Turf Capital Private Review: The Truth Behind the Claims

When it comes to choosing a broker, trust is everything. Investors and traders want to feel secure, knowing their funds and personal information are in safe hands. But how can you make an informed decision when the company you’re considering seems to be hiding more than it’s showing?

In this Turf Capital Private review, we dive deep into the details to uncover the truth. While the company claims to have been established in 2008, there are significant discrepancies that raise serious questions about its legitimacy. From its suspiciously recent domain purchase to the complete lack of reviews on Trustpilot, we explore the warning signs that suggest “Turf Capital Private” may not be what it claims to be.

Stay with us as we break down the details that could save you from falling into a potential trap. It’s time to take a closer look at the facts.

General Information on “Turf Capital Private”

Here’s a quick overview of the key details regarding Turf Capital Private:

| Attribute | Details |

| Brand | Turf Capital Private |

| Domain | turfcapprivate.com |

| Platforms | No information |

| Restricted Countries | No information |

| Regulation | Without license |

| License Type | Without license |

| Languages | English |

| Trustpilot Score | No reviews |

| Total Reviews | No reviews |

| Negative Reviews | No reviews |

| Established | 2008 |

| Domain Purchase Date | 2024-12-24 |

| Leverage | 1:500 |

| Account Types | Forex + Cryptocurrency – €100

Commodities – €250 Professional – €500 |

| Contacts | No information |

Additional Notes:

- Leverage: The broker offers a leverage of 1:500, which is relatively high and might appeal to traders seeking higher-risk opportunities, but also increases the potential for significant losses.

- Account Types: Turf Capital Private offers several account types, though details are somewhat vague. These include Forex + Cryptocurrency accounts starting at €100, Commodities accounts at €250, and Professional accounts at €500.

- Regulation: The broker is not regulated, which is a major concern. Lack of regulation means there is no formal oversight, making it much more difficult to resolve disputes if something goes wrong.

This broker provides very little verifiable information about itself, which should make any potential investor cautious. The absence of clear contact details, a solid regulatory framework, and reviews on Trustpilot all contribute to the growing suspicion that Turf Capital Private may not be a trustworthy choice.

