Sure Leverage Funding review

At first glance, Sure Leverage Funding tries to look like just another modern-day broker riding the wave of online finance. Slick name, vague promises, and a website that feels like it was put together overnight — which, honestly, might not be far from the truth.

But here’s the thing: in the world of trading platforms, appearances mean nothing. What really matters is what’s behind the curtain. And that’s exactly what we decided to uncover.

Because let’s be honest — the number of scam brokers out there today is growing like weeds. Some copy each other’s designs, some slap on fake licenses, others flood review sites with fake praise. So how can you tell who’s real and who’s just waiting to empty your wallet?

Well, that’s where our investigation begins.

We ran a full background check on Sure Leverage Funding: their launch dates, their licensing (or lack of it), real user feedback, and even the fine print most people skip over. And the more we looked, the more everything started falling apart.

If you’re considering investing with them, you’ll want to read this first. Because what we found doesn’t just raise eyebrows — it raises alarms.

Broker Overview – Sure Leverage Funding

| Parameter | Details |

| Account types | Not specified |

| Contact | Email: [email protected] |

| Leverage | Up to 1:100 |

| Website | sureleveragefunding.com |

| Regulation | None — unregulated |

Let’s unpack that.

First off — no account information. No mention of minimum deposits, spreads, commissions, or even different account tiers. That’s either pure laziness or a deliberate tactic to keep users in the dark until they deposit. Neither is a good sign.

Their only contact method is a generic email. No physical address, no phone number, no live chat. So if you run into issues — and let’s face it, with these kinds of platforms, you probably will — good luck trying to get help. Scammers love operating in silence.

The 1:100 leverage is also a classic move. It looks appealing to beginners who don’t understand the risk. But in the wrong hands — like an unregulated broker — it’s just a tool to wipe your account faster.

And the website? Barebones. It’s not there to inform. It’s just there to exist. Like putting up a fake shop window to trick passersby.

But the cherry on top — they’re completely unregulated. No license. No legal backing. No accountability.

So what are we really looking at here?

A broker with no transparency, no support, no legal responsibility… and absolutely nothing stopping them from vanishing with your money.

