TPC Invest Review: Is This Broker Just Another Scam Disguised as a Trading Platform?

Every day, new brokers pop up on the internet promising life-changing profits, instant withdrawals, and “expert” trading tools. TPC Invest is one of those names that’s suddenly everywhere — sleek website, confident language, all the right buzzwords. But is it actually a safe place to invest your money?

We’ve seen this pattern before. A flashy online presence, bold claims, and an aggressive push to get you to deposit. So, naturally, we decided to dig deeper and see if TPC Invest is the real deal… or just another digital smoke-and-mirrors act.

Let’s break down what we found — and why their entire setup raises some serious red flags.

General Broker Info – TPC Invest

| Feature | Details |

| Broker Name | TPC Invest |

| Leverage | Up to 1:500 |

| Account Types | Basic, Silver, Gold, VIP |

| Minimum Deposit | $250 |

| Contact Email | [email protected] |

| Phone | Not provided |

| Regulation | ❌ Not licensed |

| Website Domain Created | 14 November 2024 |

| Claimed Year Founded | 2022 |

Several things here stand out — and not in a good way.

First, the leverage of 1:500 is insanely high, especially for an unregulated broker. This level of risk should only be offered under strict supervision — which TPC Invest clearly doesn’t have.

Also, there’s no phone number listed anywhere. Think about that — a financial company that doesn’t want to talk to its clients directly? That’s either complete laziness or intentional avoidance. Either way, it doesn’t inspire trust.

And while they offer multiple account types (Basic to VIP), there’s very little transparency about the actual features of each. No detailed comparison, no clear benefits. Just vague marketing fluff.

So, even at the most basic level, their setup feels like it was built more for appearance than for function. The kind of platform that hopes you’ll be impressed just by fancy names — without looking too closely at what’s underneath.

