Profit Wave Review – Another Scam Broker Exposed?

The world of online trading is full of promises—big profits, easy withdrawals, and “trusted” platforms. But as we’ve seen time and time again, not every broker is what they claim to be. Profit Wave is one of those names that’s been making the rounds, but is it really a reliable trading platform? Or is it just another scam designed to drain your money?

At first glance, Profit Wave presents itself as a legitimate brokerage. They claim to have been in the industry since 2010, offering traders a solid platform to invest and profit. But when we started digging deeper, things didn’t add up—and that’s putting it mildly.

From a suspiciously recent domain registration to an unregulated status and terrible reviews, the red flags are everywhere. If you’re considering investing with Profit Wave, you need to see what we uncovered. Because once you do, you might think twice before trusting them with a single dollar.

Profit Wave – General Broker Information

Here’s a quick breakdown of Profit Wave’s key details:

| Feature | Details |

| Website | profitwave.pro |

| Established Year | ❌ Claims 2010, but domain registered in 2024 |

| Regulation | ❌ Unregulated (No financial authority oversight) |

| License Type | ❌ No valid license |

| Restricted Countries | USA (but operates without a US license) |

| Leverage | ❌ No information provided |

| Trading Platforms | ❌ No information provided |

| Account Types | ❌ No information provided |

| Trustpilot Score | ⭐ 2.8 (Mostly negative reviews) |

| Total Reviews | 3 (2 negative) |

| Contact Info | Mail: [email protected] |

This is one of the most suspicious brokers we’ve reviewed. They don’t provide basic details like trading platforms, leverage, or account types, which every legitimate broker is transparent about. The fact that they are completely unregulated while accepting traders from highly regulated regions like the USA is another massive red flag.

If a broker hides this much information, it’s not by accident—it’s by design. Profit Wave is not safe, and trusting them could mean losing your entire investment.

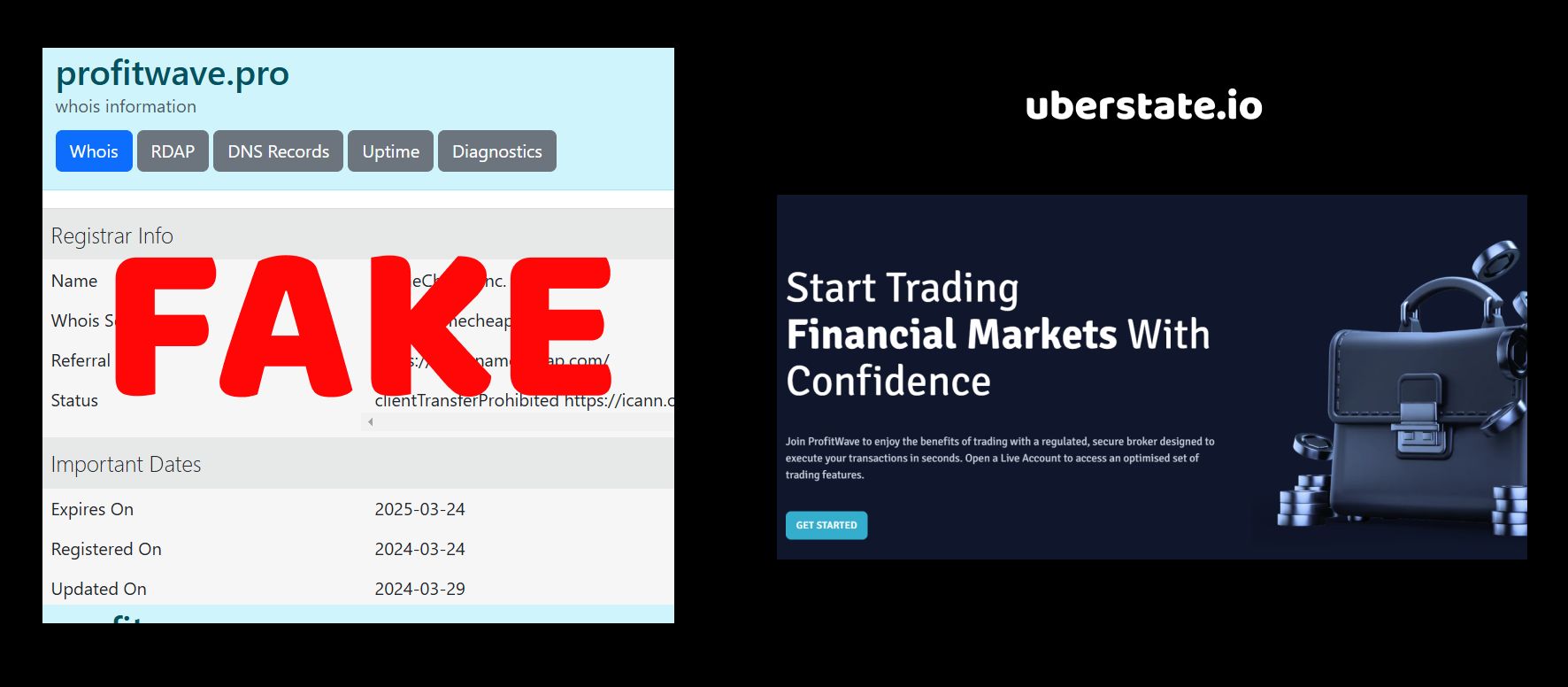

Profit Wave Scam – Suspicious Domain Creation Date

One of the first things we checked about Profit Wave was its domain creation date. And guess what? The results were quite revealing.