Sure Leverage Funding review

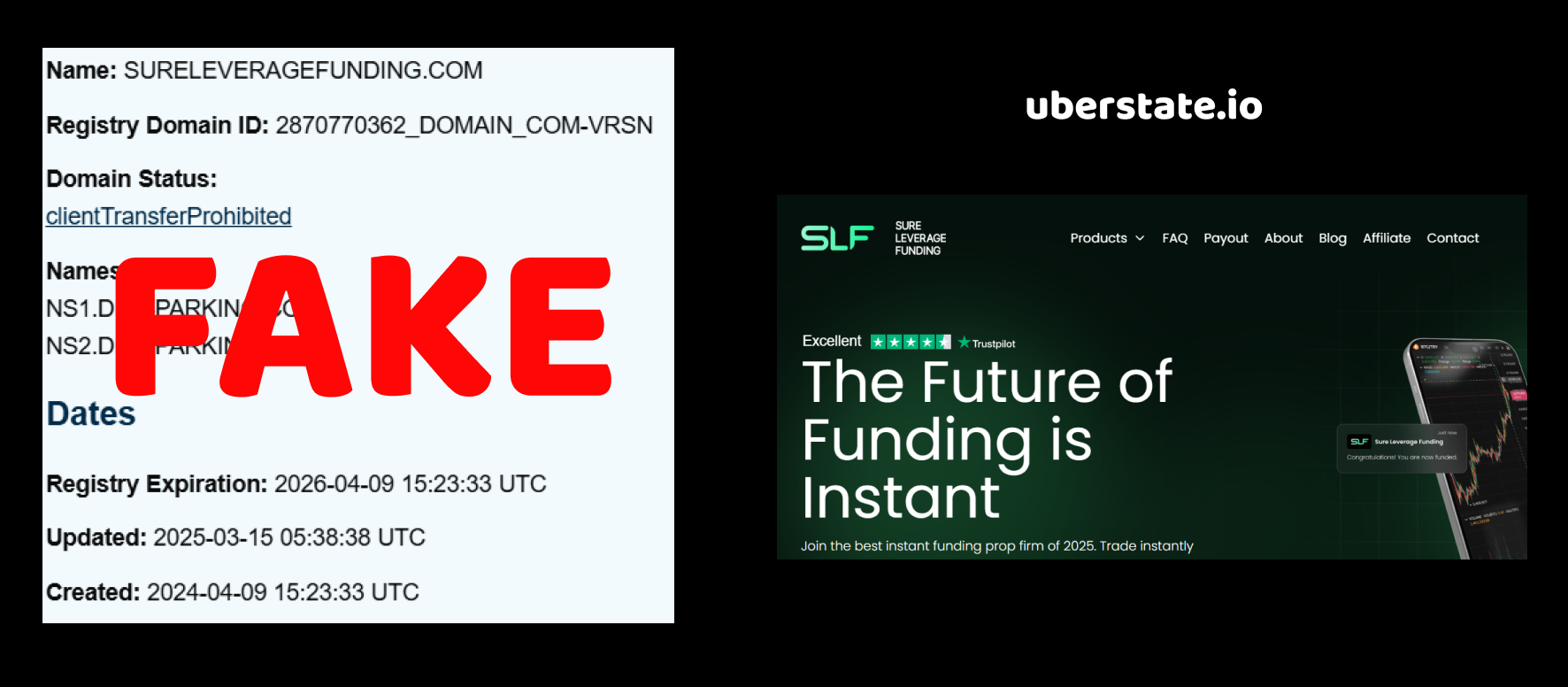

Let’s dive into what the real story is behind this broker that’s trying to present itself as something reliable. Because when we checked one of the most basic facts — the date of the domain registration, things already started to smell funny.

So here’s what we found.

At first glance, Sure Leverage Funding claims to be a solid player in the financial markets, supposedly operating since 2023. Not that this is a long history to begin with — but okay, let’s pretend for a second that they really started back then. Maybe they’re just a young but ambitious company?

But then we looked at the domain data. Their website domain was only registered on March 15, 2025.

Wait a second. How is that even possible?

Think about it. If your brand supposedly started in 2023, you had two whole years to set up a website — your main platform to attract clients, show off your legitimacy, and provide access to trading. And yet… the domain didn’t even exist until early 2025? That’s not just a delay — that’s a massive red flag.

Why would a legitimate broker wait two years to register a basic domain name? That makes zero sense. Unless — and here’s where things get interesting — the brand didn’t actually exist in 2023. They just invented that date to make themselves look more established.

This trick is painfully common among scam brokers. They slap on a fake founding year to give an illusion of credibility. But of course, the domain registration date tells the truth — and in this case, it’s clear:

Sure Leverage Funding couldn’t have been operating in 2023 if their website wasn’t even born until 2025.

Sure Leverage Funding review

Once we were done looking at the suspicious launch dates, we decided to dig deeper. Because even if the site was created late, maybe—just maybe—they at least went through the proper legal channels? But that hope disappeared fast.

Turns out, Sure Leverage Funding has no license whatsoever. Not just a shady offshore one. Literally no regulatory license at all.

And let’s be real — what kind of broker operates without any form of regulation?

In the world of financial services, regulation is not just a formality. It’s a must. Especially when a company wants access to people’s deposits, trades, and sensitive financial data. A licensed broker is required to comply with rules: transparency, segregation of funds, financial reporting, and basic accountability.

So if Sure Leverage Funding truly had good intentions, why wouldn’t they get licensed?

Well, the answer is unpleasant but obvious: because a license would make it harder to scam people.

Operating without any regulation means they can do what they want. Freeze withdrawals, manipulate trades, disappear overnight — and there’s no authority to complain to. That’s exactly why scam projects avoid proper licenses like the plague.

And what’s worse? They’re not even pretending to be regulated. No fake license, no “we’re awaiting approval” — just silence. Which tells us one thing:

They’re not even trying to fool the sharp-eyed users. So why bother getting a real license?

Simple: they’re targeting inexperienced traders who won’t notice the missing legal backbone. And let’s be honest — why would a scammer want clients who ask too many questions?

