Full review of forex broker IC Markets . All about IC Markets

IC Markets Review

Trust and Safety of IC Markets

IC Markets review stands out in the realm of online brokerage as a sanctuary for discerning traders, offering precision and a variety of account types to meet diverse needs. This platform is favored by both seasoned professionals and beginners alike. Let’s delve into how IC Markets empowers traders through this detailed review.

In the dynamic realm of online trading, safety and trust are paramount, and IC Markets excels in both regards. Regulation is a cornerstone of IC Markets’ credibility, with oversight from the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies enforce strict standards, ensuring transparency and fairness. Importantly, IC Markets holds multiple licenses, providing an extra layer of security for clients.

Fraud prevention is a priority for IC Markets, with the implementation of state-of-the-art security measures such as robust encryption protocols and stringent identity verification procedures. These measures safeguard clients’ personal information and prevent unauthorized access.

Client fund security is ensured through the segregation of client funds from the company’s operational funds. This separation provides protection for clients’ money, even in the unlikely event of financial instability within the company. IC Markets’ commitment to regulation, fraud prevention, and client fund security makes it a trustworthy choice for traders seeking a secure trading environment.

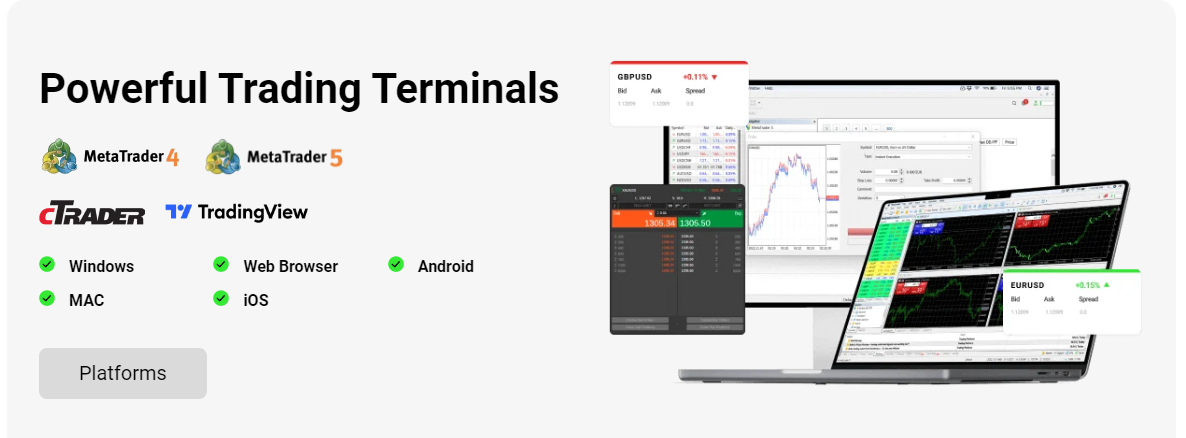

Trading Platforms

IC Markets review offers traders a range of versatile trading platforms, ensuring accessibility and functionality for traders of all levels.

Mobile Trading Apps:

Traders on the move can utilize fully functional mobile trading apps for Android and iOS devices, enabling them to manage positions and access markets at any time.

Web Trading Apps:

Access accounts and execute trades directly from web browsers using IC Markets’ web trading platform, eliminating the need for software downloads or installations.

Desktop Trading Apps:

Desktop trading platforms are compatible with both Windows and Mac operating systems, providing flexibility in choice for traders.

Charting and Ease of Use:

Advanced charting tools are integrated into IC Markets’ platforms, empowering traders with robust technical analysis capabilities. The platforms are designed for ease of use, catering to both novice and experienced traders.

MetaTrader (MT4 and MT5):

Access both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for user-friendly interfaces and extensive libraries of technical indicators.

Algo-Trading and Copy Trading:

Algorithmic trading features are available on MetaTrader platforms for traders interested in automated trading. Copy trading is also supported, allowing traders to replicate the strategies of experienced investors.

