Full review of forex broker Squared Financial . All about Squared Financial

Squared Financial Review: A Comprehensive Analysis

Customer Support and User Experience

SquaredFinancial, established to provide robust trading opportunities, allows clients to trade in the world’s most popular markets through two distinct account types. With a 3.9/5-star rating on Trustpilot and numerous awards, SquaredFinancial has earned a reputation for reliability and trustworthiness. This Squared Financial Review will delve into the broker’s offerings, benefits, and potential drawbacks to help you determine if it’s the right choice for your trading needs.

SquaredFinancial has received positive ratings from users on various platforms, reflecting its commitment to customer satisfaction. The broker provides comprehensive customer support via email and phone, with email responses typically within 24 hours. This Squared Financial Review highlights the broker’s dedication to providing excellent customer service.

Rating Platform:

| Rating Platform | Rating |

| Trustpilot | 3.9/5 |

| SiteJabber | 4.84/5 |

| TradersUnion | 3.94/10 |

| WikiFX | 8.2/10 |

| FXScouts | 4/5 |

Compliance and Regulation

SquaredFinancial is regulated by the Financial Services Authority (FSA) in Seychelles, ensuring that it adheres to strict financial standards and practices. The broker’s commitment to security is evident in its use of advanced encryption technologies and robust fraud prevention measures. This regulatory oversight is a critical element of trust and security in this Squared Financial Review.

Pros and Cons

Pros:

- Wide range of instruments

- Spreads starting at 0.0

- Access to MT4, MT5, and a mobile application

- Extensive selection of payment methods

Cons:

- No micro accounts

This comprehensive Squared Financial Review reflects the broker’s dedication to combining regulatory compliance, advanced security, and client-focused trading conditions to provide a trustworthy and efficient trading platform.

Trading Platforms

SquaredFinancial provides a range of platforms, including MetaTrader 4 and MetaTrader 5, as well as a mobile app compatible with iOS and Android devices. These platforms offer one-click trading, chart trading, email and mobile alerts, and a comprehensive charting package. The availability of streaming news feeds ensures traders stay updated on market developments. This Squared Financial Review emphasizes the importance of these advanced platforms in enhancing the trading experience.

Trading Platform:

| Platform | Available |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| iOS & Android App | Yes |

Account Types

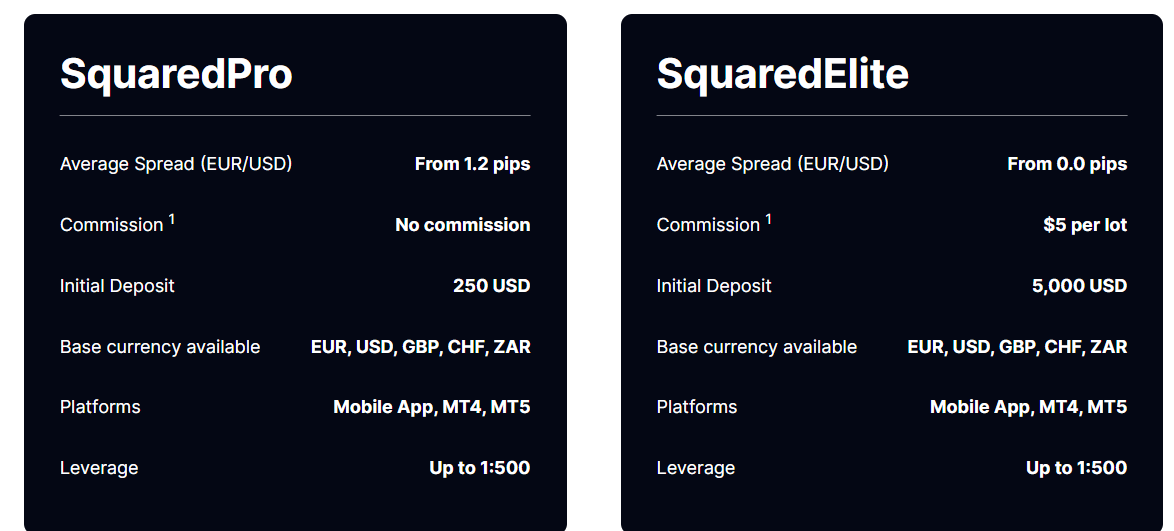

SquaredFinancial offers two main account types: SquaredPro and SquaredElite. This Squared Financial Review explores the details and benefits of each account type.

