited has painted a vivid picture: it looks, acts, and feels exactly like a scam, one designed to quietly lure victims while avoiding attention.