IC Markets does not offer a proprietary trading platform, focusing instead on providing comprehensive MetaTrader experiences alongside other platform options.

Tradable Instruments

IC Markets review offers a diverse range of investment instruments, with over 2,250 products, catering to various strategies and preferences.

Forex Trading:

Forex trading is a flagship feature, with over 60 currency pairs available, including major, minor, and exotic options.

Commodities Trading:

Commodities trading includes precious metals like gold and silver, energy products such as crude oil and natural gas, and agricultural commodities, providing traders with access to multiple commodity markets.

Cryptocurrencies:

The broker also caters to the growing interest in cryptocurrencies, offering trading options for popular digital assets like Bitcoin, Ethereum, and Ripple (XRP).

Global Indices:

Global indices trading allows traders to speculate on the performance of major stock indices from around the world.

While IC Markets excels in many areas, it does not currently support trading in exchange-traded funds (ETFs), limiting exposure to this asset class. Additionally, it does not provide trading options for futures contracts, bonds, or options. However, IC Markets AU offers the option to purchase real shares and stocks exclusively for Australian clients, presently limited to Aussie shares. Please note that this service is available for Australian residents only.

In summary, IC Markets review impresses with its vast array of tradable Contract For Difference (CFD) instruments, but traders interested in ETFs or traditional futures, bonds, or options may need to explore alternative platforms.

Account Types

IC Markets adopts a user-centric approach to account types, offering options suitable for traders of all backgrounds and expertise levels. The broker provides three primary account types: the commissions-free Standard Account, commissions-based Raw Spread Account, and the cTrader Raw Spread Account. These options offer flexibility, allowing traders to select the account that best suits their trading needs. The Raw Spread Account is particularly appealing to professionals seeking ultra-tight spreads and faster execution.

For practice and strategy refinement, IC Markets offers a demo account with virtual funds, providing a risk-free environment for traders, especially beneficial for newcomers gaining confidence before live trading.

Inclusivity is a priority, with IC Markets review offering Islamic accounts, ensuring accessibility for traders adhering to Islamic principles. Additionally, account options are designed to accommodate both beginners and professionals.

Commission and Fees

IC Markets maintains a competitive and transparent fee structure tailored to the varying needs of traders. The minimum deposit requirement is consistent across all account types, typically set at $200, though larger initial investments may be necessary for larger trades.

Standard Accounts:

These operate on a spread-only model, incorporating trading fees into the spreads.

Raw Spread Accounts:

These incur commissions per lot traded, with fees varying depending on the asset and account currency.

Competitive spreads for CFD trading ensure cost-effective access to a diverse range of asset classes, without imposing account maintenance fees or inactivity fees for dormant accounts. Deposits to IC Markets are fee-free, as are withdrawals, facilitating convenient account funding and access to funds. However, traders holding positions overnight may be subject to financing fees, depending on the asset and position size. For traders utilizing different base currencies, currency conversion fees may apply during deposit or withdrawal transactions.

IC Markets’ transparent fee structure aims to provide traders with a clear understanding of associated costs, promoting transparency and fairness throughout their trading activities. Detailed fee information is available on the broker’s website.

Unique Features

IC Markets review sets itself apart through a rich array of tools and features embedded within its trading platform, catering to traders at all levels.

Real-Time Push Notifications:

Real-time push notifications keep traders promptly informed of crucial market movements and account status changes, enabling them to seize opportunities without delay.

Sophisticated Trend Exploration Tools:

These tools empower traders to identify and capitalize on prevailing market trends, complemented by instrument-specific insights for informed trading decisions.

Comparative Analysis:

Comparative analysis of users’ trading behaviors allows traders to gain insights from peers and refine strategies, while educational resources such as articles and video tutorials cater to those seeking to bolster their trading skills.

Advanced Analytical Tools:

Advanced analytical tools, including comprehensive charting capabilities and a wide range of technical indicators, make IC Markets’ platform a powerful ally for effective navigation of financial markets.