Sure Leverage Funding review

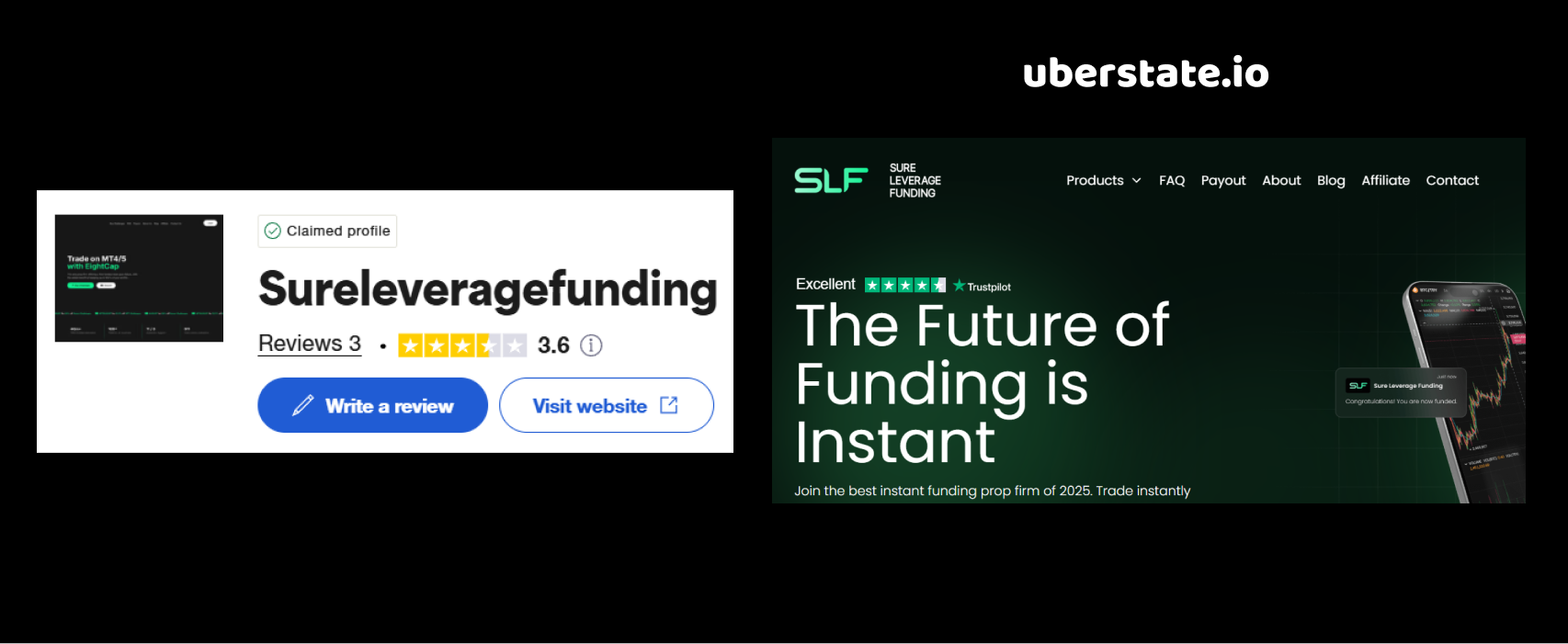

We didn’t stop at the surface. Once we realized the broker had no license and lied about their launch date, it became even more important to hear what actual users are saying. So we went to one of the most telling platforms — Trustpilot.

And the picture there? It’s not pretty.

Let’s start with the score: just 3.6 out of 5.

Now, 3.6 might sound okay-ish at first glance… until you remember that legit brokers with a solid reputation almost never drop below 4.2. Anything under 4 starts to look shaky. Especially when you see only 3 reviews total, which means the score isn’t based on wide feedback — it’s hanging by a thread.

But here’s where it gets more revealing.

Out of those 3 reviews, one is already negative. That’s one-third of all the feedback being bad. And when feedback is that limited, each bad review weighs even heavier. It’s like throwing a rock into a shallow pond — the splash is unavoidable.

So what about the positive reviews? We took a closer look… and let’s just say, they raise even more red flags.

They’re written in the same tone, same short format, almost like they were copied from a template. Zero detail, just generic praise. No names, no real trading experience, no mention of specific features or performance. It’s the typical pattern we’ve seen before: fake reviews created to boost a terrible image.

Let’s be real — if a broker was actually good, people would naturally write varied, in-depth comments. That’s not what’s happening here.

Instead, we see:

- A weak score

- A tiny number of reviews

- At least one unhappy customer already

- And “positive” reviews that look like they were ordered on Fiverr.

So, the big question: if the platform’s trustworthy, where are all the happy clients?

Or maybe… there just aren’t any.

Sure Leverage Funding brand review — Final Thoughts

So, let’s lay it all out.

They claim to be around since 2023, but the domain wasn’t even registered until March 2025. That’s not a minor oversight — that’s a deliberate lie meant to fool anyone who doesn’t bother checking the facts. And when we did check? Boom. Timeline shattered.

Then there’s the license. Or more accurately — the complete absence of one. Not even a fake offshore certificate, not a single mention of regulatory oversight. Just silence. And in this industry, silence isn’t neutral — it’s dangerous. It gives them full control and leaves you with zero protection.

The user reviews didn’t help their case either. A Trustpilot score of 3.6, based on just three reviews, one of which is already negative. The rest? Generic fluff that screams “purchased feedback.” We’ve seen that pattern before, and it always ends the same way — users left with empty accounts and no one to turn to.

When you put all the pieces together, it becomes clear: Sure Leverage Funding isn’t here to build trust, grow your capital, or support your trading journey. They’re here to play a role, lure in deposits, and disappear when the curtain drops.

So ask yourself — why would a legitimate broker hide their tracks, fake their age, avoid regulation, and prop themselves up with lazy praise?

The answer writes itself.