Quant Tekel review — a slick scam hiding in plain sight

Quant Tekel brand review — another “broker” that raises more questions than answers

Every week, a new name pops up in the world of online trading — promising innovation, security, and life-changing profits. This time it’s Quant Tekel. At first glance, it looks like just another modern platform in a crowded market. Sleek website, big words, and all the usual promises. But once we peeled back the surface, things quickly stopped making sense.

From suspicious launch dates to a complete lack of regulation, and a review section that seems artificially inflated — this broker is ticking all the classic scam boxes. And that made us wonder: is Quant Tekel really offering financial services, or just playing a role to lure in fresh victims?

Let’s take a closer look.

Quant Tekel – General Information Overview

Before you even think about trusting a broker, it’s worth taking a look at their basic offering — account types, leverage, contact details. Sometimes, the lack of depth in these sections already tells you the whole story. And in the case of Quant Tekel, the details are either shallow or downright suspicious.

Here’s what we found:

| Feature | Details |

| Company Name | Quant Tekel |

| Website | quanttekel.com |

| Claimed Launch Year | 2022 |

| Domain Registration | 2 September 2024 |

| License | None |

| Contact Info | Only email — no physical address or phone number |

| Account Types | Vague; no clear breakdown or comparison chart |

| Leverage | Not disclosed |

| Languages | English |

| Support | Online form / email only |

And here’s what’s missing that any legitimate broker should offer:

– No platform specifications (MetaTrader? WebTrader? Custom? Who knows?)

– No spread/commission breakdown

– No regulation or client protection policy

– No KYC or AML information

– No real proof of team, offices, or legal existence

So again, the question arises: why would a legitimate broker hide so much crucial information? Or maybe the better question is — what are they trying to avoid by not disclosing it?