Research and Education

IC Markets review has been actively expanding its educational resources to cater to traders of varying experience levels. The Learning Center offers a solid foundation with video tutorials, webinars, and textual guides covering core trading concepts. While the educational content aligns with industry standards, there is room for improvement, particularly in addressing advanced trading topics and intricate market analysis strategies seen in offerings from other industry leaders.

Recent progress in education includes an increased emphasis on interactive learning experiences like webinars, enhancing trader engagement. IC Markets sources its content primarily from in-house experts, ensuring relevance and reliability. Diversifying and expanding educational resources would benefit traders more comprehensively. A heightened focus on video content and inclusion of advanced topics could enrich the learning experience for IC Markets’ users.

Customer Support

IC Markets provides robust 24/7 customer support in multiple languages across various channels. Additionally, a comprehensive FAQ section on the website offers valuable information on trading-related topics, further enhancing accessibility and support for traders.

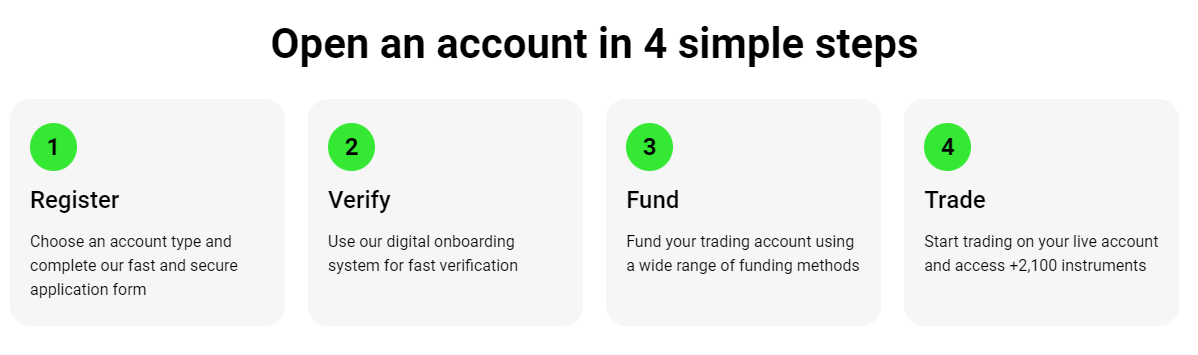

Account Opening

Opening an account with IC Markets is a streamlined process that can be completed with ease:

Registration:

Begin by registering on the IC Markets website, providing basic information like name, email, and phone number.

Account Selection:

Choose between a live or demo account. A demo account allows exploration of the platform with virtual funds before committing real capital.

Verification:

Verify your email address by clicking on a confirmation link sent to your inbox.

Personal Details:

Provide additional information such as date of birth and address for identity verification.

Trading Experience:

Share your trading experience and financial background to help IC Markets tailor its services.

Document Upload:

Upload identification documents like a government-issued ID and proof of address to comply with regulatory requirements.

IC Markets’ account opening process is swift, often taking only a day or less. There is no minimum deposit requirement, making it accessible to traders with varying capital levels.

Deposit and Withdrawals

Deposits and withdrawals with IC Markets are straightforward and efficient:

Deposits:

Multiple deposit methods are available, including bank transfers, credit/debit cards, and e-wallets like Neteller and Skrill. IC Markets does not charge deposit fees, and the minimum deposit requirement is $200.

Withdrawals:

Withdrawals utilize the same methods as deposits, with the broker aiming to process requests within one business day. IC Markets does not levy withdrawal fees, though charges from your payment provider may apply.

Conclusion

Overall, IC Markets offers a user-friendly trading environment with a wide range of instruments and competitive conditions. However, improvements in educational content could further enhance its appeal to traders. Conduct thorough research based on your specific requirements and preferences before selecting IC Markets or any broker to ensure alignment with your goals and strategies.