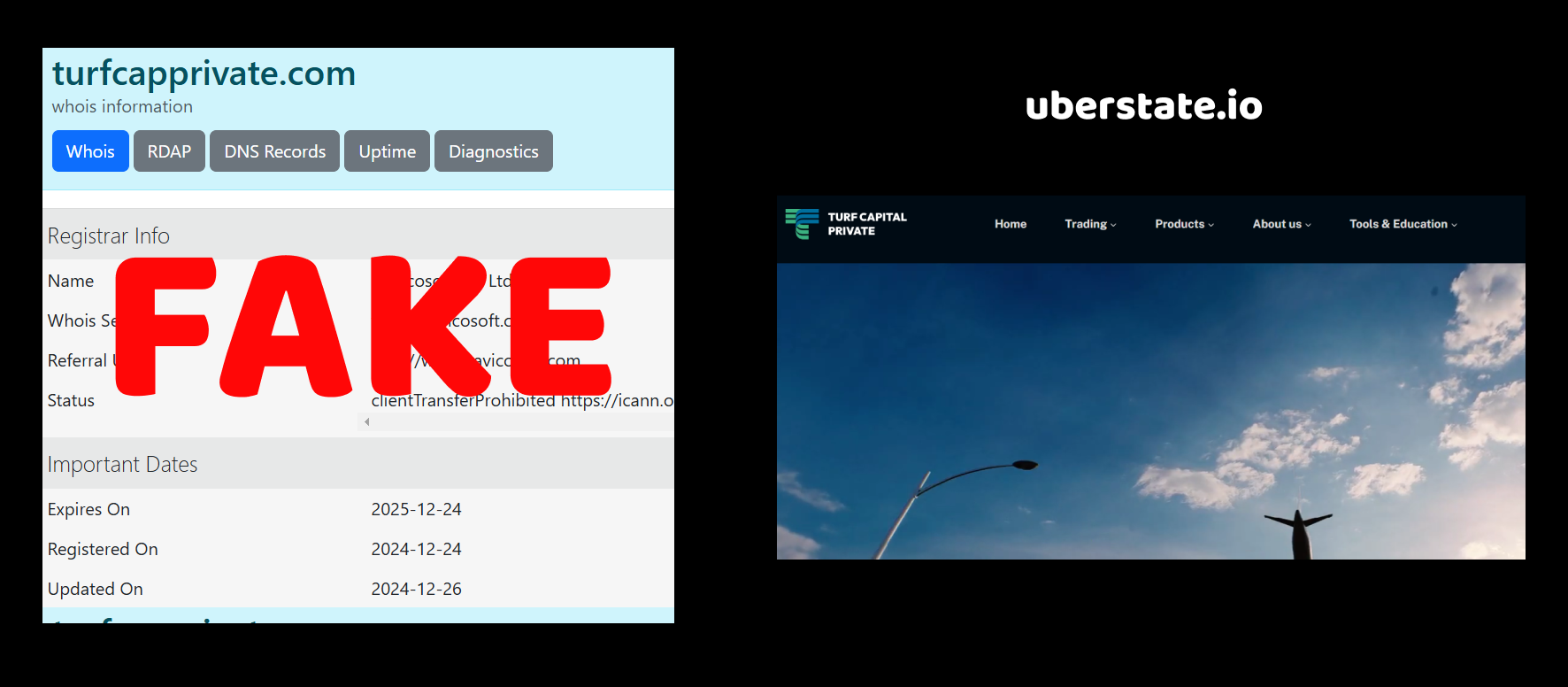

Argument 1: Creation Date of “Turf Capital Private”

Upon checking the creation date of the website “Turf Capital Private,” we immediately notice something peculiar. The domain for the site was bought in December 2024, while the company claims to have been established in 2008. Does this timeline add up? Why would a company that has been around for over a decade only just secure its online presence now?

It seems highly suspicious, doesn’t it? Typically, a legitimate company would have its domain long before launching or operating for several years, especially if it claims to have been in business for so long. This glaring inconsistency raises serious doubts about the legitimacy of “Turf Capital Private” and its history. It’s common for scams to create new websites that look like they have been around for longer than they actually have, trying to deceive potential clients.

For an established company to purchase a domain this recently is not just strange, it’s an obvious red flag that suggests something is off. Could this be an attempt to wipe the slate clean and start anew? Or is this just another tactic to appear more credible? This inconsistency in the domain purchase date, compared to the supposed establishment year, certainly warrants closer scrutiny.

Argument 2: License and Regulation of “Turf Capital Private”

One of the first things we look for when evaluating a broker is whether it has a legitimate license and regulatory oversight. “Turf Capital Private” claims to have no regulation at all, which is a major warning sign. The absence of a regulatory body overseeing its activities is extremely concerning. But it gets worse – not only is there no credible license, but the company has also listed “Without license” under its regulatory information.

Why would a company that operates in the financial space, where trust and transparency are paramount, avoid regulatory oversight? It’s almost as if they don’t want to be held accountable. Could this be because they are engaging in questionable activities that would not hold up under the scrutiny of a real financial authority?

Another important point to consider: many scams hide behind fake licenses issued by organizations that do not have any real authority or power. A quick check might show that their listed licenses are “fake” or issued by unknown or untrustworthy organizations. And here, we see “Turf Capital Private” openly admitting to being “Without license.” It’s an open admission of their desire to avoid the legitimate scrutiny that would come with being regulated.

In the world of finance, regulation is crucial. It protects investors and holds brokers accountable. So, a company like “Turf Capital Private,” which claims to have no regulation, should raise an immediate red flag. Why would any legitimate broker avoid this? What do they have to hide?