TPC Invest Review: Why the Timeline Doesn’t Add Up

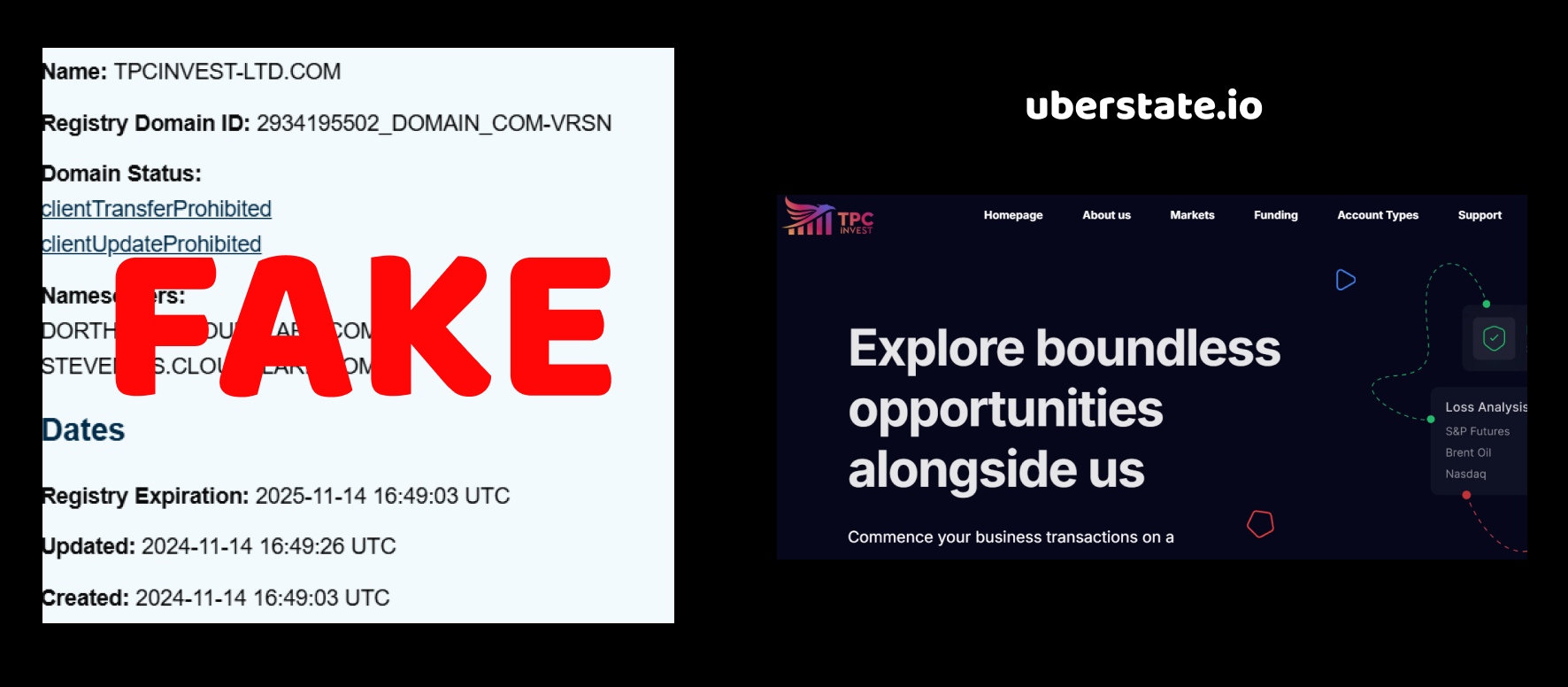

When we started digging into the background of TPC Invest, one of the first things we checked was the domain registration date. Sounds basic, right? But it often reveals way more than companies want you to know.

According to their claims, the broker was established in 2022. That’s supposed to create a sense of trust — two years on the market, some kind of track record, maybe even loyal clients. But here’s where things start falling apart.

We discovered that the domain for their official website was only registered on November 14, 2024. Yes, you read that right. Their online presence began almost two years after the supposed launch of the company. That’s not just a small detail — that’s a red flag waving right in your face.

Think about it: how does a modern-day broker operate for two full years without a website? In the era where every serious financial player has an online platform from day one, this makes zero sense. Were they working offline? Sending PDFs to clients? It’s laughable.

And no, there’s no indication that they rebranded or moved from another domain. Everything is presented as if this was their one and only digital home — created in late 2024.

So the question stands: if TPC Invest really started in 2022, where’s the proof? Because as it looks now, this timeline doesn’t just seem off — it feels manufactured.

