Full review of forex broker Doto . All about Doto

Doto Review

Service Details

Doto is an excellent choice for traders who value simplicity and effectiveness in their trading platform. It offers an intuitive interface and robust tools that make trading in forex, commodities, indices, and cryptocurrencies easy and straightforward. The platform is designed to keep trading as simple as possible, featuring a user-friendly interface, zero commission, and a low minimum deposit of just $15. This Doto review will explore the advantages and disadvantages of using Doto for your trading needs.

Doto offers customer service in English and Vietnamese, available 24/7, ensuring that assistance is always at hand. This continuous support underpins Doto’s commitment to excellent customer service.

Compliance & Regulation

Doto Group has built a formidable presence in the fintech sector, backed by a team with extensive expertise in brokerage, finance, software, and banking. Operating through various regulated subsidiaries, Doto ensures rigorous compliance and transparency. Its regulatory framework includes licenses from CySEC in Cyprus, FSC in Mauritius, and FSCA in South Africa, which underscore its commitment to providing a secure trading environment.

Who Is Doto Recommended For?

Doto is particularly suitable for traders looking for an easy and flexible trading experience. The platform is tailored to users at all levels, offering customizable features, a variety of trading instruments, and a straightforward interface. Its zero commission on deposits and withdrawals, along with the minimal deposit requirement, makes it especially appealing to newcomers. Furthermore, Doto is regulated by respected authorities like CySEC, FSC, and FSCA, enhancing its reliability. However, it’s important to note that Doto’s services are restricted in certain regions, as detailed in the cons section.

Top Features

Doto review offers a comprehensive range of features to enhance your trading experience, allowing you to personalize your approach and simplify decision-making. You can trade forex 24/5 on the world’s largest financial markets, along with crucial commodities like gold and oil. The platform also supports trading on major global indices and popular cryptocurrencies like Bitcoin and Ethereum. Starting with a small initial deposit of $15, traders can gradually build their expertise and trade with confidence.

Pros and Cons

Pros:

- Trade CFDs on forex, commodities, indices, and cryptocurrencies.

- Customizable platform with powerful tools in a user-friendly interface.

- Simple settings ensure a pleasant trading experience.

- No commission on deposits and withdrawals.

- Regulated by reputable bodies such as CySEC, FSC, and FSCA.

- Minimum deposit of $15 to start trading.

- 24/7 support via live chat or email.

Cons:

- Doto Global Ltd’s services and the information on this site are not available to residents of several regions including American Samoa, Australia, and the UK, among others.

Regulatory Bodies

Doto is regulated by several prominent authorities ensuring a secure trading environment:

