Full review of forex broker 24Yield . All about 24Yield

24Yield Review: Comprehensive Analysis

24Yield.com stands out as a premier online broker, offering over 1,000 assets, including CFDs, stocks, and ETFs. Regulated across multiple jurisdictions, such as CySEC and FMA, 24Yield boasts a zero-commission policy and a unique platform catering to both beginners and professionals. This 24Yield Review explores the broker’s features, benefits, and potential drawbacks to help you decide if it’s the right fit for your trading needs.

Pros and Cons

Pros:

- Heavily regulated across multiple regions

- Over 1,000 assets available for trading

- Zero commissions on all assets

- Unique, user-friendly trading platform

- Suitable for both beginners and professionals

Cons:

- No USA traders accepted

- Limited customer service hours

- Single proprietary platform option

Trust and Safety: Securing Your Trading Journey

24Yield prioritizes trust and safety through a comprehensive framework of regulatory compliance and security measures. Operating under the oversight of reputable regulatory authorities such as CySEC and FMA, 24Yield adheres to stringent financial standards and ethical trading practices. This multi-jurisdictional regulation underscores 24Yield’s commitment to operational integrity and provides traders with a level of protection rarely matched in the industry.

To combat fraud, 24Yield has robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) policies, complemented by stringent verification processes during account opening. These measures ensure all clients are thoroughly vetted. Furthermore, 24Yield ensures the security of client funds by keeping them in segregated bank accounts, insulated from company funds, offering an additional layer of financial safety. Refunds are processed only to the original source of deposit, safeguarding against unauthorized withdrawals.

Account Types: Accounts for Every Trader Level

24Yield caters to a diverse clientele with its range of account types, designed to accommodate varying needs and experience levels. The broker offers three main account types: Explorer, Pioneer, and Master.

Explorer Account:

- Ideal for beginners

- Access to educational resources and support

Pioneer Account:

- Enhanced trading experience

- Access to a wider range of instruments and advanced tools

Master Account:

- Designed for professional traders

- Full access to all trading instruments and advanced tools

This 24Yield Review highlights that each account type ensures both novices and seasoned professionals find a suitable platform for their trading activities.

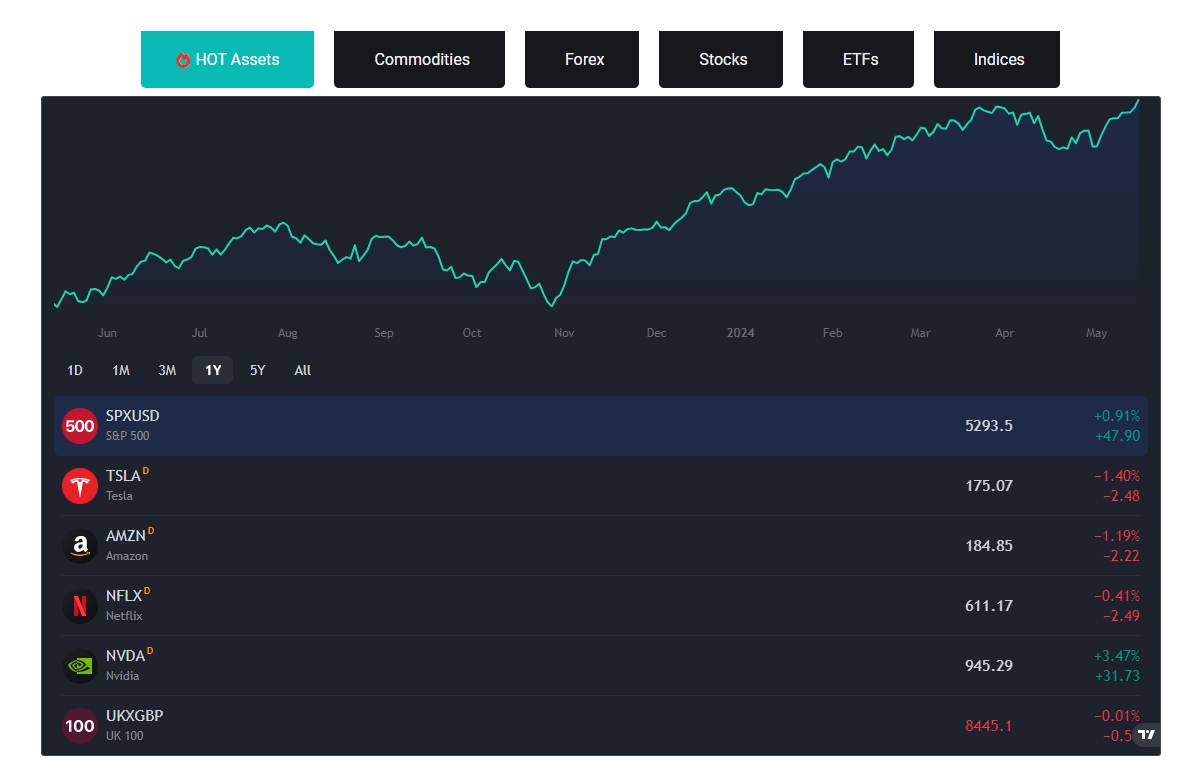

Tradable Instruments: Diverse Trading Opportunities

24Yield offers a comprehensive range of tradable instruments, catering to diverse client needs. Traders have access to over 1,000 assets, ensuring a broad spectrum of investment opportunities. The portfolio includes CFDs on stocks, commodities, indices, currencies, and ETFs. This diverse selection provides traders with versatile trading experiences.