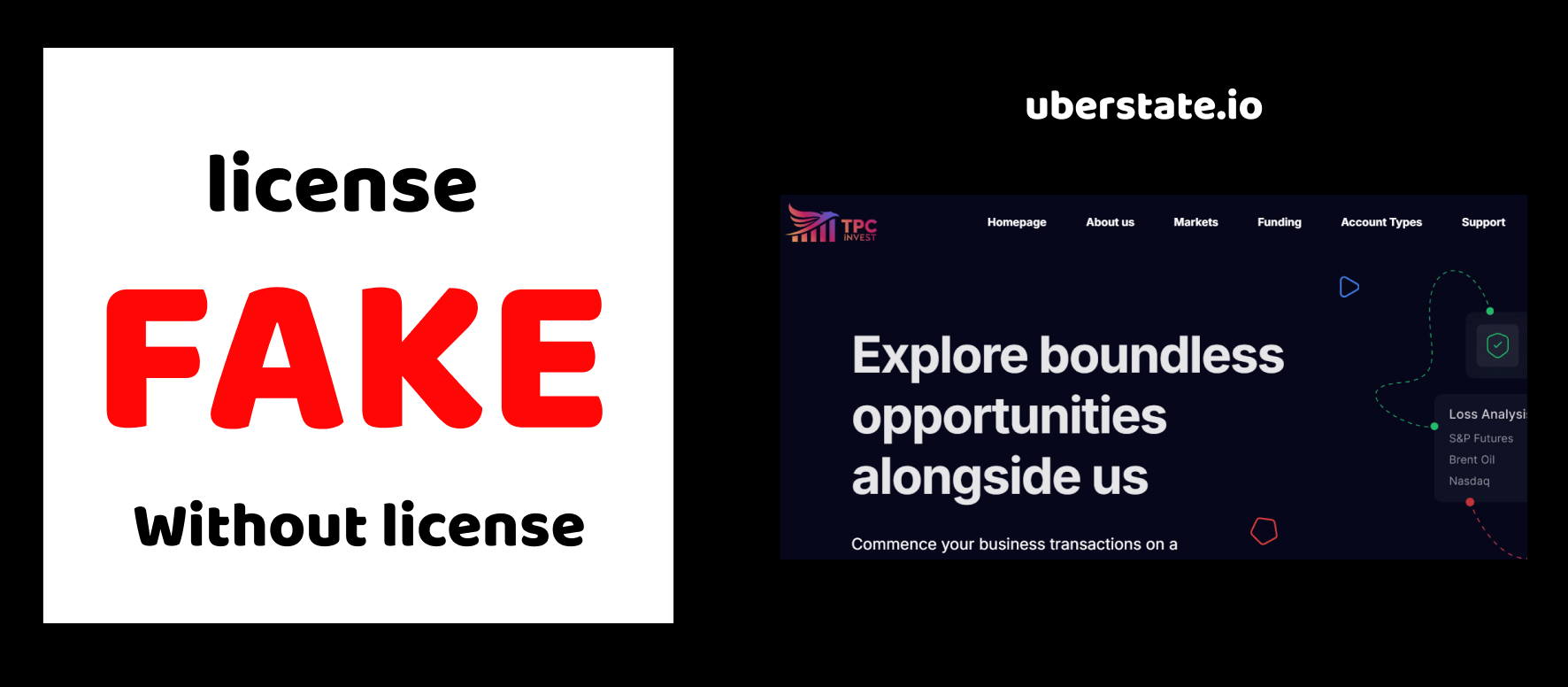

TPC Invest Review: No License, No Trust

Now let’s talk about something that should be non-negotiable for any financial service — a proper license. You wouldn’t trust a doctor without a medical degree, right? So why would anyone trust a broker that isn’t licensed?

Here’s the deal: TPC Invest has no valid license. None. Zero.

Not from a reputable authority, not even from one of those shady offshore regulators that at least pretend to offer oversight.

We scanned their website, combed through the footer, checked all the usual places where brokers post regulatory details. But guess what? Nothing. Not a single mention of a license number, no regulatory body, no registration data. Just silence.

And before anyone says, “Maybe they’re just a small firm,” let’s be real — a financial broker that handles people’s deposits, trades, and potentially huge leverage must operate under some form of oversight. That’s not a bonus feature. That’s the bare minimum.

So why would a broker skip something this critical? Maybe because licenses mean accountability. Reporting. Audits. Client protection rules. And let’s face it — why would scammers want extra attention from real regulators?

The lack of a license means one thing: there’s no one to complain to when things go south. You won’t find any investor protection fund here. No financial ombudsman. You’re just shouting into the void if they ghost you.

If TPC Invest were truly legit, they’d proudly flash their regulatory badge. Instead, they’re hiding it — because it doesn’t exist.