SquaredPro:

- Minimum Deposit: $0

- Spreads: From 1.2 pips

- Commission: $0

- Leverage: Up to 1:500

- Account Currencies: EUR, USD, GBP, CHF

SquaredElite:

- Minimum Deposit: $5,000

- Spreads: From 0.0 pips

- Commission: $5 per lot

- Leverage: Up to 1:500

- Account Currencies: EUR, USD, GBP, CHF

Both account types provide access to MT4/MT5 platforms, market execution, a 50% margin call, and a 30% stop-out level. Additionally, traders can open a demo account with $50,000 in virtual funds to practice strategies risk-free. This flexibility in account offerings is a key highlight of this Squared Financial Review.

Fees and Commissions

SquaredFinancial’s fee structure varies between account types. The SquaredPro account offers $0 commissions with spreads from 1.2 pips, while the SquaredElite account has spreads from 0.0 pips and a $5 commission per lot. This flexible pricing structure caters to different trading preferences and strategies. This Squared Financial Review provides an overview of the cost structure for transparency.

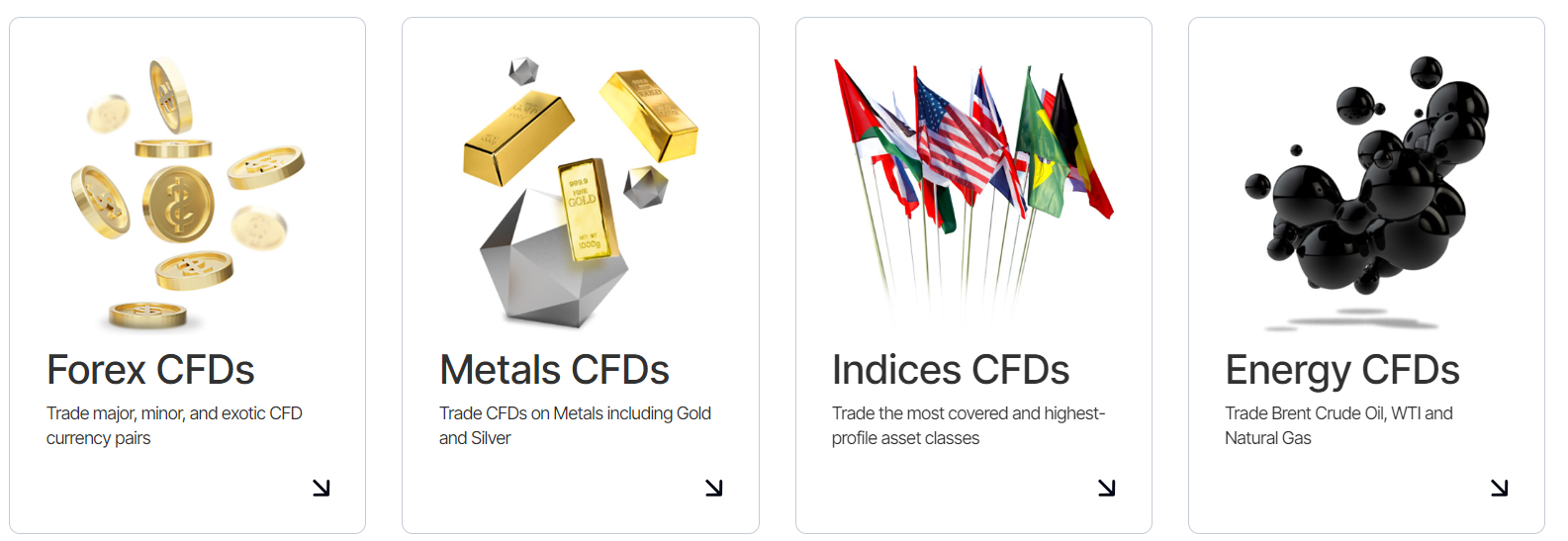

Pricing Overview by Asset Class:

- Crypto CFDs: Minimal fees, wide accessibility, no wallet required.