Quant Tekel review — suspicious from the very first step

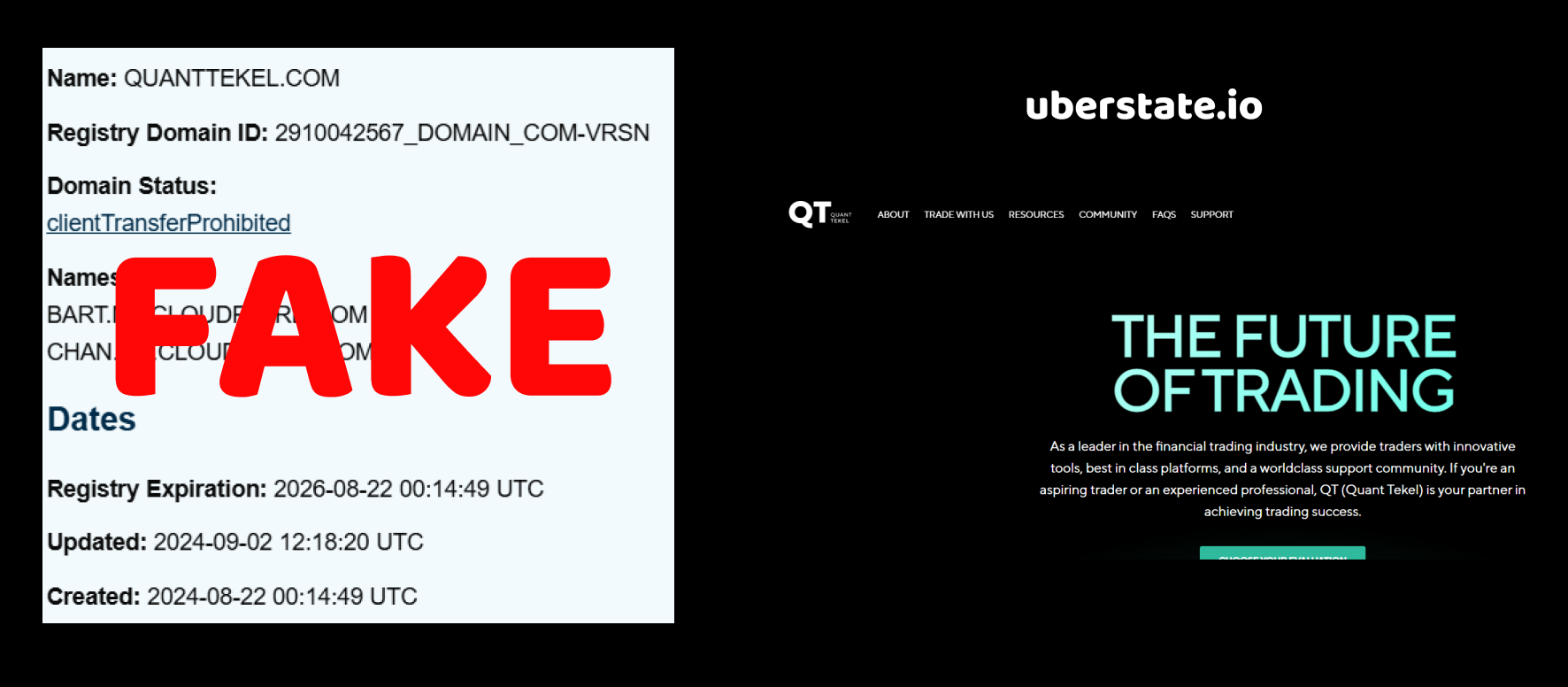

When we started digging into Quant Tekel, the first red flag popped up instantly — the domain registration date. It may seem like a small detail, but in reality, it often exposes a scam even before you open an account.

So here’s the catch. According to the broker, Quant Tekel was supposedly founded in 2022. Sounds good, right? They’re clearly trying to position themselves as experienced and trustworthy. But here’s where things fall apart — the domain quanttekel.com was registered only on September 2, 2024.

Wait a second… how does a broker operate for two years without a website? Through telepathy?

Sure, they might try to say they had a different domain before. But if that were true, why is there zero trace of it online? No redirects, no archived pages, no mentions anywhere. Nothing.

And let’s be real — what serious brokerage changes its main domain after two years of operation without leaving a digital footprint? Sounds less like a rebrand and more like the birth of a fresh scam.

Why would fraudsters want long-time clients who can expose them easily, when it’s so much safer to start clean with a new website and a fake backstory?