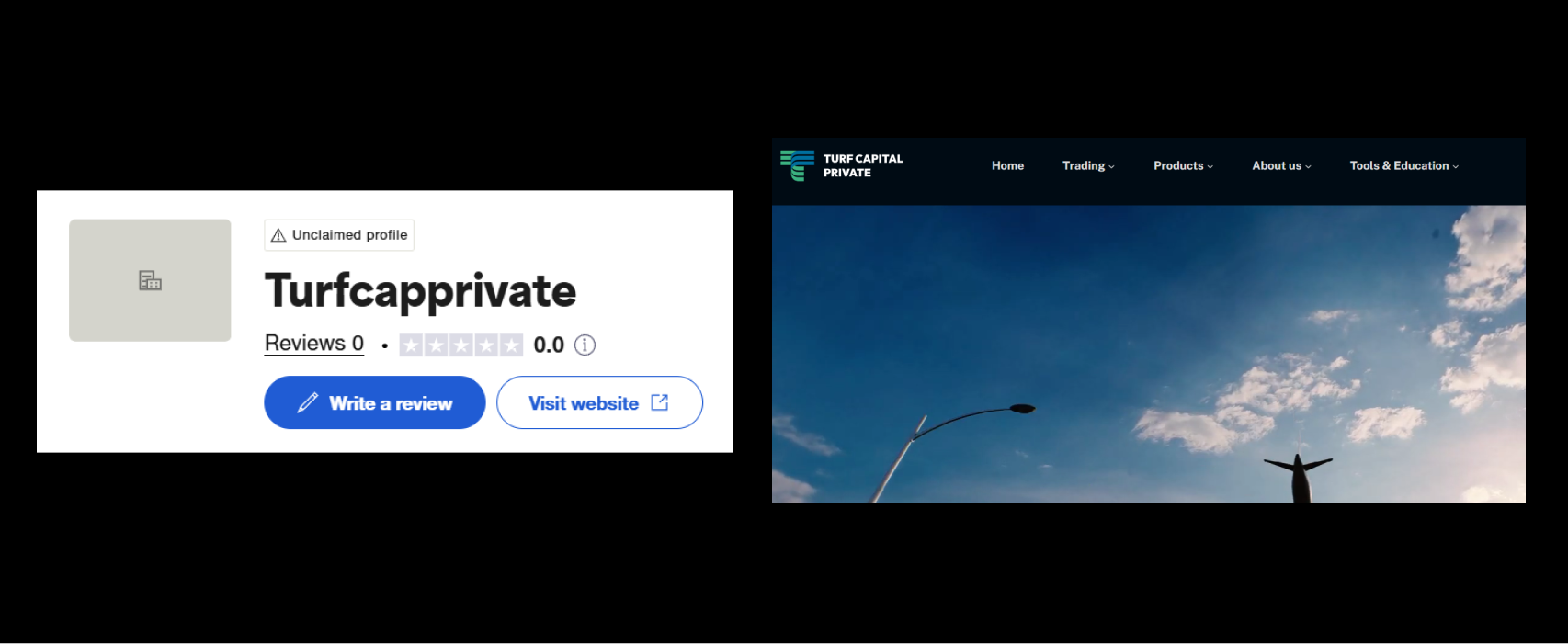

Argument 3: Trustpilot Reviews for “Turf Capital Private”

When it comes to online reviews, trust is key. After all, how else can a potential client gauge the credibility of a broker if they have no real-world feedback? Now, let’s take a closer look at the Trustpilot reviews for “Turf Capital Private.”

Strangely enough, there are no reviews available on Trustpilot—zero. This raises an obvious question: If this company has been around since 2008, as they claim, why does it have no public feedback? Could it be that they’ve recently launched or that they’re deliberately hiding negative reviews to protect their facade?

This is where things get even more interesting. Some brokers, especially those operating under shady practices, often create fake reviews to give the illusion of trustworthiness. How hard is it to see that no reviews at all might be a deliberate move? Real clients, especially those dealing with the volatility of Forex and cryptocurrency markets, tend to leave feedback—whether it’s positive or negative. The absence of any reviews, coupled with the fact that they have been around for years, is a red flag.

Think about it: If a broker has been operating for so long but has no visible reputation or client feedback on major platforms, doesn’t that make you wonder if they’ve been actively blocking or hiding negative opinions to maintain a clean image? It definitely doesn’t add up. So why are there no reviews to check? It’s a question worth asking.

Final Thoughts on Turf Capital Private

After thoroughly examining the available information, it’s hard to ignore the numerous red flags surrounding Turf Capital Private. From the incredibly suspicious timeline of the domain purchase, which occurred just recently in 2024, despite the company claiming to have been around since 2008, to the eerie absence of any reviews on Trustpilot—everything points to something being off.

When you add this to the fact that the broker operates without a legitimate license and has no verifiable reputation, the picture becomes much clearer. Why would a legitimate company, especially one claiming to be established for years, not have its domain up and running earlier? Why are there no customer reviews, even though they should have accumulated over the years? And most importantly, why would such a company remain so elusive about its credentials and history?

These unanswered questions should serve as a warning. The inconsistencies in their claims and lack of transparency about their operations are enough to raise serious doubts. In the world of Forex trading, where trust and transparency are paramount, a broker with these kinds of red flags is not one you should consider entrusting your funds to.

Remember, in the world of trading, if something doesn’t feel right—chances are, it isn’t. Stay informed, stay cautious, and always dig deeper before making a decision.