- Financial Services Commission Mauritius (FSC): C119023978

- Cyprus Securities and Exchange Commission (CySEC): 399/21

- Financial Sector Conduct Authority South Africa (FSCA): 50451

Account Options

Type of Broker: Regulated Broker

Minimum Deposit: $15

Hedging: Yes

Free Demo Account: Yes

Traders From USA: No

Trading and Investment Tools

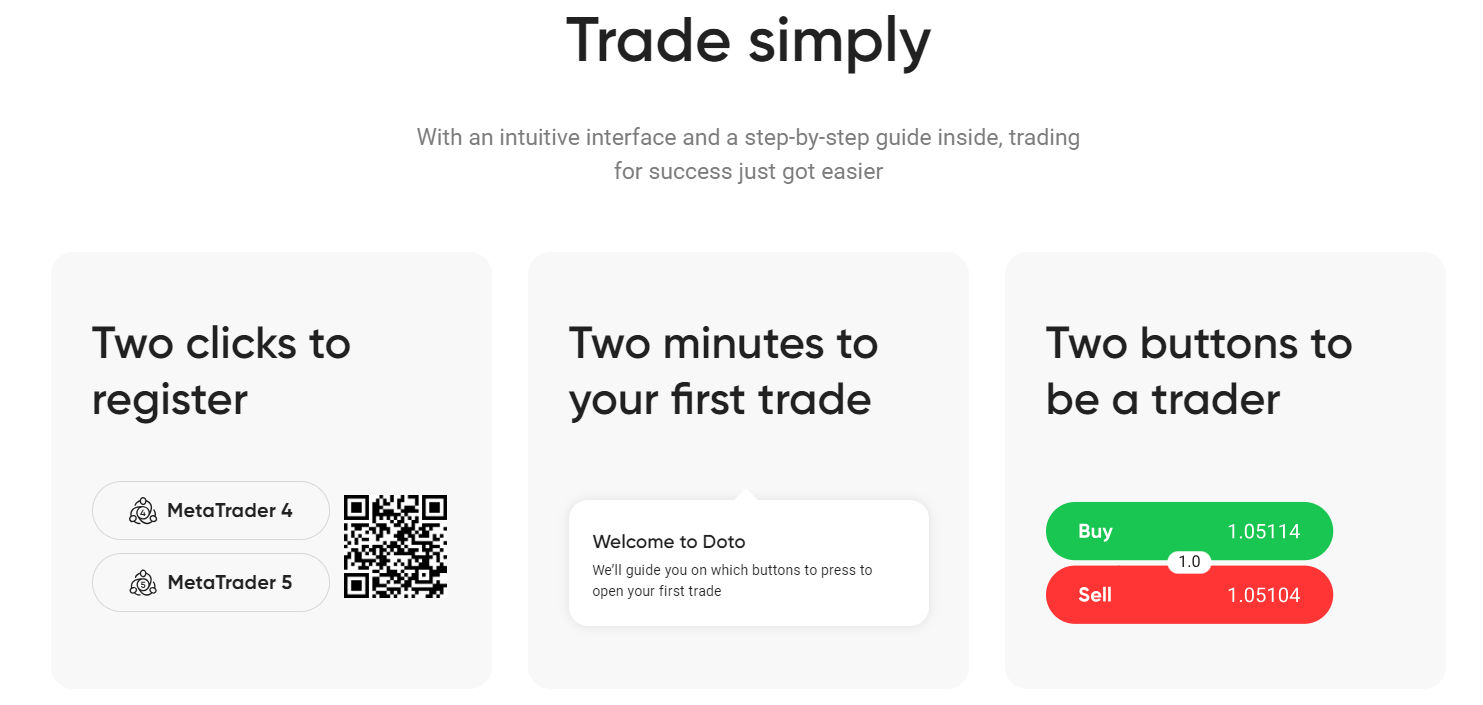

Doto review provides a comprehensive suite of trading and investment tools that cater to both novice and seasoned traders. The platform supports one-click trading, mobile alerts, and a variety of orders including stop, market, trailing stop, and limit orders. However, it does not support OCO orders. Traders can also benefit from 24-hour trading and a rich charting package, though there is no streaming news feed. These features are designed to enhance trading efficiency and adaptability.

Overview

Broker Type: Regulated Broker

Regulation & Licensing: FSC, CySEC, FSCA

Assets Offered: 130+

Platforms Available: MetaTrader 4, MetaTrader 5, The Doto Platform

Mobile Compatibility: iOS, Android

Payment Types Accepted: Visa, Mastercard, Maestro, Momo, QR Payments, Bank Transfers, Crypto (USDT)

Account Types: Standard Account

Small Minimum Deposit

Doto review requires a small minimum deposit of $15 to start trading. This low barrier to entry allows new traders to get started easily.

Trade Forex 24/5

Traders can engage in forex trading 24/5 on the world’s most active financial markets, taking advantage of various trading opportunities.

CFDs on Cryptocurrencies

The platform supports CFD trading 24/7 on popular cryptocurrencies, offering flexibility for traders interested in the crypto market.

Demo Account

Doto offers a free demo account, allowing traders to practice and refine their strategies without risking real money.

Spreads and Commissions

Spreads: Doto provides low spreads and fast execution, ensuring cost-effective trading.

Commission Per Trade: There are no commissions on the trading account, making trading more affordable.

Copy Trading Support

Copy trading is not available on Doto’s platform, which may be a consideration for traders looking for this feature.

Trading Instruments

Trading Instruments: FX, CFDs on commodities, CFDs on indices, CFDs on cryptocurrencies

Trading Platforms: MetaTrader 4, MetaTrader 5, Doto Platform

User Experience

Doto’s platform is engineered to streamline the trading process, offering a user-friendly interface that removes complex configurations, making trading enjoyable and straightforward. Traders have access to CFDs on forex, commodities, indices, and cryptocurrencies, all without any commission on deposits and withdrawals. The minimal deposit requirement is only $15, allowing traders to start small and gradually build their trading proficiency.

Fees & Commissions

Doto champions transparency and affordability in its pricing structure. It offers leverage up to 1:500, enabling traders to maximize their market exposure with minimal initial investments. Doto review does not charge commissions on deposits or withdrawals, ensuring cost-effective fund management. Competitive spreads and fast order execution further reduce trading costs and minimize slippage. A swap fee is applied to positions held overnight, known as the rollover fee, which traders need to consider in their long-term trading strategies.

Reliability & Security

Security and reliability are paramount at Doto. The platform adheres to strict industry standards under the supervision of multiple regulatory authorities. With advanced technological infrastructure and segregated client accounts, Doto review safeguards both the financial assets and personal data of its users. These measures establish Doto as a reliable and secure online broker.

Final Thoughts on Doto

Doto distinguishes itself as a user-centric and customizable trading platform. By adhering to stringent regulatory standards and focusing on a positive user experience, Doto review has become a preferred choice among traders who seek a personalized and straightforward trading environment. Its extensive range of tools and commitment to low costs make it a compelling option for traders at all levels.