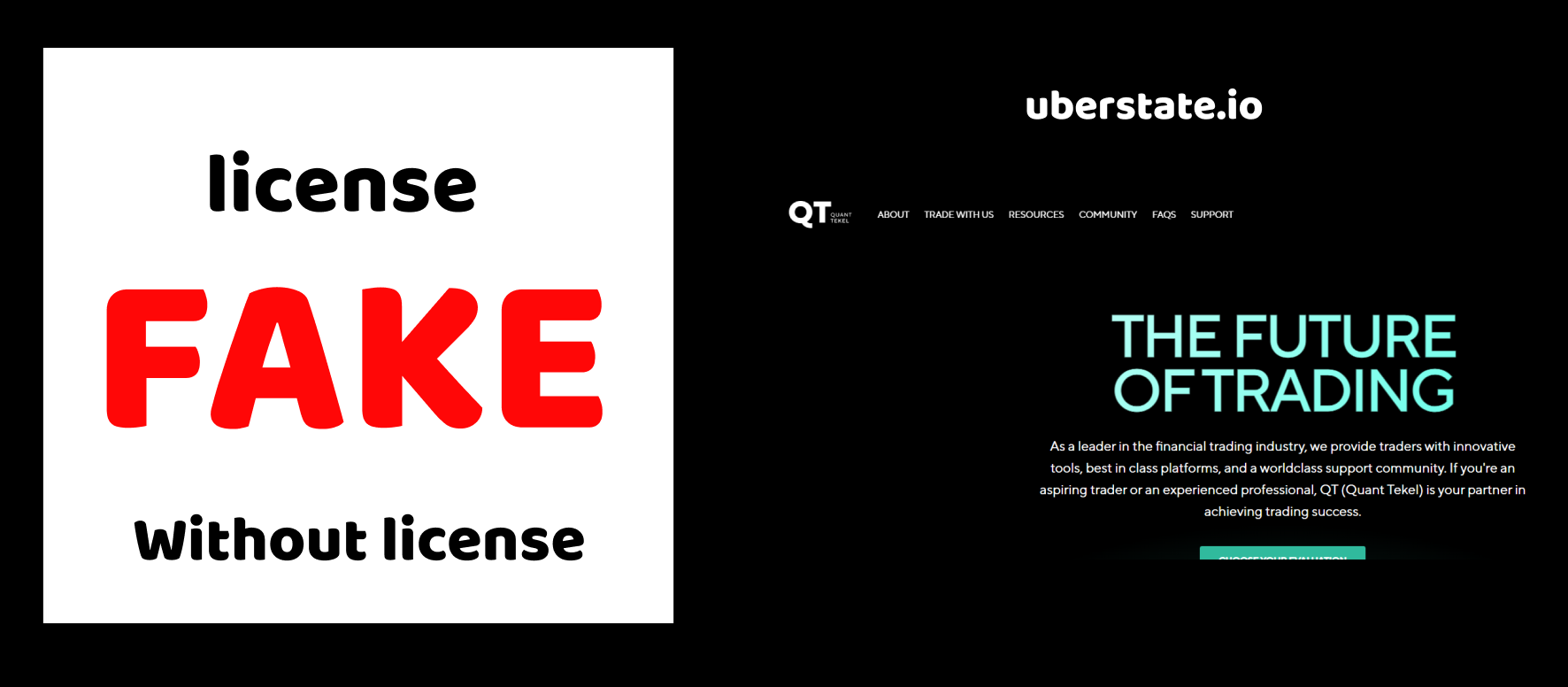

Quant Tekel review — operates without any valid license

Now here’s where things get even uglier. While many shady brokers at least try to wave around some kind of fake license, Quant Tekel doesn’t even bother doing that. Not a single document. No registration number. No mention of a regulatory body. Nothing.

We combed through every corner of their website, and guess what? There isn’t any indication that Quant Tekel is regulated by any authority — not in Europe, not in offshore zones, not even by some invented “Financial Commission” that scammers love to throw around. Total silence.

Let’s stop for a second and think. What legitimate financial service provider, dealing with people’s money, would operate like this in 2025? The answer’s simple: none. Regulations exist for a reason — to protect clients from exactly this kind of operation.

So why would Quant Tekel avoid regulation completely? Because being licensed means being accountable. It means audits, financial transparency, dispute resolution… and scammers don’t like rules that make it harder for them to vanish with your money.

And here’s the ironic part: they promote themselves as a “secure and advanced” trading platform — yet they don’t even meet the minimum legal requirement to operate.