TPC Invest Review: The Review Section That Smells Like a Setup

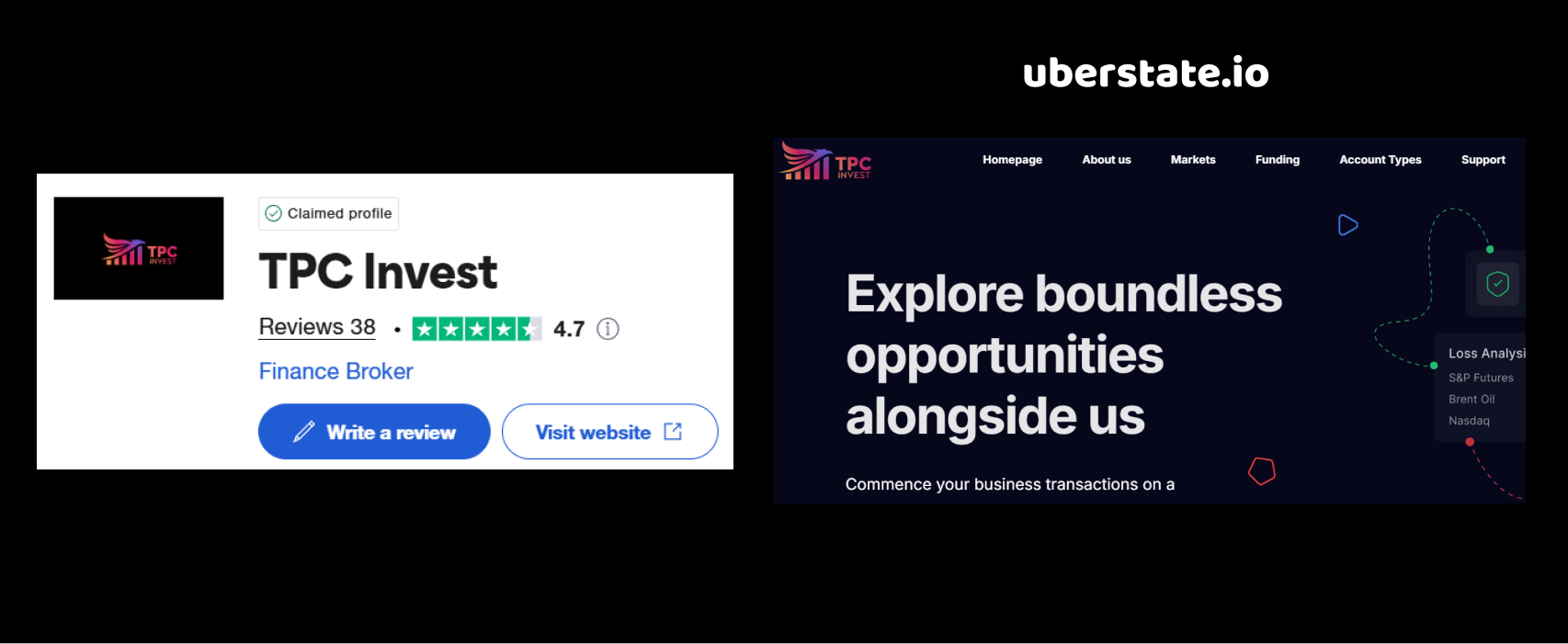

So, you might be thinking — “Okay, maybe they’re new, maybe they’re unlicensed… but what are people saying about them?”

Fair question. We asked it too. And what we found on Trustpilot only deepened our suspicions.

First off, let’s look at the numbers: TPC Invest’s score is below 4. That alone should make you cautious. But what really got our attention wasn’t the rating itself — it was how the positive reviews were written.

They’re suspiciously uniform.

Same tone, same structure, same type of vague praise like:

“Great service, highly recommend!”

“Very professional team, helped me a lot.”

“Fast withdrawals, amazing experience.”

Sounds familiar? Like they were all written by the same person on different accounts?

After reading dozens of these, it became painfully clear — these aren’t real clients. They’re plants, probably written in batches to quickly pump up the score. No mention of specific trades, account types, or anything that indicates actual user experience. Just generic fluff.

And here’s the kicker: genuine negative reviews — the ones where users describe being unable to withdraw, getting ghosted by support, or seeing their account suddenly frozen — are either buried or met with the classic “please contact our support” copy-paste response. No real solutions, no accountability.

So what does this tell us? TPC Invest isn’t just ignoring transparency — they’re actively trying to manufacture credibility through fake feedback. And if a broker needs to fake trust, ask yourself: what are they trying to hide?

TPC Invest Review: Final Verdict – A Risk Disguised as Opportunity

After digging through every layer of TPC Invest’s operation, the picture is clear — and it’s not pretty.

They claim to have been around since 2022, yet their domain was only registered in late 2024. That’s not a small inconsistency. That’s a fabricated origin story. And it begs the question: why lie about something so fundamental?

Then there’s the total absence of a license. Not even a sketchy offshore one. For a company handling people’s money, that’s a massive red flag. Without regulatory oversight, they’re free to do whatever they want with your funds. If things go south, you’re on your own. No regulator, no protection, no refund.

And finally, the reviews. Oh, the reviews. The few positive ones read like a bad script — vague, repetitive, and clearly mass-produced. Meanwhile, the real user experiences — the ones that mention actual problems — are either ignored or brushed aside with robotic copy-paste replies.

Put all of this together and ask yourself:

Would a legitimate broker need to fake their founding date, operate without a license, and flood Trustpilot with fake praise?

TPC Invest might wear the mask of a trading platform, but behind it hides a classic setup we’ve seen too many times — built to look real, but structured to exploit. This isn’t just a risky broker. It’s a calculated trap designed to lure in unsuspecting clients and drain them.

So if you’re considering giving them a try — stop.

There are safer, regulated, and transparent options out there. TPC Invest isn’t one of them.