- Futures CFDs: Tight spreads, bidirectional bidding.

- Forex CFDs: Trade 40+ forex pairs 24/7.

- Energies CFDs: Access commodity markets, tight spreads.

- Metal CFDs: Spot gold and silver trading with low spreads and swaps.

- Indices CFDs: Low margin requirements, trade key global indices.

- Stock CFDs: Trade global stocks with up to 1:5 leverage.

Top Features

Wide Asset Range

SquaredFinancial offers a comprehensive selection of trading instruments, including CFDs on cryptocurrencies, futures, forex, energies, metals, indices, stocks, and ETFs. This variety ensures that traders can diversify their portfolios effectively. This Squared Financial Review underscores the broker’s dedication to providing a broad spectrum of trading options.

Dynamic Leverage

SquaredFinancial provides dynamic leverage options, with a maximum leverage of 1:500 for certain assets. Major currency pairs have leverage up to 1:30, while other CFDs range from 1:10 to 1:50. For some accounts, leverage can go as high as 1:2000. This flexibility in leverage is a crucial point to note in this Squared Financial Review.

Social Trading

Social trading has gained popularity, especially among new traders. SquaredFinancial’s Social Trading Tool allows users to mimic successful traders’ actions. A minimum balance of $50 is required, and traders maintain control over their positions while copy trading. This feature is particularly beneficial for those looking to learn from experienced traders, as highlighted in this Squared Financial Review.

High-Tech Platforms

The broker offers MetaTrader 4, MetaTrader 5, and a mobile app, providing advanced indicators, charting tools, and other useful features. These platforms cater to both novice and experienced traders. The availability of such robust platforms is a significant advantage, as noted in this Squared Financial Review.

Educational Resources

SquaredFinancial is dedicated to educating its users. Resources include webinars, seminars, market insights, signals, ebooks, and video tutorials. These materials are designed to empower traders with knowledge and strategies. The educational commitment is a standout feature in this Squared Financial Review.

Payment Methods

SquaredFinancial supports a wide range of payment methods, including bank transfers, Visa, Mastercard, cryptocurrencies, and more. This variety offers convenience and flexibility for clients. The ease of deposits and withdrawals is a notable point in this Squared Financial Review.

Regulation and Security

SquaredFinancial is regulated by the FSA in Seychelles (License No. SD024), which mandates stringent adherence to financial and operational standards. The broker’s compliance with these regulations ensures a secure trading environment for clients. This regulatory compliance is a crucial aspect of this Squared Financial Review.

Reliability and Security

SquaredFinancial has built a strong reputation for reliability and security. The broker continually invests in optimizing its products and services while maintaining robust fraud prevention measures. Client protection remains a top priority, with efforts to identify and eliminate suspicious activities. This commitment to security and reliability is a significant point in this Squared Financial Review.

Final Thoughts

Overall, SquaredFinancial stands out as an excellent broker with a broad range of assets, flexible account types, and competitive pricing. Its dedication to providing educational resources, coupled with advanced trading platforms and robust regulatory compliance, makes it a strong choice for both new and experienced traders. This Squared Financial Review highlights the broker’s strengths and potential drawbacks, offering a balanced perspective to help you make an informed decision.

In conclusion, this Squared Financial Review aims to provide a comprehensive understanding of what SquaredFinancial has to offer. Whether you are a novice trader or an experienced investor, SquaredFinancial’s diverse offerings and commitment to customer satisfaction make it a compelling option in the competitive world of online brokerage.