Quant Tekel review — reviews look polished, but the cracks show

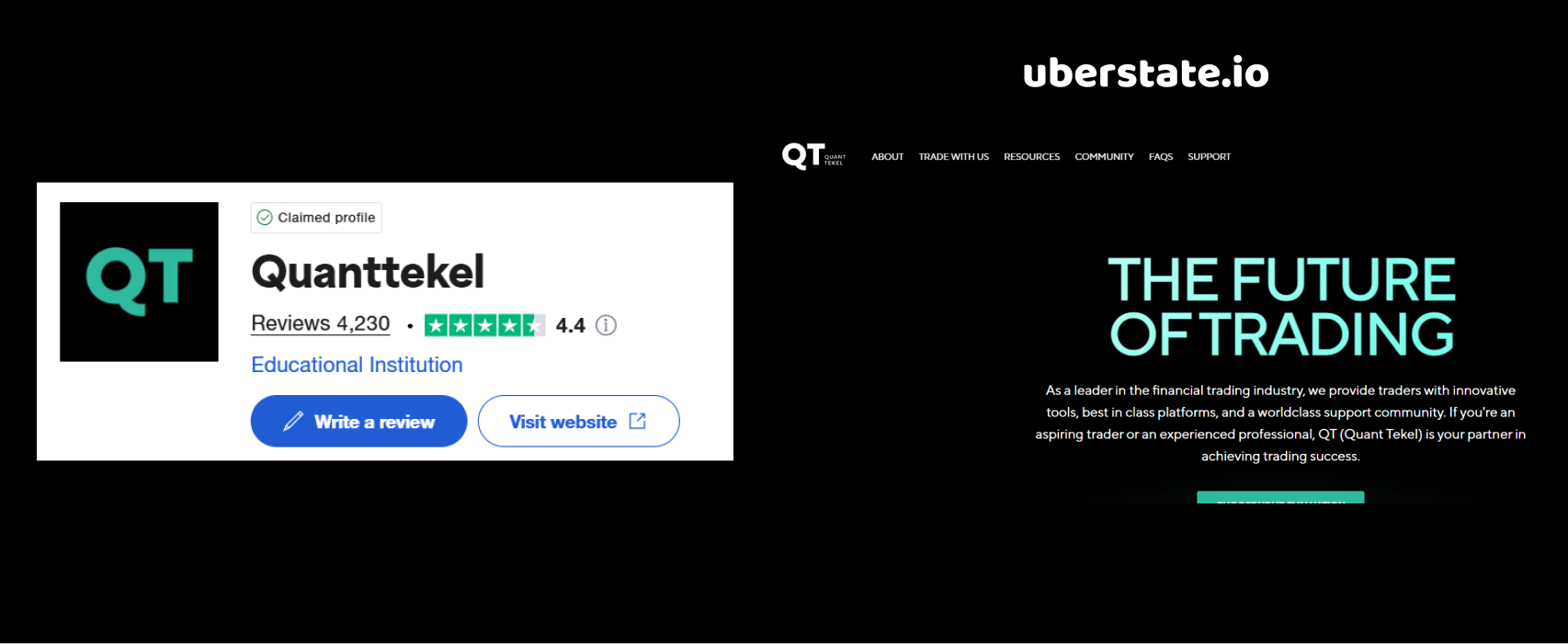

At first glance, Quant Tekel seems to be doing just fine on Trustpilot — a 4.4 rating and over 4,200 reviews. Sounds solid, right? But the deeper we went, the more this whole thing started to smell artificial.

Let’s start with the basics: 499 bad reviews out of 4229 is not a small number. That’s nearly 12% of users openly calling out problems — and you can bet not everyone who’s been scammed bothers to write a review. So if 1 in 8 people took the time to complain publicly… imagine how many more were quietly ripped off?

But here’s where it gets interesting. We went through a chunk of those 5-star reviews — and you know what stood out? They’re eerily similar. Same writing style. Same vague praise like “Great platform, fast withdrawals, excellent support!” No real trading experience, no actual details. Just copy-paste level fluff.

And when reviews look like they were written by a bot farm or outsourced to some Fiverr freelancer, it’s time to ask — who benefits from a flood of fake positivity? Real traders? Or the scammers trying to drown out the angry voices?

Meanwhile, the negative reviews are a different story. They’re long, emotional, and painfully detailed. People talk about lost funds, blocked accounts, and customer support that vanishes the moment you ask about a withdrawal.

So yeah, the 4.4 average? Not impressive when it’s built on a house of fake stars.

Final verdict on Quant Tekel — a textbook scam in modern packaging

After analyzing every layer of Quant Tekel, the picture became painfully clear. This isn’t a brokerage firm. It’s a façade.

They claim to be operating since 2022, but the domain only appeared online in late 2024. They offer financial services, yet operate without any license whatsoever. Their Trustpilot rating might fool the untrained eye, but behind the glossy 5-star spam lies a mountain of real complaints from people who lost money, got ignored, or straight-up scammed.

There’s no transparency. No accountability. No legal standing. Just marketing noise and copy-paste fake reviews designed to build trust fast — so they can disappear just as quickly once they’ve drained your wallet.

Let’s be honest — if a broker has to fake their history, dodge regulation, and flood the internet with fake praise… can you really expect them to play fair with your funds?