The brand claims to have been established in 2010, which might sound like a long history of experience in the trading world. But here’s the kicker: their domain was only registered on March 24, 2024.

So, if they’ve been around for 14 years, why did they only buy their domain this year? This is a classic red flag seen in scam brokers. A real, long-standing brokerage would have owned its domain for years, building a solid online reputation. But in the case of Profit Wave, it looks like they just popped up out of nowhere—most likely as a newly launched scam operation trying to fake credibility.

The discrepancy between the claimed establishment date and actual domain purchase is one of the easiest ways to spot fraud. Many scammers create fake backstories to seem legitimate, but simple research exposes the lie.

If a broker truly had a decade of experience, wouldn’t they have an online presence to match? The fact that their domain is brand-new tells us one thing: Profit Wave is not what it pretends to be.

Profit Wave Scam – No Legitimate License in Sight

If you’re looking for a regulated broker, Profit Wave is NOT it. They operate without any license, which means they aren’t overseen by any financial authority. And we all know what that means—no rules, no accountability, and no protection for your money.

Let’s break it down. A real, trustworthy broker needs to be registered with a recognized regulator like:

- FCA (UK) – protects clients and ensures fair trading.

- CySEC (Cyprus) – regulates many EU brokers under strict guidelines.

- ASIC (Australia) – has high standards and client protection policies.

But Profit Wave? They don’t even try to fake a license. They simply operate in the shadows, avoiding regulations so they can manipulate trades, withhold withdrawals, or disappear entirely—without consequences.

And it gets worse. They claim to accept traders from the USA, a country with one of the strictest regulatory environments (CFTC, NFA). Yet, they aren’t licensed by any US authority. That means US traders (or anyone, really) have zero protection if Profit Wave decides to freeze funds, manipulate trades, or shut down overnight.

So, the big question: why wouldn’t a legitimate broker get a license? Because they don’t want to follow the rules. And brokers that don’t want rules only have one goal—to scam their clients.

Profit Wave Scam – Suspicious and Fake Reviews

If you’re the type to check reviews before trusting a broker (which you should be), Profit Wave’s Trustpilot rating is a disaster. They have a terrible 2.8-star rating, with only three reviews in total—and two of them are negative. This is a major red flag.

Why is this a problem?

- Too Few Reviews for a “2010” Broker

Profit Wave claims to have been around since 2010, yet they only have three reviews? That doesn’t add up. A legitimate broker with over a decade of experience should have hundreds or even thousands of reviews, not a handful. This suggests that either they’re brand new (which we already proved) or they delete bad reviews to hide their reputation. - Negative Feedback Dominates

Out of those three reviews, two are bad—meaning most people who actually took the time to write about Profit Wave had a terrible experience. And since unhappy clients usually leave reviews faster than satisfied ones, imagine how many others got scammed but didn’t bother to write a review. - Fake or Manufactured Positive Reviews?

While there’s one positive review, it looks generic, with little detail about actual trading experience. Many scam brokers buy fake reviews to balance out their bad reputation. Real traders share specifics about withdrawals, customer support, and platform issues. But when all you see is vague praise like “great broker!” without details, it’s a sign of review manipulation. - Low Trustpilot Score = High Risk

A 2.8-star rating is dangerously low in the brokerage world. Most reputable brokers maintain 4+ stars, and when a broker is below 3 stars, it usually means delayed withdrawals, manipulation, or straight-up fraud.

So, what do we have here? A broker that claims a long history but barely has any reviews, is overwhelmingly negative, and might be using fake reviews to cover their tracks. That’s a classic scam pattern, and it should be enough to make you run in the opposite direction.

Profit Wave – A Scam You Should Avoid

After analyzing Profit Wave from every angle, the verdict is clear—this is not a broker you can trust. The warning signs are too strong to ignore:

- They claim to be established in 2010, but their domain was only registered in 2024—a blatant lie that exposes their fake backstory.

- They operate without any license, meaning they have no regulatory oversight, no accountability, and no obligation to return your money.

- Their Trustpilot rating is a miserable 2.8 stars, with almost no reviews and a suspicious pattern of negative feedback.

A legitimate broker wouldn’t need to fake its history, dodge regulations, or silence unhappy clients. But Profit Wave does all of that—and more. These are the classic signs of a scam broker, one that exists only to steal from traders before disappearing and rebranding under a new name.

If you value your money and your peace of mind, stay far away from Profit Wave. There are plenty of legitimate, regulated brokers out there. This one isn’t worth the risk.