The inclusion of commodities allows traders to access markets influenced by economic, political, and environmental factors. Indices provide exposure to broader market trends, while currency pairs offer opportunities in the forex market. ETFs allow for diversified investments in asset baskets, mirroring indices, sectors, or commodities. This 24Yield Review emphasizes the broker’s commitment to serving as a one-stop shop for traders looking for variety and flexibility in their trading strategies.

Trading Instrument Availability

- Commodities: Yes

- Currencies: Yes

- Cryptocurrencies: No

- ETF: Yes

- Futures: No

- Indices: Yes

- Stocks: Yes

- Bonds: No

- Options: No

Commission and Fees: Cost-Effective Trading Simplified

24Yield offers a transparent and appealing fee structure, eliminating many typical online trading costs.

- Account Minimum: Minimum deposit of 250 EUR/USD

- Trading Fees: Zero commissions across all assets

- CFD Fees: Commission-free CFD trading

- Forex Fees: No commission on forex transactions

- Futures Fees: Commission-free futures trading

- Account Fee: No account maintenance fees

- Inactivity Fee: No inactivity fee

- Deposit Fee: Free deposit process

- Withdrawal Fee: Free withdrawal process

- Overnight Funding Fee: Standard swap fee applied to overnight positions

- Currency Conversion Fee: No currency conversion fees

- Guaranteed Stop Order Fee: No fee for stop loss orders

This 24Yield Review underscores the broker’s commitment to providing cost-effective trading conditions, making it accessible for traders of all levels.

Trading Platforms: Seamless Trading Across Devices

24Yield offers a unique and proprietary trading platform, designed to meet the needs of its diverse clientele.

Mobile Trading Apps:

- Available for iOS and Android

- Manage portfolios, monitor markets, and execute trades anytime, anywhere

Web Trading Apps:

- User-friendly interface and robust functionality

- Access a wide range of financial instruments directly from a web browser

Desktop Trading Apps:

- No desktop trading app, focusing on versatile web and mobile platforms

Trading Platform Availability

- MT4: No

- MT5: No

- cTrader: No

- Proprietary: Yes

Desktop and Web Platform Availability

- Desktop Windows: No

- Desktop Mac: No

- Web Platform: Yes

Mobile Platform Availability

- Android: Yes

- iOS: Yes

This 24Yield Review highlights the broker’s commitment to accessibility and convenience through its versatile trading platforms.

Unique Features: Superior Trading Experience Guaranteed

24Yield distinguishes itself with several unique features catering to a wide range of traders. Its proprietary trading platform offers a seamless and intuitive experience across web and mobile applications. The platform’s accessibility on iOS and Android devices ensures traders can manage their portfolios and trade on the go.

24Yield’s regulatory compliance across multiple jurisdictions provides a secure and trustworthy environment for trading activities. The broker’s customer service approach includes direct email and phone support, addressing client queries promptly.

Moreover, 24Yield offers analysis from leading investment banks and a wealth of educational materials, supporting traders in making informed decisions. These features collectively underscore 24Yield’s commitment to delivering a superior trading experience.

Research and Education: Empowering Traders With Knowledge

24Yield places a strong emphasis on empowering traders through comprehensive research and educational tools. The broker offers analysis powered by some of the largest investment banks, providing high-quality insights to inform trading strategies. This 24Yield Review highlights how these resources ensure traders are well-equipped to navigate financial markets confidently.

In addition to market analysis, 24Yield provides a wealth of free educational materials covering a range of topics from basic trading to advanced strategies. By offering these resources, 24Yield demonstrates its dedication to supporting client growth and success in trading.

Customer Support: Dedicated Support for Traders

24Yield is committed to providing reliable and accessible customer support. The broker offers email and phone support from 8:00 to 17:00 GMT, ensuring traders can get assistance within reasonable hours. While the absence of 24/7 support and live chat is noted, the quality and responsiveness of the provided channels reflect 24Yield’s dedication to customer satisfaction.

Account Opening: Smooth and Secure Start

Embarking on your trading journey with 24Yield is straightforward and secure.

- Registration: Quick and easy registration form

- Verification: Thorough verification process for security and compliance

- Document Upload: Upload identification and proof of address documents

This 24Yield Review highlights how these steps secure your account and align with the broker’s commitment to providing a safe trading environment.

Deposit and Withdrawals: Smooth Financial Transactions

24Yield ensures a seamless process for deposits and withdrawals.

- Deposits: Accepts various payment methods; direct debit and card payments processed instantly; bank transfers processed within 1-2 days

- Withdrawals: Processed within the same day; subject to delays depending on card schemes or interbank transfer times

This 24Yield Review underscores the broker’s dedication to providing a hassle-free trading experience.

Final Thoughts

In the bustling world of online trading, 24Yield stands out by blending regulatory rigor with a diverse array of trading instruments and a user-centric approach. Its zero-commission policy, combined with a unique and intuitive trading platform, positions it as a compelling choice for traders at any skill level. The broker’s dedication to security through stringent anti-fraud measures and segregated accounts instills confidence among users.

Furthermore, 24Yield’s comprehensive educational resources and professional market analysis empower traders to make informed decisions. While the absence of services for USA traders and a desktop platform may be limitations, the overall offering of 24Yield, highlighted by its regulatory compliance across multiple jurisdictions, makes it a noteworthy contender in the global online brokerage space. This 24Yield Review provides a detailed insight into what makes 24Yield a top choice for many traders.